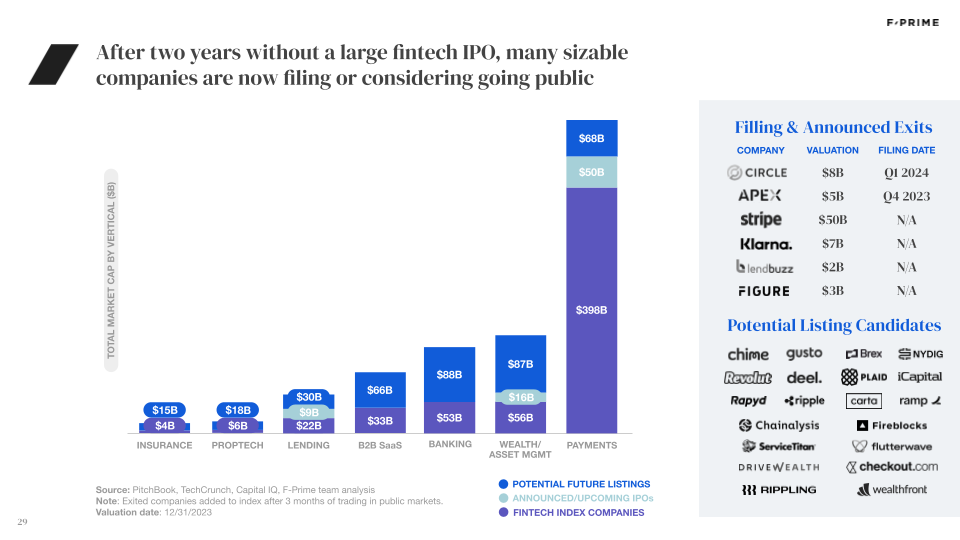

In sectors like mobile banking and commission-free trading, fintech companies have had a profound on financial incumbents. In other areas, the future of banking and fintech is still being developed.

Fintech is growing up.

Over the last few decades, a generation of startups have surfed a wave of new technology spanning digital payments, roboadvisors, blockchain, and more, staking out a share in new and existing financial markets. Meanwhile, many incumbent financial service providers have sunk or swum based on their ability to anticipate, react to, or adopt new technology.

