Quantum Circuits, Inc. (QCI) was founded in 2015 with the goal of developing, manufacturing and selling the first practical and useful quantum computers based on superconducting devices. QCI was founded by pioneers in quantum devices and information processing from the Department of Applied Physics at Yale University. Their group has produced many scientific firsts, including the development of a “quantum bus” for entangling qubits with wires and the first implementation of a quantum algorithms and error-correction with a solid-state device.

Sector: Technology

Dispatch

Dispatch is a data orchestration platform powering cross-application workflows for financial advisors, enabling them to seamlessly sync client data across the advisor tech stack and to free them from continually building and maintaining integrations.

Dispatch: Building the Data Integration Layer for Wealth Management

Over the last ten years, investing in wealth management has become decidedly more exciting on the back of TikTok “finfluencers” and direct-to-consumer brands like Robinhood, Titan, and Public. An estimated $45B of venture capital flowed into wealth startups over the last decade, with B2C startups receiving 80% of late-stage capital raised. Robinhood almost singlehandedly disrupted $1.4B of retail brokerage commissions when incumbent brokerages matched Robinhood’s free stock trading (see F-Prime’s Wealth and Asset Management sector report for more).

However, gems are often found on the seemingly sleepier sides of markets, and we see some of the most exciting startups solving problems in the traditional world of financial advisors (aka WealthTech). At F-Prime Capital, we have had the opportunity to partner with the founders of exceptional WealthTech companies, including Quovo (acquired by Plaid), Vestwell, FutureAdvisor (acquired by BlackRock), and Canoe Intelligence. We are also thrilled to have just led the Seed round in Dispatch (fka OneAdvisory).

We wanted to share why we feel WealthTech is so interesting right now and why Dispatch has an opportunity to become a core part of the modern wealth management tech stack.

Why financial advisors?

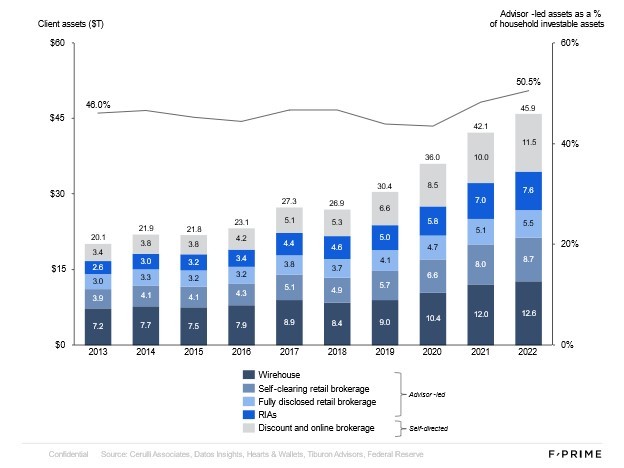

Easy: that’s where the money is. Just over half of retail investable assets are managed by ~300,000 financial advisors. Second, it is an industry that only gets bigger. Advisor-led assets under management (AUM) has grown a steady 8-10% over the last 10 years; up from $17 trillion in 2013 to $34 trillion at the end of 2022.

Why now?

The wealth management industry is experiencing a fundamental need for automation. While investing has become more automated over the last 10 years, most client-facing activities have not. Client onboarding, account opening, investment analysis, and reporting still involve an enormous amount of people and paper. We see four key drivers of automation, each presenting opportunities to rebuild the industry’s technology infrastructure.

Breakaway RIAs: Registered Investment Advisors represent the fastest-growing segment of wealth management. In 2022, nearly 1,300 advisors left traditional wirehouses (e.g., Morgan Stanley, Merrill Lynch, Wells Fargo, UBS) to follow the independent RIA route, taking an estimated $200 billion AUM with them. Alongside the breakaways, private equity is powering M&A across the industry – we estimate there were almost 1,000 RIA acquisitions in 2023. New RIAs want modern tech stacks (they are giving up those huge back-offices) and acquisitive RIAs want one modern tech stack, not one for each acquired firm. These trends require integration, digitization, and automation.

The rise of alternatives: Financial advisors were always a relevant channel for private equity, credit, and real estate funds; however, they are now the star of the show. Private funds need retail investors to continue growing, and financial advisors have embraced the idea of 25-30 percent allocations to private funds, substantially above the current five percent client average. It’s the perfect match, yet the infrastructure is missing. Client onboarding, capital calls, and reporting are all paper-based and advisors pay a high administrative price in exchange for the long-term commitment from their clients. We have written more here and here about the rise of alternative assets and the need for a new tech stack.

Generational wealth transfer: Financial advisors know they are on the verge of a stunning $70 trillion generational wealth transfer over the next 20 years. In anticipation, new wealth management firms like Titan and Facet are targeting those low-balance Millennials. While we expect both old and new firms to win their share, the one thing we know for certain is that Gen Y and Z want digital tools first, humans second. Most traditional wealth management firms will need major upgrades in their digital client onboarding, engagement, and reporting.

Artificial intelligence: We are just beginning to see AI extend into wealth management, but it is exciting to anticipate the impact it will have on client onboarding and servicing, as well as financial planning and advice. The combination of public and private LLMs can radically change the way clients interact with their advisors (and their chatbots). We wrote more about AI in financial advisory here.

Introducing Dispatch

Financial advisors recognize this need for automation, and numerous startups have emerged to address it. The typical financial advisor today uses 10 distinct financial advisory platforms, up from five just two years ago. The tech vendor landscape has truly exploded as well. As Jess Bost has noted, a picture is worth a thousand words:

At this point, the solution has become a part of the problem. There are so many fragmented point solutions and duplicative sources of customer and investment data, that just maintaining data integrity and synchronization has added manual work and risk of errors. Client onboarding into ten separate tech platforms robs advisors of the very productivity they hoped to gain by adding a new tech tool. While an all-in-one tech platform could in theory solve these problems, that is simply not going to happen in an industry with a complex value chain (asset managers, advisors, custodians, servicers, et al.), all-in-one platforms built through M&A, and a highly fragmented advisor base.

The talented co-founders Rob Nance, Madalyn Armijo, and Rafi Lurie started Dispatch to address this fundamental problem of data management. Dispatch automatically (i) ingests client data from tax returns, financial statements, IDs, etc., (ii) enters it into advisor tech platforms, and (iii) perpetually maintains data synchronization across the advisor tech stack. Where a custodian offers API access, Dispatch will also automate account opening.

This is one of those deep infrastructure solutions that solves an enormous pain point, offers an immediate ROI, and can run in the background as the integration layer for customer data. The more integrations they support, the more valuable they become to the industry.

We have never been more excited to be investing in wealth management and feel fortunate to have partnered with Dispatch. The team thinks big, cares deeply, and executes relentlessly. The next few years are going to be great!

Allison MacLeod

As CMO of Flywire (Nasdaq: FLYW), Allison sets the company’s marketing and revenue operations strategy worldwide. Since joining Flywire in 2019, Allison has led the growth of its marketing function, building out new teams in APAC and EMEA, and scaling up a new revenue operations function. Allison was also instrumental in leading Flywire to its successful IPO in May, 2021.

She has more than 15 years of marketing experience, including seven years at Rapid7 (Nasdaq: RPD). There, she focused on building and optimizing the company’s growth by building and scaling demand generation, business development, and operations. Previously, she worked at Forrester in several digital and field-based roles.

Allison is on the Board of Trustees of the Massachusetts Technology Leadership Council, and serves as strategic advisor to early-stage companies. Allison holds a Master of Arts in Integrated Marketing from Emerson College, and a Bachelor of Arts in Communications from the University of Massachusetts, Amherst.

