Colored by his own experience with OCD, Stephen Smith helped create NOCD, a digital health startup to address this chronic and severe psychiatric condition that affects one in 40 people, which is over 180 million people globally.

NOCD is dedicated to helping people with OCD and related conditions receive effective, affordable, and convenient treatment. Therapy is delivered through a virtual platform, which offers members live video sessions with a licensed therapist who specializes in Exposure and Response Prevention (ERP) therapy –the gold-standard treatment for OCD. The platform also offers interim support between sessions from peer communities and self-help tools. It’s a model that Smith wishes he had access to when he was first navigating the disorder.

Smith explained, “I realized that my journey with OCD sadly was the norm, not the exception, and it didn’t have to be that way, considering how effective ERP can be for most with the condition.” In ERP therapy, an individual is encouraged to confront the stimuli that trigger distress related to their obsessions, while also resisting the urge to perform compulsions to reduce that distress.

As the success of ERP often depends on consistently practicing exposures outside of therapy sessions, Smith identified that “the problem was operational in nature, not clinical, which meant it could be solved.” That was the catalyst for the inception of NOCD, and an on-demand platform was developed to identify, engage, and manage people with OCD more effectively, affordably, and conveniently.

What motivated you to start NOCD?

I didn’t start experiencing severe OCD symptoms until I was a sophomore in college. Prior to my OCD onset, life was great. I was playing quarterback at a small university in Texas, doing very well academically, and thriving socially. However, my life changed on a dime once I returned home to the Chicagoland area for summer break. One evening, I started having strange fears that made me question my core values and character. Unlike other fears that naturally went away over time, these were different. They felt stuck in my head, and the harder I tried to make them go away, the worse they became. Because I didn’t realize that these were hallmark OCD symptoms, I sought help from a generalist psychologist in my area. He misdiagnosed and mistreated me, teaching me strategies that weren’t just ineffective but were harmful in retrospect. I got worse and saw several other providers who similarly misdiagnosed and mistreated me, causing me to become constantly distressed, develop severe depression, halt my football career, leave school, and eventually become housebound.

While housebound, I spent most of my time compulsively searching Google, to disprove my recurring, unwanted, fears and relieve my debilitating anxiety. This put me in a position to find a forum for other people going through the same experience. They defined their symptoms as OCD and shared how they regained their life by doing ERP Therapy. I felt like I had a breakthrough and immediately searched for ERP Therapy. That’s when I ran into a whole other set of barriers: There was only one licensed therapist in my area who specialized in ERP, and it cost over $300 per session to work with her. Moreover, she had a seven-month waitlist, preventing me from getting help even if I could find a way to pay for the care. It was a disaster, but a family member helped me eventually get off the waitlist, cover the cost of the treatment, and see the provider. The experience completely changed my life. The ERP specialist diagnosed me with OCD, started me on ERP Therapy, and helped me see transformational results after only a handful of months. The progress allowed me to eventually return to school, restart my football career, and finish my degree. While at school, I had an opportunity to reflect on my journey, ultimately forming my vision for NOCD.

What differentiates NOCD from other telehealth providers in the industry? In what ways have you achieved success where others in the field have fallen short?

NOCD is the only OCD-specialty provider in the industry that accepts insurance for over 140 million Americans in all 50 states and has a wait time of less than 7 days on average. Further, we offer care that is a hybrid of “tech and touch,” an integrated treatment experience that helps people not only during sessions, but also between sessions when their therapist isn’t available. Consequently, in the largest peer-reviewed OCD treatment study ever conducted, NOCD Therapy was proven to drive significant reductions in OCD severity in half the amount of time than standard ERP Therapy.

What’s been the most rewarding part of your tenure with NOCD to date?

One of the most rewarding parts of my tenure with NOCD is seeing the outcomes we generate for our members, particularly their personal anecdotes because they are a testament to the profound impact of our efforts. OCD can feel really isolating and we make it a priority to bring together the OCD community so that no one feels alone. Also, it’s been very rewarding watching several people on our team develop professionally over the years. We’ve had people who joined the company out of college who are now directors or VPs. They’ve flourished here, and they’ll be able to work anywhere they choose down the road.

How would you describe your leadership style?

Although my sports background makes me competitive, I pride myself on being involved. My style is to form strong relationships with people on our team at all levels, so I can ensure they feel happy, healthy, and properly supported. I try to lead by example and push the tempo operationally, so people can be in a situation that allows them to achieve beyond their personal expectations and move mountains in the industry.

What’s one lesson you’ve learned so far as Co-Founder and CEO?

As Co-founder and CEO, there comes a time when the success of the company is completely based on how well key people in the company perform. Therefore, it’s up to me to not only find excellent talent but also to groom and develop talent.

What does the future look like for NOCD?

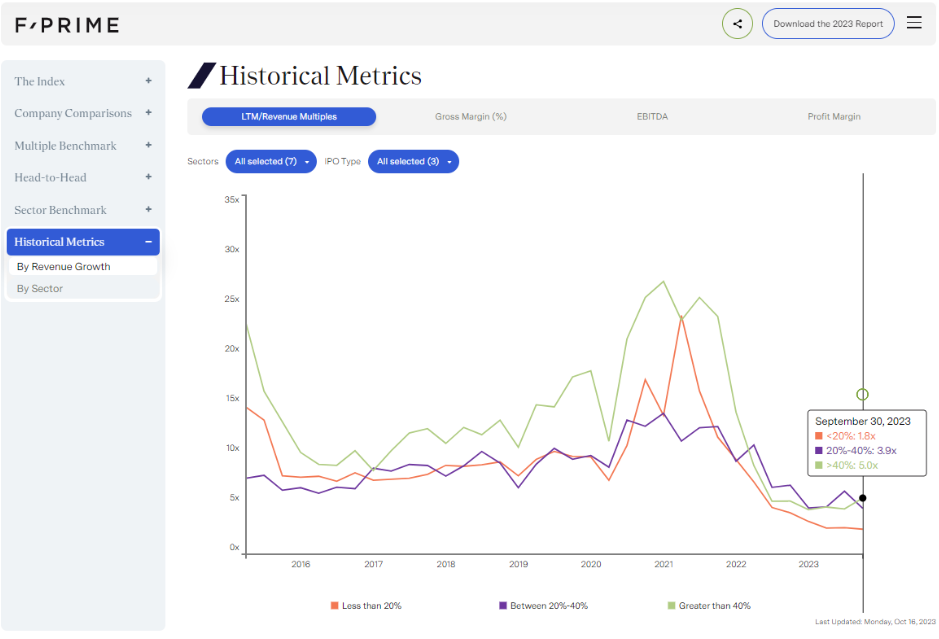

F-Prime has been crucial in helping my team and me understand how to scale NOCD in such a way that it withstands the test of time. We have “product-market fit,” with patients, providers, and payers, so now we’re focused on efficiently scaling to reach millions of people globally in need of evidence-based care.

Our company is excited about the opportunity to scale with partners who are interested in identifying people with OCD and related conditions. For instance, we would like to make at least one preferred psychiatrist partner in each U.S. state that we serve, to allow us to expand medication management operations. We don’t offer medication management services, for context. Seeing our members get better makes me most hopeful about NOCD’s future—many of them not only experience life-changing outcomes but sometimes even life-saving outcomes.

What’s the best piece of professional advice you’ve ever received?

Build a product that people don’t just like, but love. It is the key to building a generational company. We take that advice seriously every day at NOCD.

Subscribe to our newsletter to get the latest updates on how our portfolio companies continue to lead the way in their respective fields.