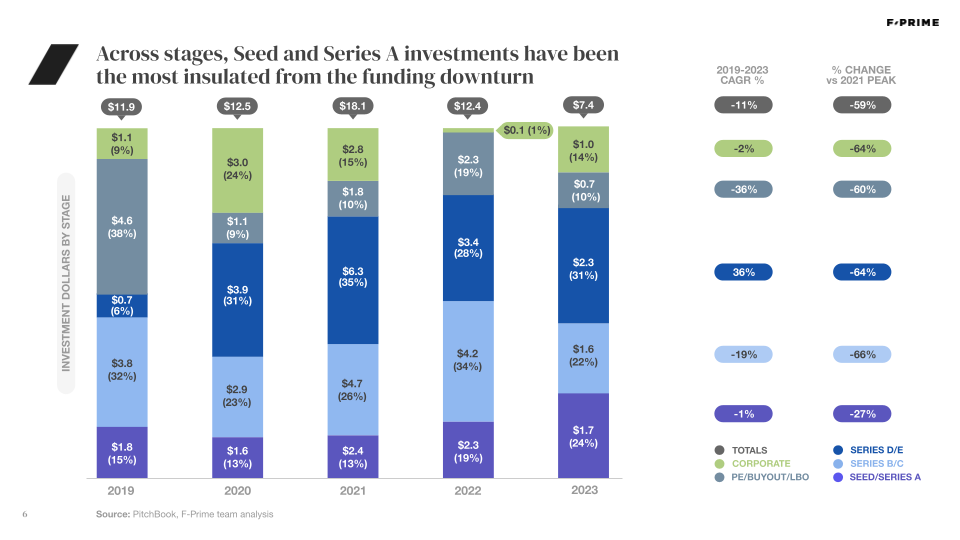

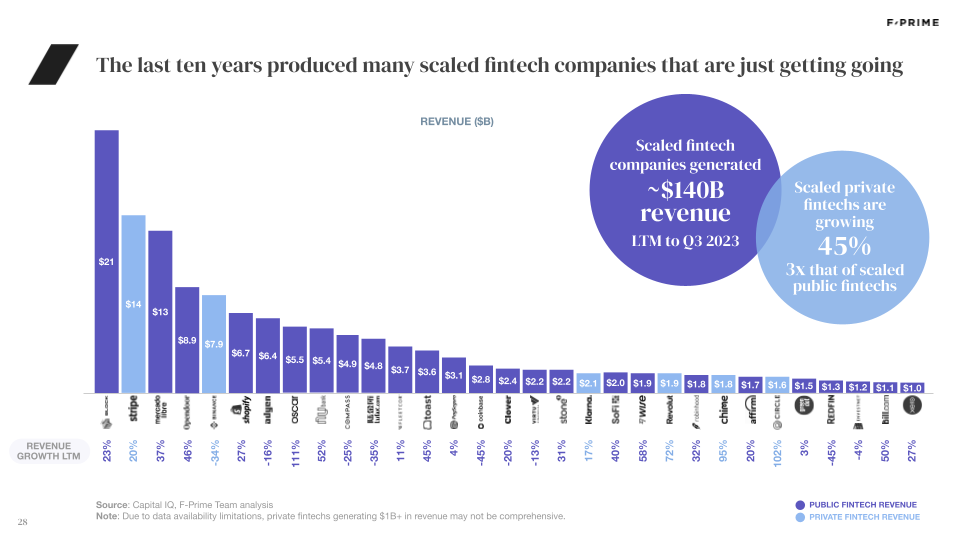

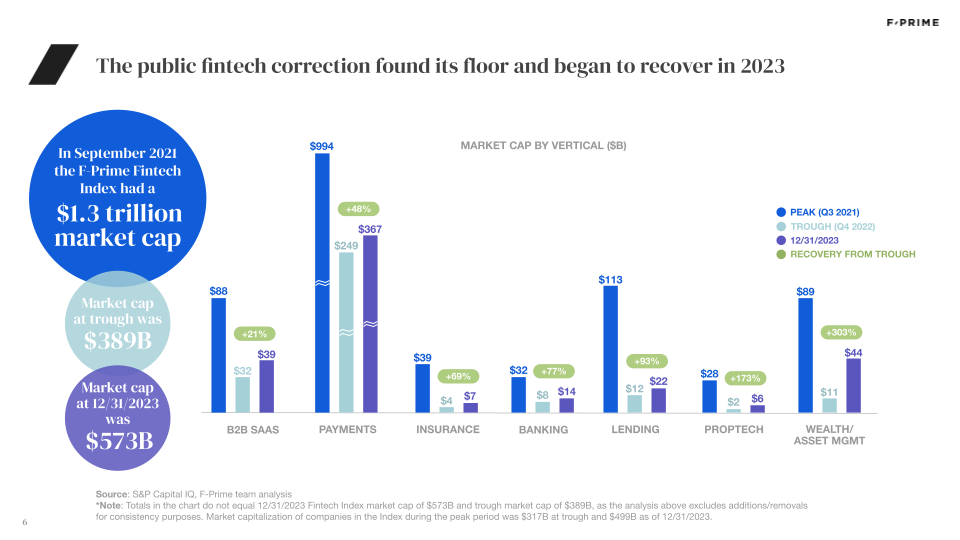

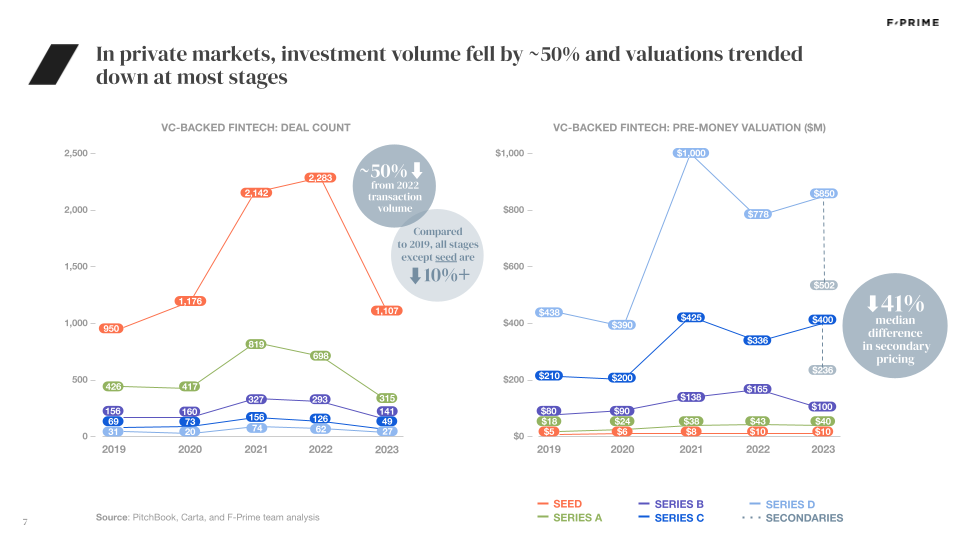

For the last three years, we at F-Prime Capital have produced our annual State of Fintech report to track the sector’s road into adolescence. 2024 marks a decade since fintech started to attract meaningful venture investment (that is, more than $10B annually), so in this year’s report we looked back on fintech’s impact on the broader finance industry.

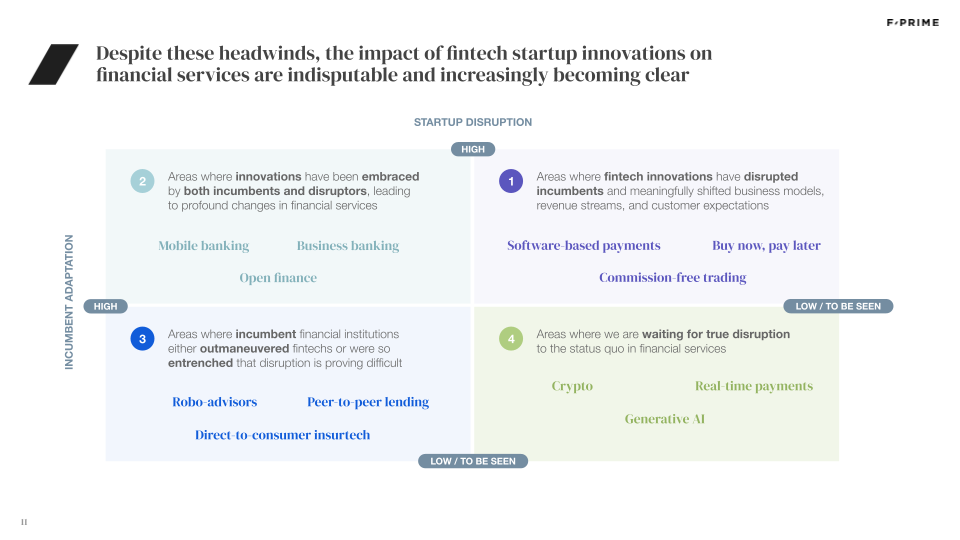

Where did startups truly innovate and disrupt incumbents? Which sectors owe their technological innovation to startups and incumbents alike? Where did incumbents prove difficult to disrupt, or simply outmaneuvered the disruptors? And are there any sectors where these questions have yet to be decided?

True Startup Disruption