Future Of Financial Advice – More Co-Pilot Than Autopilot

When you put “wealth management” and “genAI” in the same sentence, most minds jump straight to some version of “autonomous finance.” However, that’s a concept that would have to overcome significant trust hurdles with advisors and the public to gain widespread adoption. According to research by Vanguard, the personal connection and trust that exists between financial advisors and consumers drives about 40 per cent of the value in any advisory service.

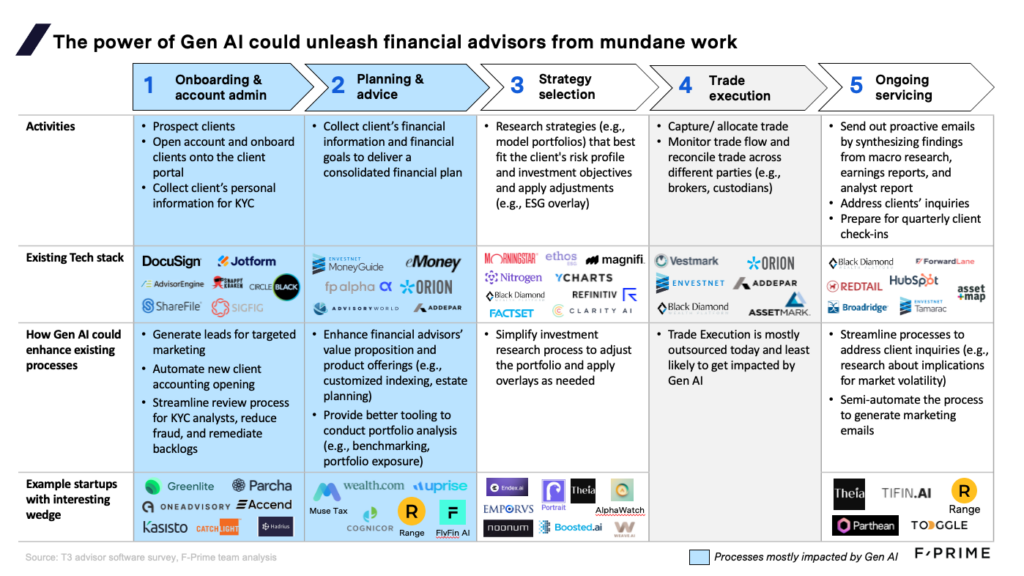

Over the last 10 years, advisors have started to transition from “stock pickers” to client relationship builders. As a result, new inefficiencies have emerged in the value chain: advisors now spend their time collecting and synthesizing information across a sprawling and outdated tech stack to help clients make decisions.

So, while generative AI isn’t going to put our money on autopilot any time soon, it has the potential to save advisors’ time by handling the more repetitive and labour-intensive aspects of their jobs. As a result, advisors will be free to build deeper relationships and trust with an expanding client base.

The current state of play

Most financial advisors juggle five different tech platforms every day:

Many of the steps outlined above involve pulling together disparate information, often supported by different tech stacks, and synthesising it all to generate insights – a unique strength of generative AI technology is that it can quickly process large amounts of data.

Freeing financial advisors from mundanity

Generative AI will enable the construction of new “co-pilots” for financial advisors. Seeking to cut costs in an environment of fee compression, firms are eager to automate routine tasks. Those tasks include reviewing legal documents, opening accounts, preparing client presentations, adjusting asset allocation, requesting query service, addressing ad hoc questions, and other activities beyond their core role of advising clients, which currently take up 36 per cent of advisors’ time. Put another way: the average advisor spends more than two hours “behind the scenes” for every hour they spend with clients.

One way that CIO offices have attempted to streamline these processes is through the creation of in-house research databases. However, advisors still burn much of their workday conducting research, digesting information, and surfacing the most relevant insights in response to specific questions by their clients. It’s important to remember that most of those clients are seeking intuitive responses from a human they trust, rather than highly technical or precise answers.

Generative AI can swiftly perform the synthesising legwork for an advisor, who can then spend more face-to-face time with the client, create suggestions, and ponder implications for their personal portfolios.

Some incumbents (such as Morgan Stanley) are taking the time to build these solutions in-house. However, legacy tech debt means that they usually take a long time to build – for example, Bank of America spent 10 years and $100 million to build its proprietary Merrill One Wealth Management platform. Others are understandably open to partnerships – see JP Morgan’s and TIFIN’s initiative to develop AI-enabled fintech companies. Meanwhile, startups such as Parcha envision a co-pilot that goes beyond answering questions and can instead complete tasks autonomously.

Many startups have built compelling AI-enabled products for advisors: Muse finds tax deductions and credits; Toggle assists advisors with investment research and addresses client questions based on the firm’s proprietary research; Greenlite and Parcha AI assist wealth management companies with KYC review and fraud reduction; and OneAdvisory is automating the collection of client data and account opening while maintaining data synchronisation across the advisor tech stack. In the past, companies such as DriveWealth helped fintech players build investment products for their end users. Going forward, we see a similar opportunity for API-based solutions that help fintechs build GenAI-enabled co-pilots for wealth managers.

Over the last five years, a few trends have emerged that create opportunities for GenAI-enabled wealth management solutions:

Growing data pools: The amount of data available to wealth advisors (from their internal systems, partners, third parties, and elsewhere) has significantly increased over the past decade. If advisors can quickly understand and harness this data they will be well-positioned to optimise financial planning for their clients, and offer tailored products and data-driven advice.

PE involvement: A wave of consolidation in the wealth management industry, with significant participation from private equity firms, would suggest an easier go-to-market path for startups by selling to a single decision maker who oversees many advisors. A GenAI solution that gives advisors more time to reach new customers would be an attractive tool in a PE firm’s search for cost-cutting and efficiency-boosting tools.

End-to-end options: We have also seen the emergence of end-to-end RIA tech stacks from companies like Farther Wealth, Zoe Financial, and Savvy Wealth. Financial data is currently fragmented across a broad advisor tech stack, which hampers the ability to take advantage of GenAI in this field. However, an end-to-end solution could create a proprietary data lake to effectively power GenAI tools. These platforms also have no legacy tech debt, reduce per-head-cost of growing an advisory business, and could therefore accelerate AI adoption in the industry.

Increasing budget share: Finally, wealth managers are spending more on software – an extra 10 per cent of wealth managers’ budgets have gone to third-party tech purchases since 2018, mainly to replace the industry’s 20-to-30 year-old existing stack. This means that advisors have cause and budget to seek out new solutions, and a wedge with generative AI could be a great catalyst to switch.

Implications for wealth management

While it’s still early, it is clear that generative AI will have a profound impact on the wealth management industry. Here are a few potential effects we see:

– Automated creation of individualised client summaries and tailored performance reports en masse, portfolio synthesis for advisors prior to client meetings, and much more – all powered by GenAI;

– With more time on their hands, advisors will expend more effort on deepening and expanding their client base. Co-pilots will also cut the cost of service delivery, reduce the duration of client meetings, and make room for more self-serve and bespoke services;

– By allowing fewer advisors to serve more customers, AI-enabled tools should also expand margins for the larger companies in the F-Prime Fintech Index over time. Meanwhile, GenAI would expand the capabilities for the industry’s best wealth managers, allowing them to win significant market share. However, poor-performing managers may lose clients as they flock to high performers with increased capacity; and

– Finally, as the cost of advisory services decrease, financial advice will continue on a trend of democratisation.

In 2022, we released a report highlighting the trends affecting the wealth and asset management sector. When we release our next report, we expect generative AI will have planted seed across the advisor value chain.

This story originally appeared in WealthBriefing.

