Generational Shifts Drive New Fintech Innovation and Investment

Generational Shifts Drive New Fintech Innovation and Investment

Our latest deep dive in the Wealth and Asset Management sector

Over the past few years we’ve witnessed the rapid rise of the wealth & asset management (WAM) sector. Broad media coverage of meme stocks, cryptocurrencies, and the IPOs of first-movers like Coinbase and Robinhood have heightened public attention on the work of innovative founders who are building in this space. There are now well over 3,400 startups disrupting this fintech category, yet the status quo still reigns in wealth management. As we highlighted in our inaugural State of Fintech Report, nearly 94% of annual brokerage revenue is still generated by incumbents.

The past five years have seen the largest brokerages go commission-free on trading, Robinhood surge to 7.6 million daily average revenue trades, and the rise of robo-advisors to the tune of $350 billion under management. However, the market, technology, and demographic forces that underpin our third State of Fintech sector deep-dive were set in motion years ago. And the ‘who, what, where, and how’ of wealth management have changed significantly.

In response, fintech startups are racing to manage these three dynamic forces:

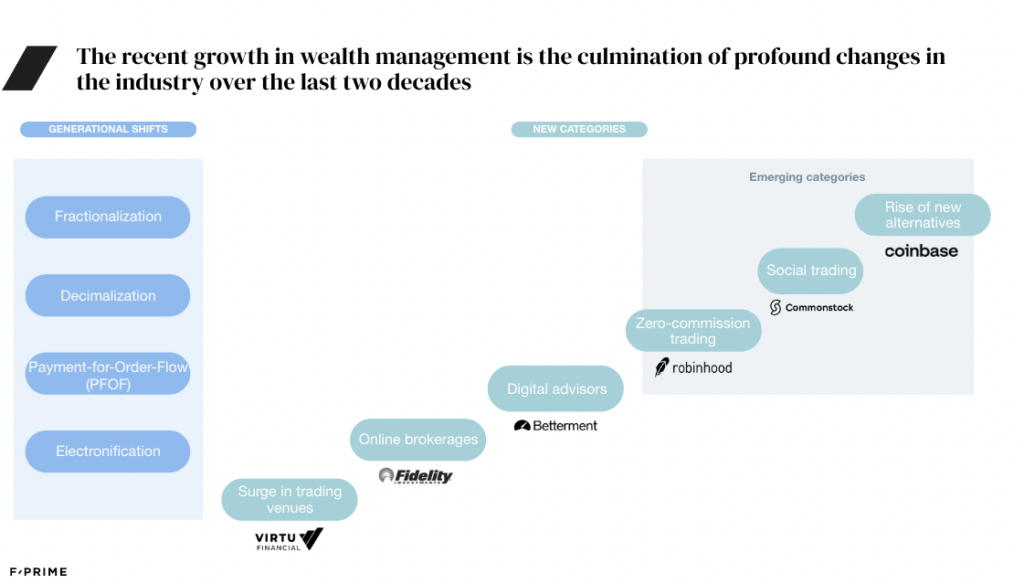

Becoming more accessible. Much of the recent growth in the wealth management ecosystem can be attributed to profound changes in the industry over the last two decades. After electronification and decimalization modernized the trading system early on, payment for order flow practices accelerated investment app development and lowered costs of trading. Most recently, fractionalization of illiquid assets has made ownership more accessible by removing hefty capital requirements.

These changes paved the way for recent advances in the industry such as commission-free trading, popularized by Robinhood during its launch in 2013. Robinhood ignited a generation by altering retail investors’ behavior with active trades, while offering a more intuitive, gamified user experience – surging to 23 million funded accounts by 2021. Similarly disruptive robo-advisors, which empower investors to automate investing and money management, are on the rise – with the top 10 robo-advisors holding an estimated $350 billion in assets under management. Lower-fee and low-touch robo-advisors are better equipped to serve populations previously underserved by traditional high-touch financial advisors.