In the race against incumbents, startups have had the most disruptive impact in two sectors: embedded payments and commission-free trading models.

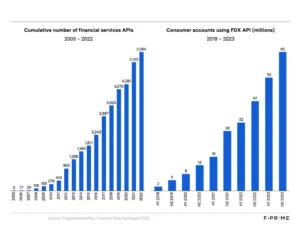

Software-based payments startups have been enormously successful. Riding on the creation of the PayFac model in the 1990s and the API-ification of payments in the 2010s, payments have been increasingly embedded into software vendors and are often the first of many adjacent fintech products offered.

In 2017, software-based payment companies Toast, Flywire, and the still-private Stripe processed just shy of $60 billion in payments, but by 2022 their total payment volume jumped to $927 billion — rising from 3 to 42% of incumbent FIS’s volume.

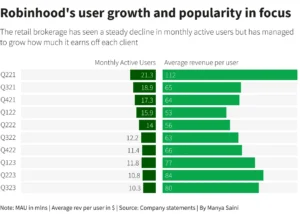

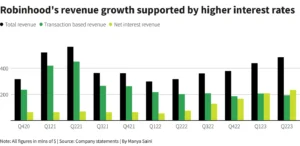

In the wealth management world, Robinhood won a generation of new and active investors with a mobile, gamified mobile experience and, most importantly, a commission-free trading model.