A Venture Capitalist’s Perspective on Robotics

Despite the expectations of past science fiction writers, robots are still far from common in our everyday lives, notes the venture capitalist community. More than a fifth of the 21st century has now passed, and the worlds of The Jetsons and Lost in Space still feel like projections of a distant future.

However, away from the domestic lives that most of us inhabit daily, robots have suddenly become pervasive in some industries. Self-driving cars are moving from research labs to the road, Boston Dynamics continues to release incredible video demos — and many investors are starting to take notice.

What has changed to drive this acceleration in both the technological capability and deployment of robotics? Venture capitalists see three key factors:

1. Labor costs continue to rise and are now 45% above 2000 levels.

2. The cost of robotics components has dropped, so innovators can piece together existing platforms and spend more time focusing on the truly groundbreaking elements of their technology. For example, the cost of a robotic arm has fallen 90% since 2000. In business speak, this means nobody has to “reinvent the wheel” every time they want to build a new robotics solution.

3. Software has advanced to the point that it can support robotics technology with complex tasks, buoyed by a 400% increase in AI investment over the past five years.

Where the Money is Flowing

The robotics space changes rapidly, with constantly rotating “hot sectors,” tweaks to business models, and shifting investment and exit dynamics. To better understand the industry landscape, F-Prime Capital recently completed a comprehensive analysis of more than 1,250 robotics companies that raised funding over the past five years.

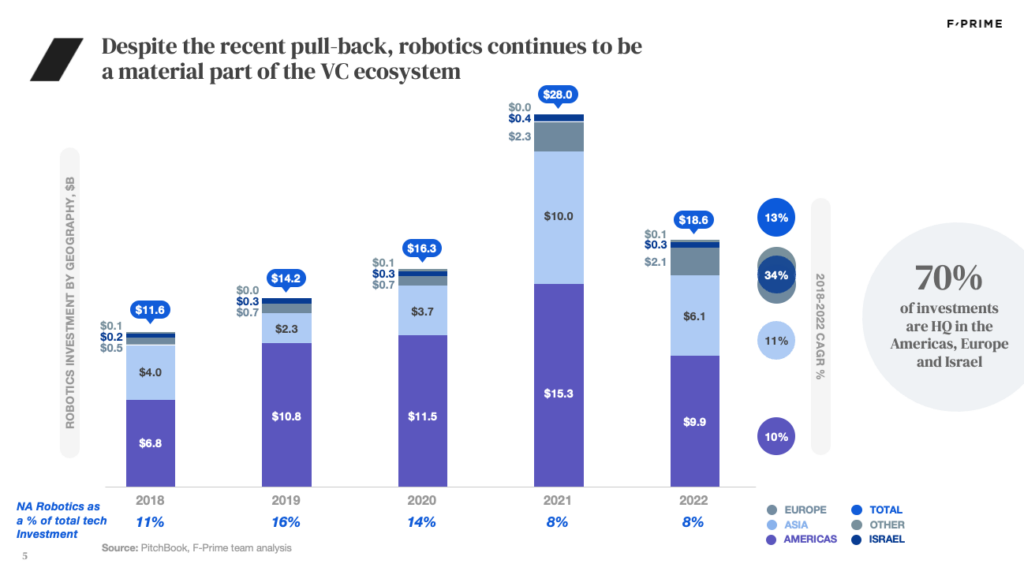

In the resulting report, we found that $90 billion worth of funding had gone to the robotics industry since 2018, representing roughly 10% of overall investments in tech.

We identified three main categories for robotics investment:

Autonomous vehicles — public roads only

Vertical robotics — use-case specific and mostly focused on industrial settings

Enabling systems — hardware and software components that others can use to build complete solutions

Autonomous vehicles (AVs) accounted for more than 50% of robotics funding in most years. However, as investors began to question the paths to commercialization for many companies in the sector, AVs saw a stark decline in 2022.

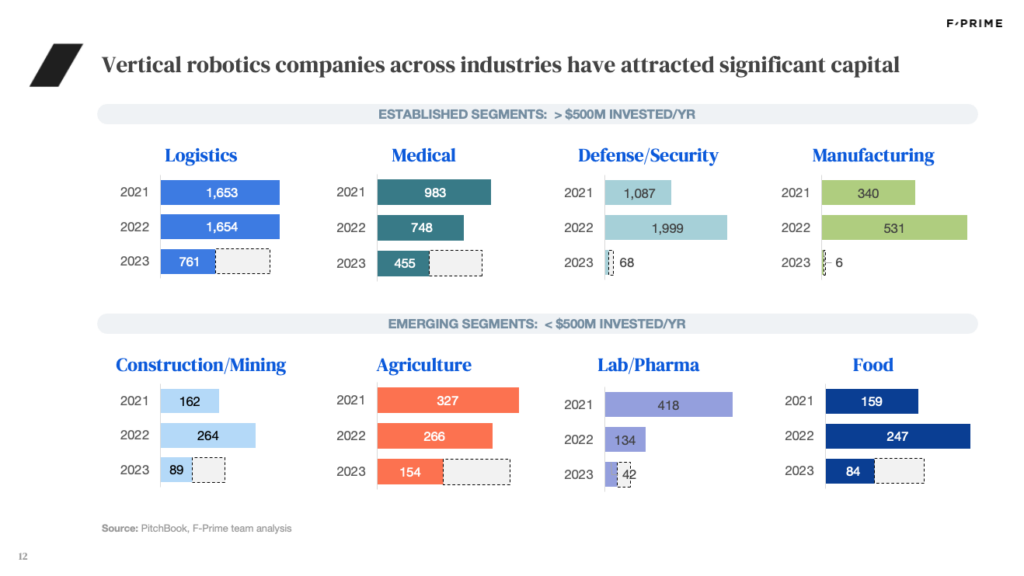

Vertical robotics companies now take the majority of venture funding available for robotics technology. Within this, logistics, defense, medical, and manufacturing applications tend to attract the most investment capital.

However, as we’ll discuss below, the fall in investment that began in 2022 is on track to continue through 2023.

![]()

Another way to trace this shift in focus from AV to vertical robotics is to observe the types of unicorns that have emerged in the space. The 2018 and 2019 crops of robotics unicorns clustered in the AV and enabling lidar space — several of which have since shut down — while the 2021 and 2022 crops tend to center around vertical robotics.

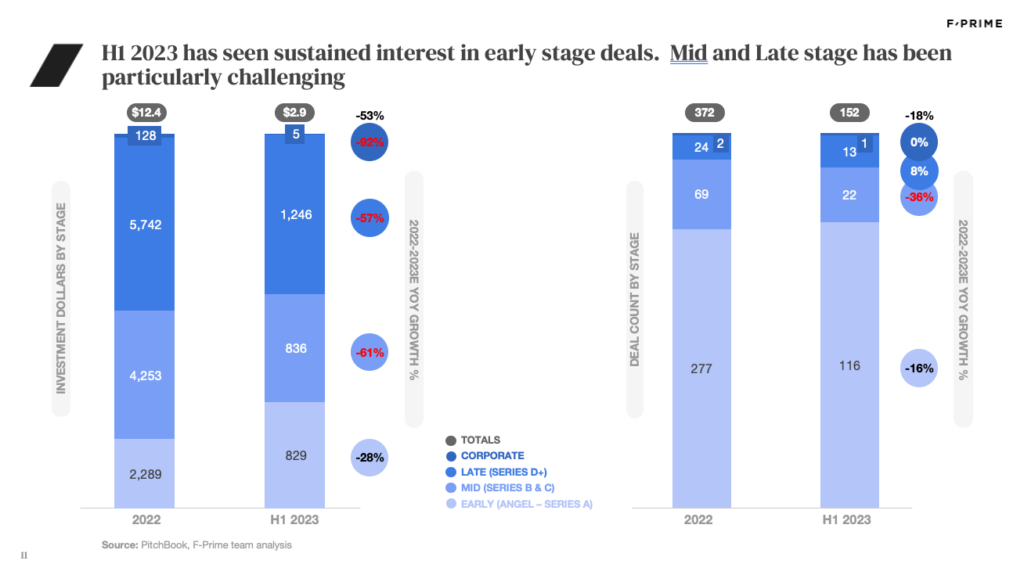

This year has been challenging for startup fundraising, and robotics is no different. The first half of 2023 saw investments decline more than 50% relative to 2022, which itself was down 30% from the heights of 2021.