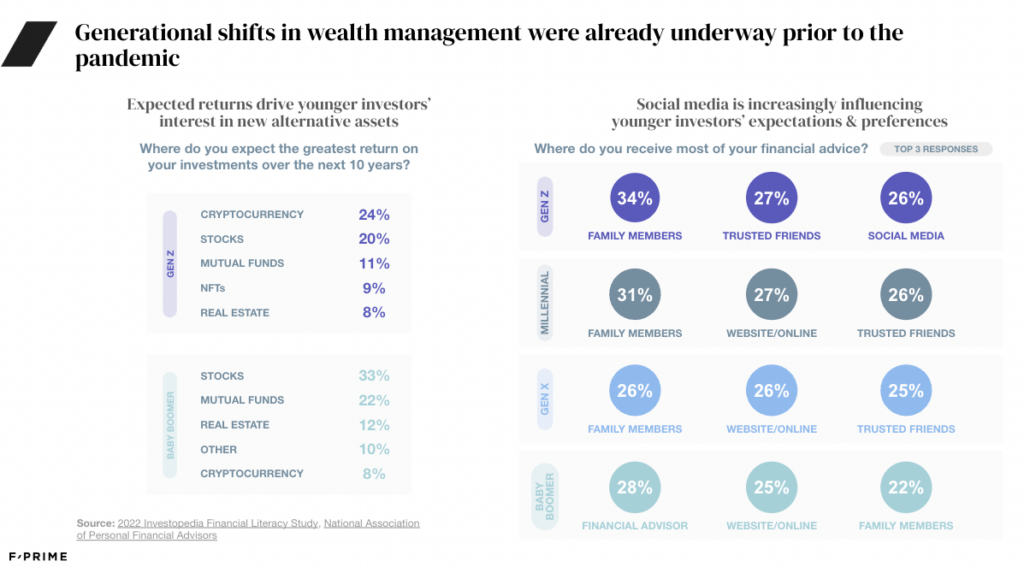

Recasting the wealth & asset management model for younger generations. As Gen Z and Millennials amass or inherit wealth, they bring a new set of expectations and preferences. Not only do younger investors more actively trade than older generations, but with longer investing time horizons, they also align their portfolios to riskier asset classes. When asked where they expect to see the greatest ROI over the next ten years, Gen Z was bullish on cryptocurrency (24% of survey respondents) while Baby Boomers were understandably more reliant upon stocks and mutual funds (33% and 22%, respectively).

Similarly, millennials and Gen Z seek advice and consume content differently than prior generations. For the first time, a generation relies heavily on social media content, including memes, to make investment decisions: 26% of Gen Z name social media as the source from which they receive most of their financial advice. On the other end of the spectrum, Baby Boomers now seek access to tools to manage wealth decumulation, assess health/wealth trade-offs, and manage extended retirements. However, having had a lifetime to accumulate wealth, their top source of financial advice continues to be traditional financial advisors (28%).

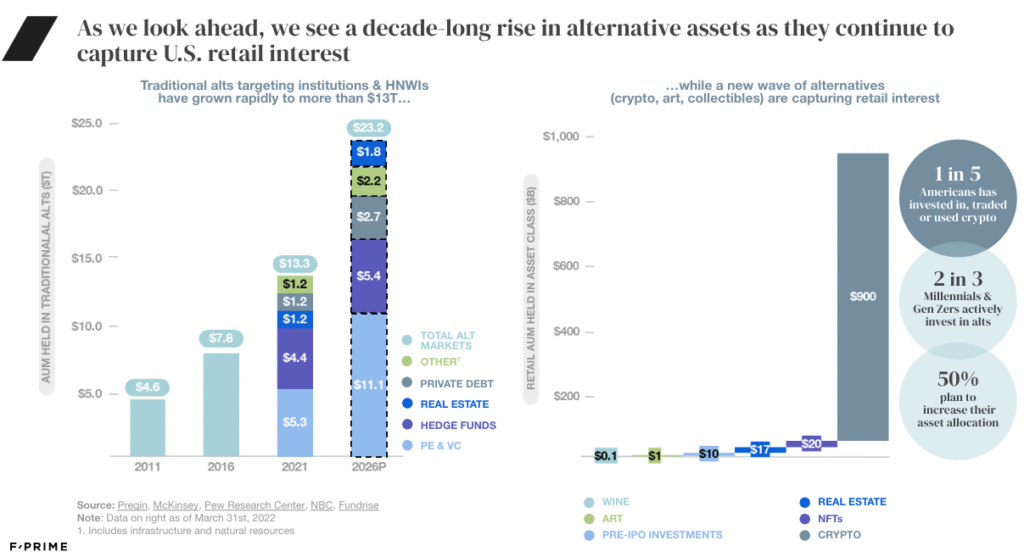

Reallocating portfolios to encompass ‘alt’ investments. Alternative assets are on the rise in two meaningful ways: traditional alts are increasing both in terms of retail access and recommended portfolio allocation, and the breadth of alternative assets is also expanding to the likes of crypto, wine, and fine art.

Historically, alts have been an exclusive domain for institutions and accredited or high net-worth individuals (with AUM nearly tripling to $12 trillion over the last decade) but are now increasingly accessible to retail investors who eschew the traditional 60/40 stock/bond split in favor of a more diversified portfolio. And not only are these ‘traditional’ alts – among them private equity/debt, hedge funds and real estate – becoming more accessible, investments in cultural assets like art, music, wine, and collectibles are rapidly growing as well. Two in three Millennials and Gen Zs invest in alts – among them crypto and NFTs – with 50% planning to increase their asset allocation in this direction.

Where in the World is Wealth and Asset Management Going?

A wave of new wealth players aim to address generational wealth and asset management shifts. Like Robinhood’s early days, many platforms have gamified the investing or savings process. Social trading platforms and ESG-focused players are addressing emerging preferences to obtain investment information from friends and influencers, as well as to focus on aligning investments with sustainability initiatives.

A historic wealth transfer (estimated at $70 trillion) is underway between the generations. Fintech startups understand this transfer presents vast opportunities to establish a high-margin niche with the fastest-growing segment of new investors, while serving older populations with retirement and wealth decumulation solutions. The market is expanding its reach to pull in younger investors and broadening to develop innovative fintech products and services that will drive growth despite today’s economic uncertainty.

The downstream impact is a deeper investment in this space. More personalized recommendations will require AI-powered advancements. More comprehensive access to alts will require a new tech stack and infrastructure. User experience must keep pace. These will remain battlefields for fintech companies, and a boon for retail investors. And the next fintech battlefields will not be limited to the U.S. – they will be global. Fintech startups are emerging to address the faster-growing global investor base in regions including LatAm, Asia, and Africa.