Though not the first company to rely on payment for order flow (PFOF) as a major revenue source, Robinhood’s dramatic rise in 2019 spurred incumbents including Interactive Brokers, Charles Schwab, TD Ameritrade, and E-Trade to forgo commissions. Schwab and Ameritrade (which later merged) estimated that nixing trading fees eliminated $1.4 billion in annual revenue, although much of that was ultimately recovered through PFOF.

Startups and Incumbents Both Disrupted

Broadly speaking, incumbent banks have adapted well to the past decade’s wave of fintech innovation, while startups have also managed to carve out meaningful market share.

Both were able to drive and adapt to changing technology in the consumer banking space. Neobanks like Chime, SoFi and Varo found success providing “new front doors” for consumers — between them, the three companies’ apps were downloaded over 8 million times in 2023 alone. Meanwhile, incumbents were able to quickly adopt neobanks’ more attractive features like zero overdraft fees and continue to see substantial user base growth. Mobile app download data suggests incumbents and disruptors are both winning the race to be consumers’ primary financial relationship.

On the business banking side, startup neobanks like Mercury and Brex benefited from early 2023 bank instability — receiving an estimated 29% of Silicon Valley Bank (SVB) deposit outflows. However, most companies were drawn to the security of J.P. Morgan, an incumbent that has recently acquired innovative fundraising and cap table businesses to bolster its startup product offering. In the wake of the SVB collapse, it secured an estimated 50% of the stricken bank’s deposit outflows.

Where Incumbents Remain Entrenched

By facilitating “hands-off” investment and trading, the rise of roboadvisors opened the door to millions of consumers who were otherwise unreachable to wealth and asset management companies. Early innovators like Betterment and Wealthfront created and owned a $200 million assets under management market in 2012, but weren’t able to secure distribution before incumbents innovated. Within a few years of launch, Vanguard and Charles Schwab developed and launched competitive products that swiftly gobbled up a growing market: by 2021, total roboadvised assets under management had reached $415 billion — and more than 85% owned by incumbents.

Peer-to-peer (P2P) lenders emerged in the 2000s with the ambition to disrupt traditional banking by eliminating the middleman, offering borrowers lower interest rates and retail lenders an attractive return on their investment.

This worked until it did not: in 2014, more than 84% of P2P lender LendingClub’s originations were funded by retail investors, but by 2020 retail sources of funding dried up to only 20%. Both LendingClub and Funding Circle have sunsetted their P2P lending products and instead grew to rely on institutional sources of capital — the very model which they had set out to disrupt. LendingClub went full circle and acquired a bank (Radius Bank) to secure a stable source of bank deposits.

Where Disruptors’ Impact Remains to be Seen

We identify three areas where the dynamic of startup disruption and incumbent innovation remains to be seen: crypto, real-time payments in the US, and generative AI.

Crypto has had a volatile history and its use cases are still dominated by investment and speculative trading. However, stablecoins show promise in both their ability to act as a store of value (in markets where the local currency is volatile or inflation is rampant) and as a new transaction method. In 2022, stablecoin transaction volume reached $6.9 trillion, surpassing that of PayPal at $1.4 trillion — suggesting crypto’s real value may lie in payments, after all.

Last year’s launch of FedNow, the U.S.’s late-arriving real-time payments system, generated a lot of speculation about whether real-time payments (RTP) could rival other payment methods in this country. For now, the effect of RTP in the U.S. remains to be seen. While RTP’s volume share of non-paper-based transactions dominates in India and Brazil (83% and 49%, respectively), the figure is just 1.8% in the United States.

Similarly, we are still in the very early days of a generative AI-driven innovation wave and its lasting effects in financial services. For now, fintech disruptors and incumbents are mentioning AI in company earnings calls at a similar rate, suggesting equal levels of focus on the technology across the industry.

The last decade of financial innovation brought remarkable change to the ways consumers earn, save, borrow, build wealth, and move money — and we look forward to seeing how our list of genuine fintech disruption changes over the next decade.

Originally published in The Financial Brand.