Fortunately, the second half of 2023 is looking more promising, with several high-profile funding rounds for companies like Anduril, Aurora, and Stack AV.

A deeper dive into the funding environment, however, shows a wide range of behavior by stage. Early-stage deals have shown a relatively modest decline in 2023, whereas mid- and late-stage deals have been far more challenging. This is largely attributable to overvalued earlier-stage companies that raised at the height of the market, which are now facing valuation expectation mismatches when they re-engage investors for their next round of funding.

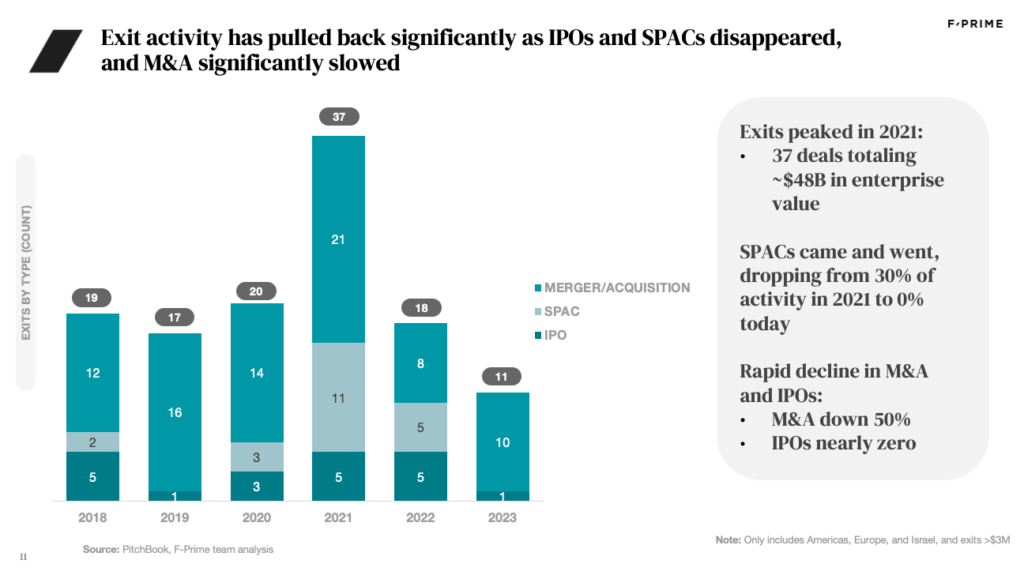

The exit environment has also created challenges for robotics startups. IPOs and SPACs have ground to a halt in the past 18 months, while mergers and acquisitions are down 50% since 2021.

However, even in the best of times, the vast majority of M&A deals since 2018 have been worth less than $250 million, with only a handful of notable exits. Among them: Auris’ $5.75 billion acquisition by Johnson & Johnson in 2019, and Uber ATG’s acquisition by Aurora for $4 billion in 2020.

Public market performance has also been mixed, with robotics companies that have built scaled, high-growth businesses faring best — Symbotic, AutoStore, PROCEPT Biorobotics, and Hesai Technology are the standouts here. For others, valuations have significantly reset.

What’s next for venture capital and robotics?

The boom in autonomous vehicle investment catalyzed a new generation of robotics entrepreneurs and engineers. They are now using that know-how to build startups that solve real customer pain points.

As venture capitalists, we believe the industry remains in its early innings. Indeed, the exit environment is still maturing, and hardware businesses still face an additional layer of complexity compared to pure software businesses.

But for those with experience in the industry — and who understand its unique metrics and business models — it is clear that opportunity is growing at an accelerated rate.

Founders should be aware the era of exiting a business based on little more than “promising technology” is over — you must eventually build a real business. Tech demos do not equal commercial success, and investors have wised up to the fact that production deployments delivering measurable ROI trump pilot customers who are “excited by the technology” every time.

As demonstrated by the data outlined above, it’s also important to note that, for now, capital remains scarce. Founders must build capital-efficient businesses to entice investors. For many, capital efficiency, or a lack thereof, can make or break a founder’s pitch.

Today’s robotics founders have several tailwinds at their back: technological acceleration, labor shortages, stagnant productivity gains, and a cadre of investors who are increasingly interested in the category. Those who can learn the hard-fought lessons of the past five years — including the experience of AV companies and the macro rise and fall in tech investment dollars — are well-placed to find success in this unique category.

Originally published in The Robot Report

Check out the full State of Robotics report here.

Software Buying Has Changed Forever

Software buyers are now more sophisticated than ever. In an early age of software sales, suited-and-booted Oracle salespeople were taking buyers out to dinner and educating them about a solution while engaging in a formal discovery and RFP process. It was an excessive and long sales cycle, with buyers learning about a product and building a trusted relationship with a small number of sellers. This formal dance led to a mediocre problem-solution fit, no concept of after-sale customer success — and still came with a big-ticket price tag.

Today, buyers are far more savvy and educated software purchasers, and range from CIOs to departmental teams. They know the right questions to ask and if they don’t, formal and informal networks exist for virtually every job function — from CISO slack channels to engineering manager meetups to conferences for finance heads and HR leaders. Public forums like G2 Crowd and Capterra have digitized formal review services (which now include feedback from peers as well as experts) while data-driven buyer intelligence platforms like Vendr support the full procurement lifecycle.

Buyers now come to vendors already understanding their needs and how it will work with their tech stack, and it’s very likely they already know which solution is best for them. With hundreds of B2B SaaS companies in our global portfolio, we have had a front-row seat as these interactions between reps and prospects changed over time, and this market transparency has been an incredible forcing function for software vendors to step up their game — from product to sales to customer success and beyond. And as a result, the existing tools of managing customer engagement are no longer sufficient. Software vendors and their sales and marketing teams need solutions that help them engage with better-educated customers at precisely the moments customers want that interaction.

Enter Warmly, which is building the world’s first AI-driven, autonomous sales orchestration solution to help software vendors thrive in this digitally-enabled, fast moving environment. Warmly intelligently alerts sales and marketing reps when a potential customer engages across channels, complete with context about the prospect’s role and network. Warmly automatically sends intent-based outreach on behalf of the sales team, which frees time for higher value activities like building relationships with customers or personalizing messaging. It allows sales teams to scalably interact with prospects in a way that is productive and personalized for both parties. We believe Warmly can be a foundational solution for this type of event-driven sales future.

Congrats to founders Maximus Greenwald, Carina Boo, Alan Zhao, and the visionary team at Warmly on their $11M Series A funding from Felicis, NFX, Zoom Ventures, Maven, and F-Prime Capital.

Tracking the Industry Rebound with the F-Prime Fintech Index

Introducing our upgraded tool for tracking public fintech markets

Last month, we launched our new version of the F-Prime Fintech Index. Users can now explore:

- Adaptive visual multiples and benchmarks

- Head-to-head company comparisons

- Adaptive sector and vertical-specific benchmarks

- Time series of historical metrics by sector and revenue growth

- Company and sector comparisons by revenue, growth, margins, multiples, and more.

