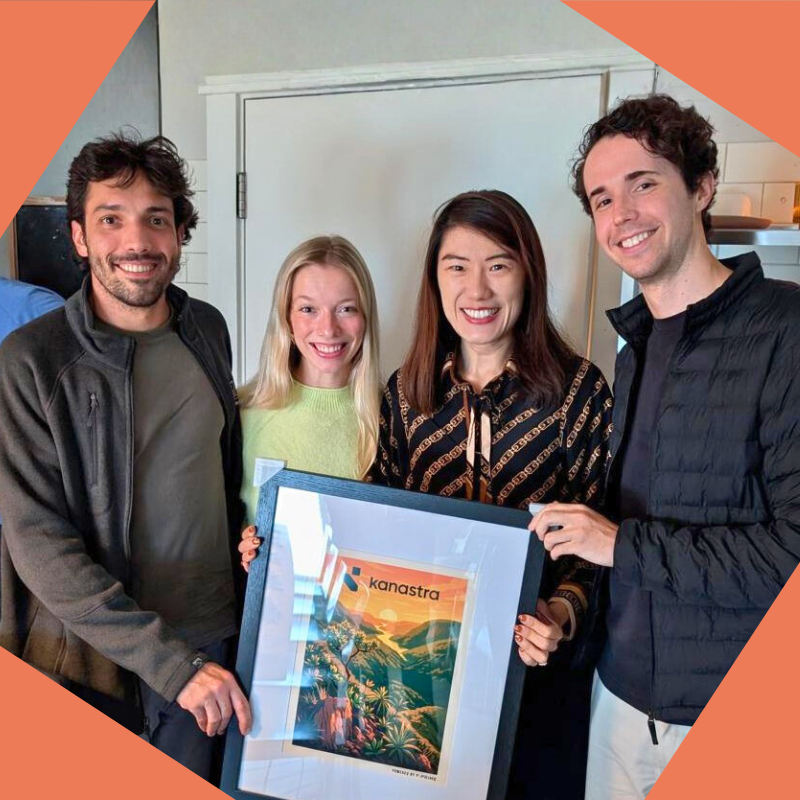

Rocio Wu

Rocio Wu

Rocio Wu is a Partner at F-Prime Capital, where she leads investments across AI, Enterprise, and FinTech. She regularly publishes her investment theses in the Forbes VC Column, exploring how emerging technologies reshape industries and global markets.

Previously, Rocio was an investor at Liquid 2 Ventures, founded by NFL Hall of Fame quarterback Joe Montana, where she backed companies including Chipper Cash, a leading African cross-border payments platform, and Overjet, an AI company transforming oral healthcare. Before her investing career, Rocio held operating roles at Google and Amazon spanning corporate development, go-to-market strategy, and marketing across the U.S., Japan, Spain, and China.

Rocio is a community builder who convenes founders, operators, and investors across networks such as Xooglers, Women in AI, Female Founders & Funders, and HBS Circles. She is drawn to founders who challenge conventional wisdom and to ideas that connect disciplines in unexpected ways – an orientation that shapes her approach to investing and company-building.

Rocio holds an MBA from Harvard Business School and a BA from Shanghai International Studies University, through a joint program with Universidad Pontificia Comillas in Spain.