Across every sector and every geography, the teams that attract and retain the strongest talent are the ones that ultimately win.

Reading the headlines you’ll see no shortage of well-capitalized startups seemingly poised for growth. Yet in boom times and bust, one common thread has always connected the very best companies: talent. Across every sector and every geography, the teams that attract and retain the strongest talent are the ones that ultimately win.

Given the importance of recruiting, it has been rewarding to see so many startups tackle talent acquisition. Yet retention, equally as important, has typically been under-served by the startup market, which is suffering from a historically tight labor market and a Covid-inspired “Great Resignation” leading millions of workers to leave their jobs. In fact, 55 percent of Americans expect to look for a new job in the coming year.

Enter Hone, the company providing live, cohort-based management and leadership training that teams love.

During the pandemic, consumers and professionals have come to rely on high-quality digital experiences, such as Peloton for fitness, Zoom for video-based meetings and Outschool and Coursera for education. Hone epitomizes the next evolution in employee education tools that leverage the kinds of digital experiences we’ve come to expect in the post-Covid era. In short, they’re building the next generation employee engagement, training, and retention tools–the kind of technology today’s employers and employees need–to usher in the future of work.

There’s an old adage that people don’t quit jobs; they quit bosses, and the data proves it out. 94% of employees say they would remain with one company longer if their employers were more invested in their training and education. And managers, too, feel more engaged when they have room to grow. Managers who have room to learn and grow are 3.5x more likely to be happy and engaged and 3.3x more likely to want to stay at their organization for 2 years.

Through live, cohort-based training, Hone delivers the tools managers need to increase employee retention. By focusing on the highest-impact competencies for leadership and management and by practicing skills live in cohort-based learning teams, Hone has helped over 11,000 managers across 100+ organizations turn lessons into skills and drive lasting behavioral change. Their 300+ monthly courses include management themes, such as giving feedback that lands and building high-trust relationships, as well as issues relating to DEI, such as managing bias in the workplace, addressing microaggressions on the team and embracing diversity with inclusion.

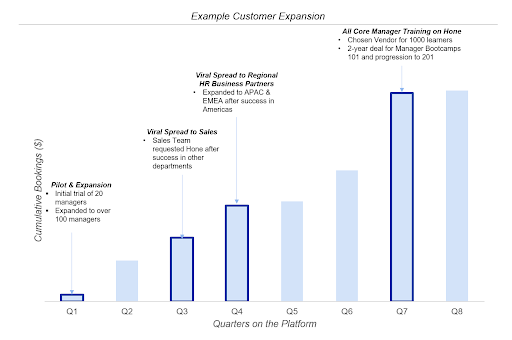

Most importantly: Hone works. Unlike most e-learning lessons that average 10% completion rates, Hone’s training completion rates are 84%, with 90% of learners demonstrating a lasting behavior change. This shouldn’t be surprising given the caliber of the coaches — on average they score an impressive 4.8/5.0. HR buyers are happy, too: 89% of pilot programs lead to expansions.

As with any startup, the strength lies in the team, beginning with a strong bench of leaders at the helm. Co-founder and CEO Tom Griffiths was formerly co-founder and Chief Product Officer at gaming unicorn FanDuel. In his capacity at FanDuel, he successfully helped the company pivot from a news surveying app to a multibillion-dollar sports gaming platform earning $150M+ in revenue. Meanwhile, co-founder and Chief Customer Officer Savina Perez is an HR and DEI guru, having led growth at several venture-backed startups and previously served in executive roles at Culture IQ and Curalate. The two united over their passion for training, culture and people and are the perfect duo to help companies upskill and retain their most precious resources: their employees. They have successfully built out a stellar team of 30 members, 50% of whom are female, and 43% of whom are non-white.

We couldn’t be more excited to join Tom, Savina and the rest of the Hone team on their journey to revolutionize employee performance and retention through live, cohort-based leadership and management training. If you think your team could use a boost in employee engagement and retention (and what team can’t?), check out their incredible offerings at Honehq.com.