Using these new tools, we wanted to share some key insights.

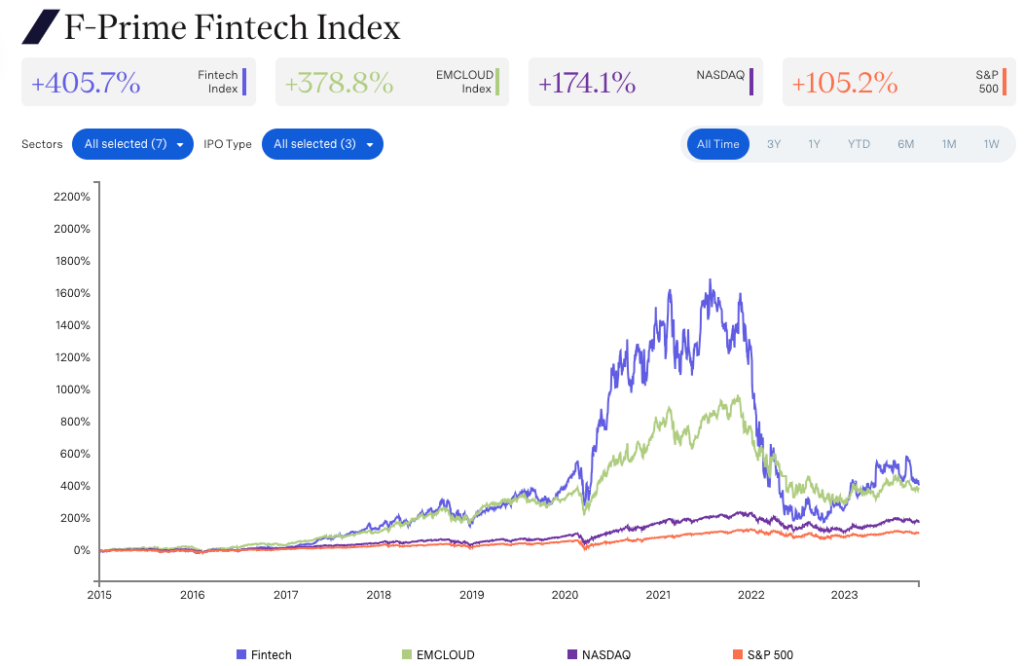

Fintech is Recovering

While the F-Prime Fintech Index took the steepest decline of all the indexes we’re tracking in 2021 and 2022 — plummeting 72% in 2022 — it has also experienced the sharpest rebound over the last 12 months, climbing 67%. While this is still far from its peak, fintech businesses continue to grow and we expect to see more IPOs return to the market over the next few years.

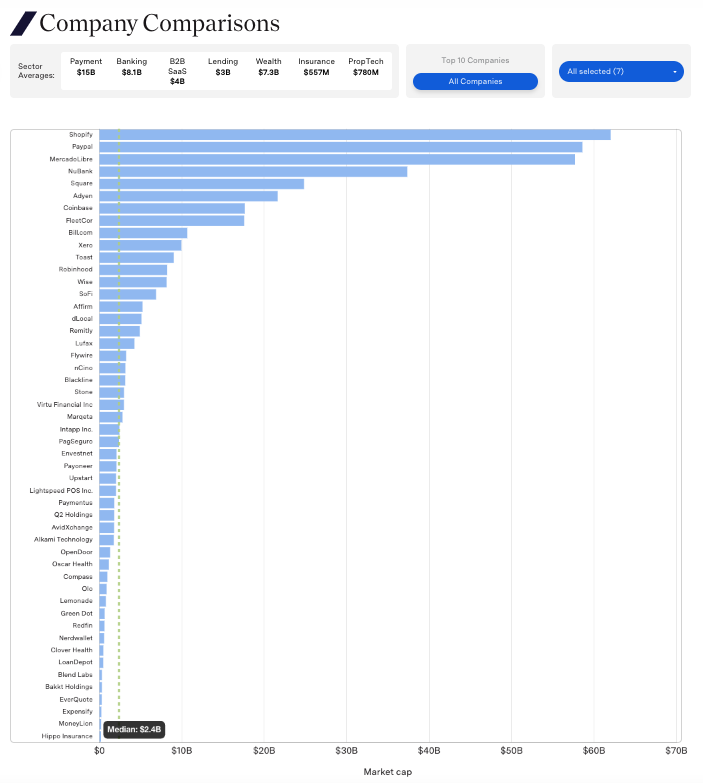

In terms of market capitalization, Shopify, Paypal, MercadoLibre, Nubank, and Square are all leading the F-Prime Fintech Index. These companies are also top contenders for revenue.

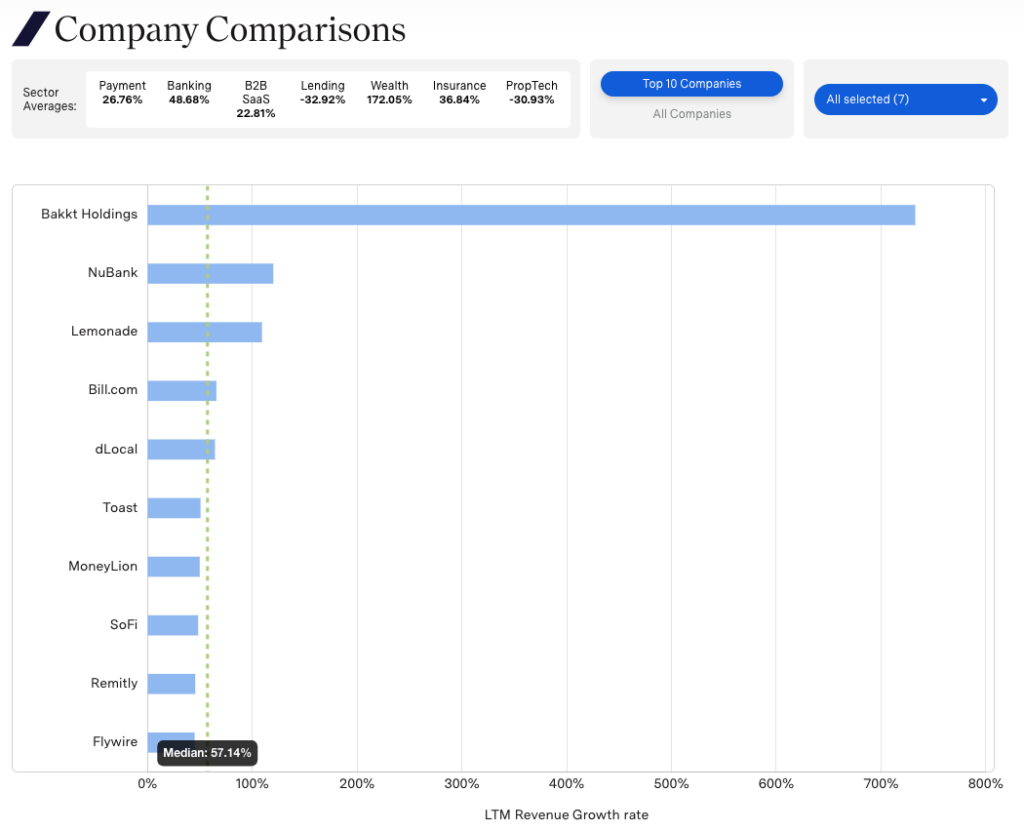

For the top ten companies in the F-Prime Fintech Index, median growth rate remains stable at 57 percent despite the changes in valuation.

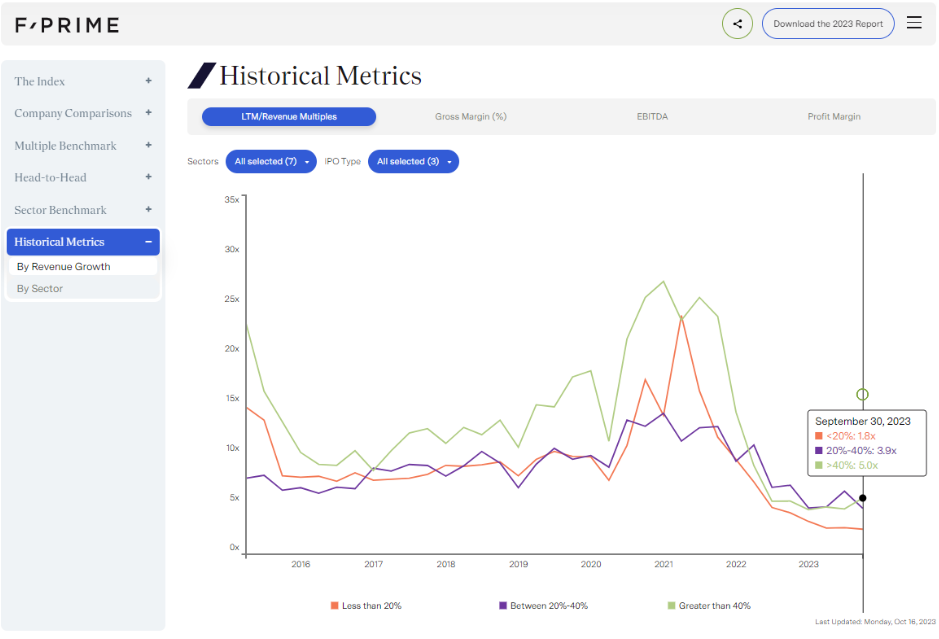

Meanwhile, there has been a large recalculation of revenue multiples. Median growth rate companies (those that grew LTM revenue by 20-40 percent) are now trading at 5x. Throughout 2020 and 2021, they regularly traded at more than 10x.

Payments

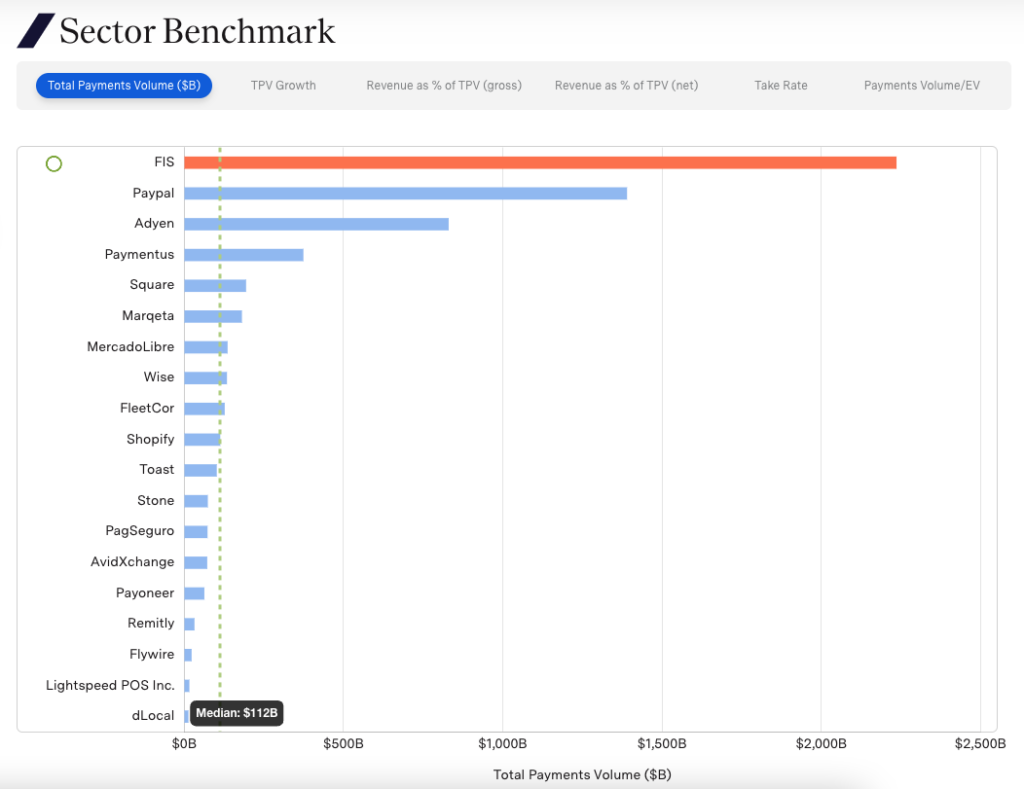

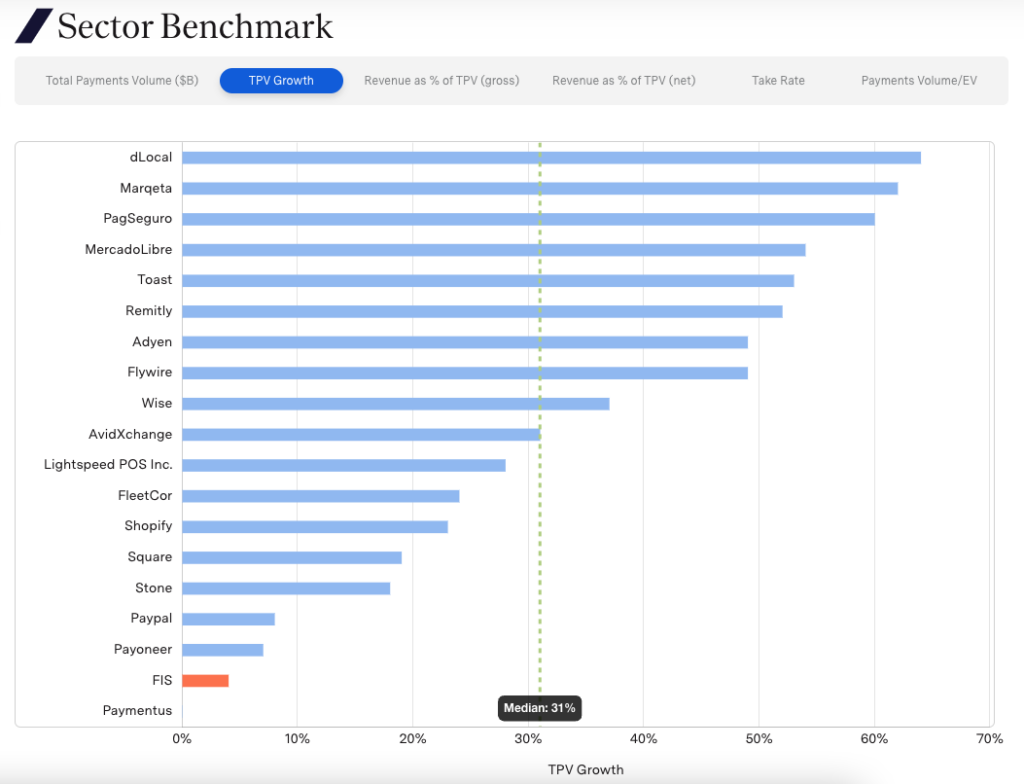

FIS, Paypal and Adyen have the largest payment volume, with $2.2T, $1.4T, and $829B respectively.

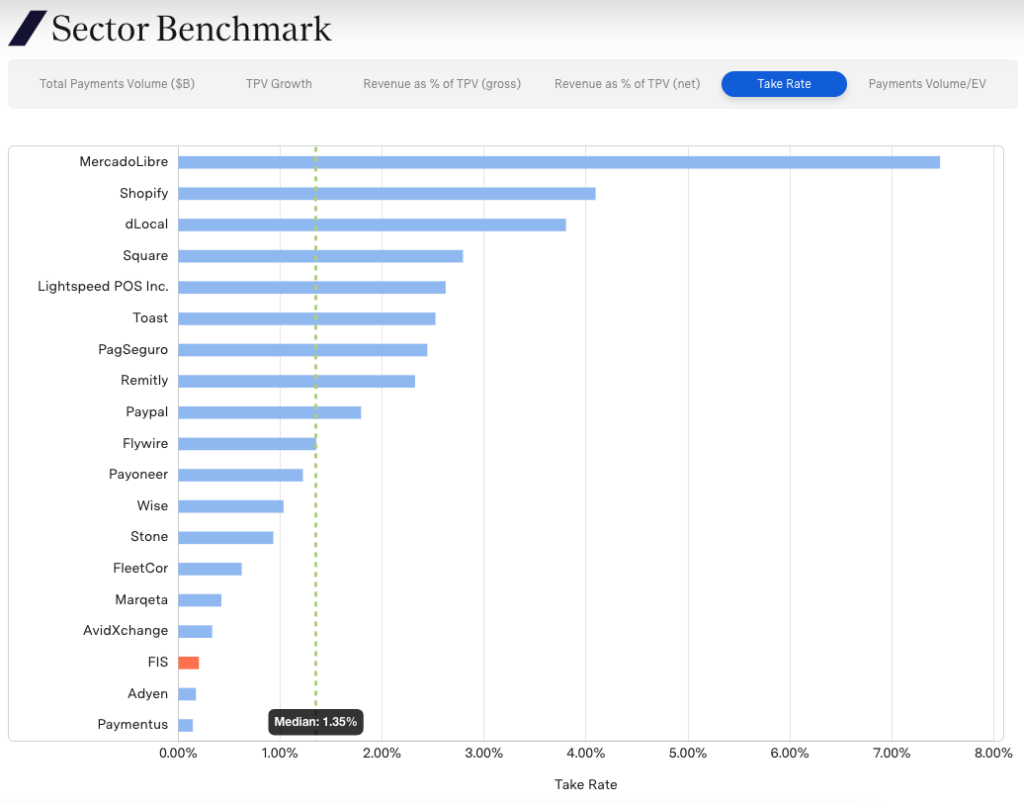

Meanwhile, MercadoLibre, Shopify and dLocal have the highest take rate.

Finally, dLocal, Marqeta and PagSeguro top the TPV growth chart.

Banking and WAM

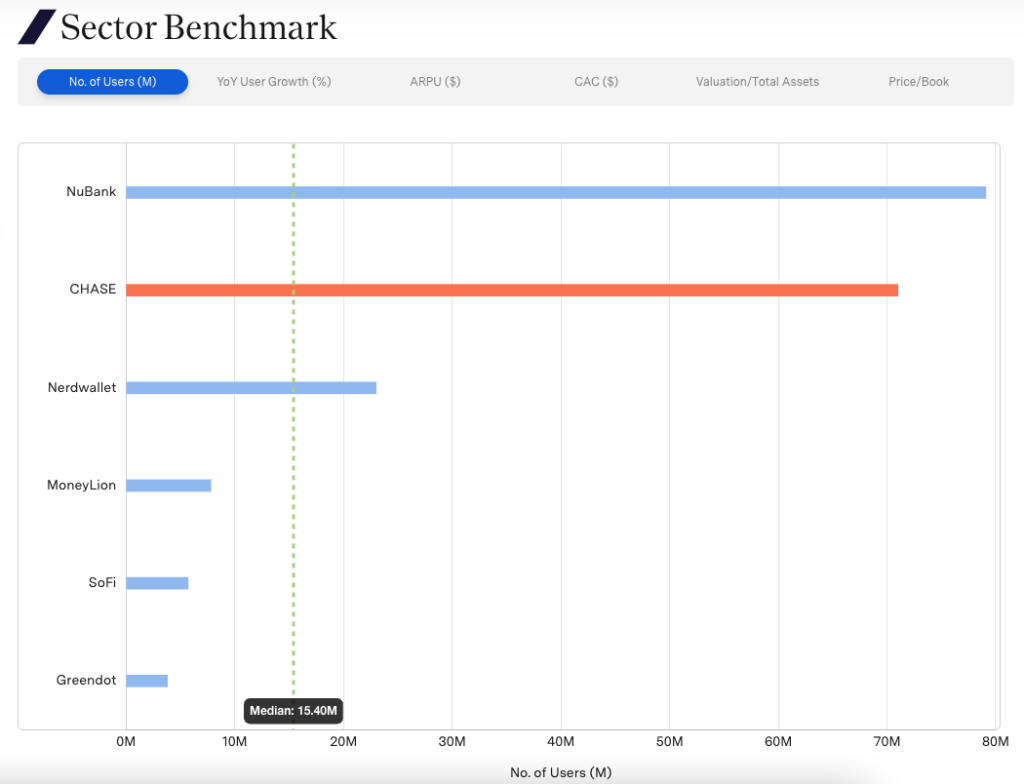

In terms of users, disruptors like Nubank and Nerdwallet are catching up to large incumbents like Chase. Their growth rates are high — 33 and 7 percent, respectively — with considerably lower CAC.

Of course, Chase clearly has a much, much higher market cap — $410B vs $37B for Nubank — as it can extract more value with multiple lines of business, the most profitable of which are Consumer & Community Banking and Asset & Wealth management. It remains to be seen if the challengers can monetize users as successfully as incumbents.

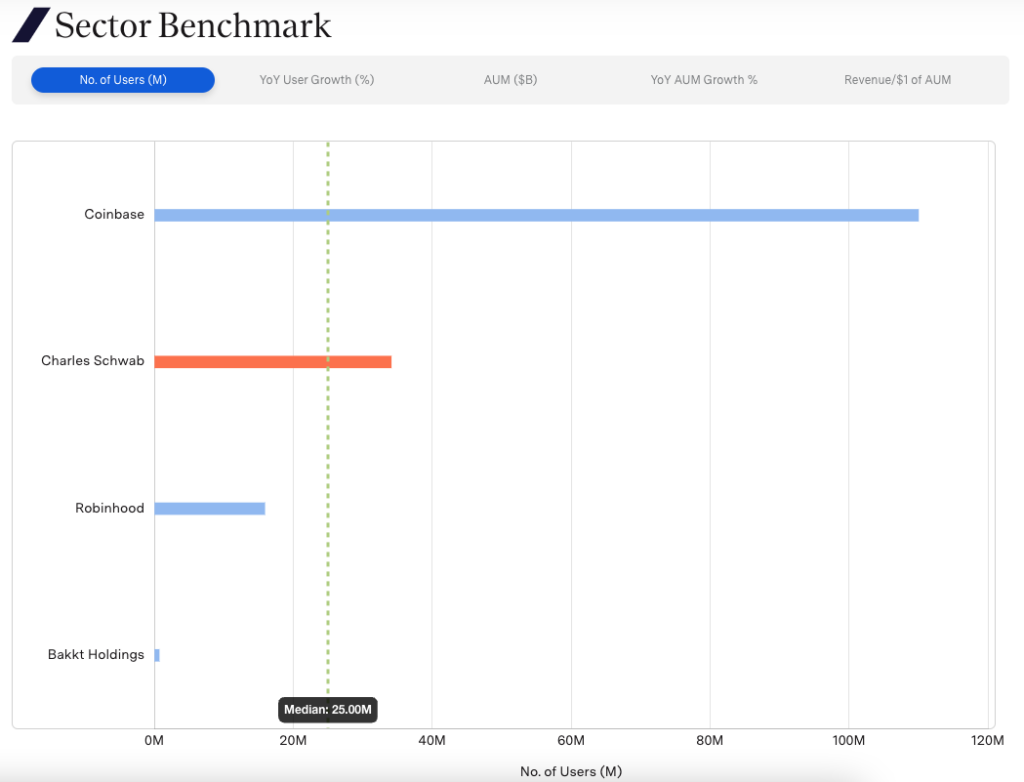

Despite an ongoing “crypto winter” that has reduced the number of users and overall holdings for companies like Coinbase, crypto companies are still managing large numbers of both. Meanwhile, equity trading disruptors like Robinhood are also quickly catching up to traditional incumbents like Charles Schwab in terms of number of users, with 15.9M vs 34.1M and a 34 percent growth rate. At the current rate, Robinhood could eclipse Charles Schwab’s user numbers by 2026.

However, much like in the banking sector, incumbents like Schwab retain considerably higher AUM and can monetize users more effectively. It remains to be seen whether challengers like Robinhood can challenge incumbents in terms of monetization.

Explore the Index

The F-Prime Fintech Index is a free resource, and a great place to see what’s really going on in the industry. Questions? Insights? Get in touch here.

Fintech in Q3 — And Loads of New Functionality for the F-Prime Fintech Index!

Profitable Fintechs That Demonstrate Sustained High Growth Are Rewarded With Big Multiples in Q3. The Rest — Not So Much.

Headline: This quarter, we wanted to show how the Index has performed over the past year. After the significant decline in fintech stocks alongside the broader tech sector in 2021 and 2022, fintech disruptors have quietly recovered a lot of ground over the last twelve months. The F-Prime Fintech Index is up 80%+ LTM, though still ~60% off its 2021 highs. The F-Prime Fintech Index continues to outperform other indexes we’re tracking: the Emerging Cloud Index was up ~6%, Nasdaq grew ~27%, and the S&P 500 climbed ~19% over the past year.

Despite a year-to-date rebound, the F-Prime Fintech Index lost $74B in market cap in Q3, with the median market cap decreasing from $2.8B to $2.4B. Payments companies Adyen, Shopify, and Block drove 75% of the decline, losing $31B, $13B, and $13B respectively in market capitalization in the wake of earnings and profitability misses, plus headwinds in the overall market.

Multiples: Companies that continue to grow rapidly (that is, 40%+ YoY) have seen an increase in multiples to 5x, up from 3.8x last quarter. Investors are rewarding sustained high-growth with higher multiples — a reversion to historical valuations and a change from our last update. For the first time since Q4 2021, high-growth companies are garnering higher multiples than medium growth companies (see the flip in the chart above), despite the fact that most have not achieved profitability.

However, most high-growth companies are still trading significantly below their 2021 multiples, on average reaching ~40% of their Q4 2021 multiples. A few companies have nonetheless exceeded their 2021 multiples, rewarded for their sustained high growth and profitability. Well done, Wise — 72% YoY growth and 12% profit margins.

By sub-sector: Sectors that experienced significant valuation re-ratings in 2022 saw the biggest bounce back in Q3. Multiples in the lending vertical rebounded from 1.1x in Q4 2022 to 6.1x this quarter. Category leader Affirm increased to 6.8x from 3.7x; however, removing Funding Circle from the Index and Lufax’s lack of multiples (due to its negative enterprise value) account for ~50% of the increase in average lending multiples.

Macro and real-estate sector concerns continue to weigh on the proptech vertical which is still trading at ~1x, though better than 0.5x at the beginning of the year. Meanwhile, all proptech companies in the F-Prime Fintech Index saw multiples increase, with Blend seeing a jump to 2x from 0.8x.

While the durability of payments businesses has garnered stable multiples (4.5x for the past year), a few — Shopify, Flywire, Mercado Libre, Remitly, and Wise — have seen improvements in multiples. Likewise, B2B SaaS companies have continued to attain the highest multiples (more details below).

Index removals: While M&A activity continues to increase in both public and private markets, no F-Prime Fintech Index companies were acquired this quarter. However, Bright Health Group (BHG) no longer met our criteria and was removed from the Index.

F-Prime’s Summer Internship Program: Meet our 2023 interns and fellows

Thank you to our interns and fellow for their contributions this summer and for choosing F-Prime!

This summer, F-Prime was thrilled to welcome a talented cohort of interns and fellows to our Cambridge and London offices to help with competitive landscape analysis, sourcing, founder calls, and more. Read on to learn what it’s like to join our internship program.

“I have been able to explore new thematic areas in which the team was still building its knowledge base. By getting deep into the science and innovation through meeting entrepreneurs and academics, I have added to the team’s thinking and identified potential plays which culminated in presentations to the partners. A special shout out to Ana and Martin for the mentorship and support over the summer!”

“My time was split between assisting with an ongoing deal — leading a summer exploration project — and taking part in meetings with potential investments. I’ve had a great time in all of these activities, but I particularly enjoyed being an integral part of a deal team. Between self-guided research into standards of care, calls with key opinion leaders, diving into the relevant primary literature, and doing some basic market forecasting, I was able to leverage the clinical and research training I’ve received and develop so many new skills along the way.”

“I have been researching the biotech landscape of foreign markets and performing due diligence on interesting licensing opportunities abroad. I have also participated in many introductory and follow-up meetings with prospective US-based companies, where my research expertise and previous work experience have been invaluable in helping me evaluate each opportunity. I’ve learned a lot throughout the summer and was able to connect with people at all professional levels and across disciplines. One important skill I’ve been able to develop during my time at F-Prime is learning how to become versed in a new area of science within days, which is quite different from my Ph.D. experience of developing deep expertise in one area over many years.”

“I joined the F-Prime/FBRI team primarily due to the invaluable opportunity to collaborate with individuals deeply committed to fostering and accelerating my personal learning and professional growth. Although it is a lean team, I am fortunate because it translates to more one-on-one attention. I am getting opportunities to actively participate in diverse projects that make me feel valued as an individual, and that my contributions are noticed and appreciated (even as an intern!).”

“I was drawn to F-Prime because of the learning culture at the firm. I wanted to play a role in the translation of good ideas into real medicines and the firm has amazing people doing exactly that. On virtually every topic I encounter, there is a resident expert at the firm who can help me in framing my thinking. This ability to get to the right answer faster makes everyone more productive.

I also want to highlight that the deals the firm sees are a function of its reputation. People want to invest with F-Prime because they know they’ll not only receive capital but also an engaged partner who can help them along the trajectory of the company. This means that we see some of the most interesting ideas that will shape the future of medicine and often get to take part in their realization.”

“One of the exhilarating projects I’ve been involved in is the thematic research on Gen AI x Fintech. The possibilities with breakthrough technology like Gen AI are awe-inspiring. I find it fascinating to delve into its potential for the future and hear how visionary entrepreneurs contemplate disrupting the financial services landscape. It’s been an incredible journey so far, and I’m eagerly looking forward to sharing the outcomes of our research.”

“I have always planned to spin out my PhD research but had no idea how VCs actually decide to fund these projects. I joined to learn how other spinouts and startups pitch to VCs and learn about the decision processes that VCs make.”

Applications for 2024 are not open yet, but if you are interested in learning more, please send an email to careers@fprimecapital.com.