Did you ever watch the original Lost in Space series from 1965?

The last 50 years of sci-fi television and movies have led many of us to expect that robots are an inevitable part of our future. To be sure, robots are now pervasive in some industries, particularly manufacturing. However, they are far from being a part of our daily lives, and the character “Robot” (of Lost in Space) still feels like a distant dream.

Nevertheless, the last few years have felt different. Autonomous vehicles are moving from research labs to the road, Boston Dynamics releases jaw-dropping new videos every few months, and (a few) venture capitalists are starting to take notice.

What’s really going on?

As one of the VCs that have actively invested in robotics the last few years, we’ve seen a rapidly changing landscape of ‘hot sectors’, business model evolution, and investment and exit dynamics. At the same time, it’s been difficult to get a grasp on exactly what’s going on. Robotics as a sector is not well-defined in the standard deal databases that VCs use, making it difficult to get a comprehensive overview.

To remedy the situation, we spent the last several months doing a comprehensive analysis of more than 1,250 robotics companies that have raised capital in the last five years, with a company-by-company analysis of which companies should be classified as ‘robotics’ and, if so, what use case they are pursuing. You can access the full report here.

Where are the VC dollars going?

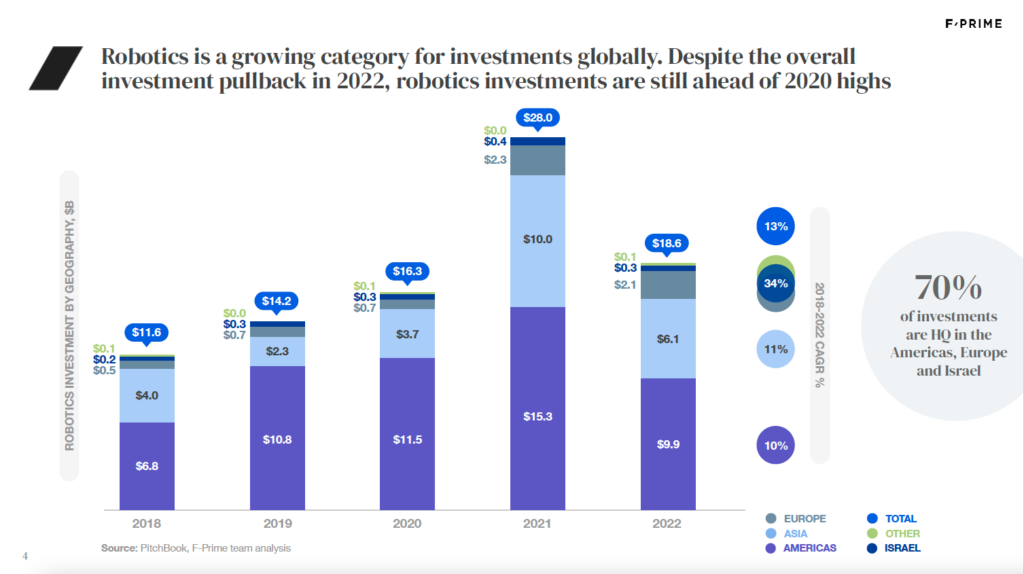

The last five years saw $90B invested in startups across the global robotics industry, representing roughly 10 percent of overall VC investments in technology. As with the rest of the market, there was a significant spike of investment in 2021, though the market remained robust into 2022, with dollars invested exceeding 2020 highs. Western markets, including the US, Europe, and Israel, were 70 percent of overall investment, though Asia — particularly China — is becoming a growing force.

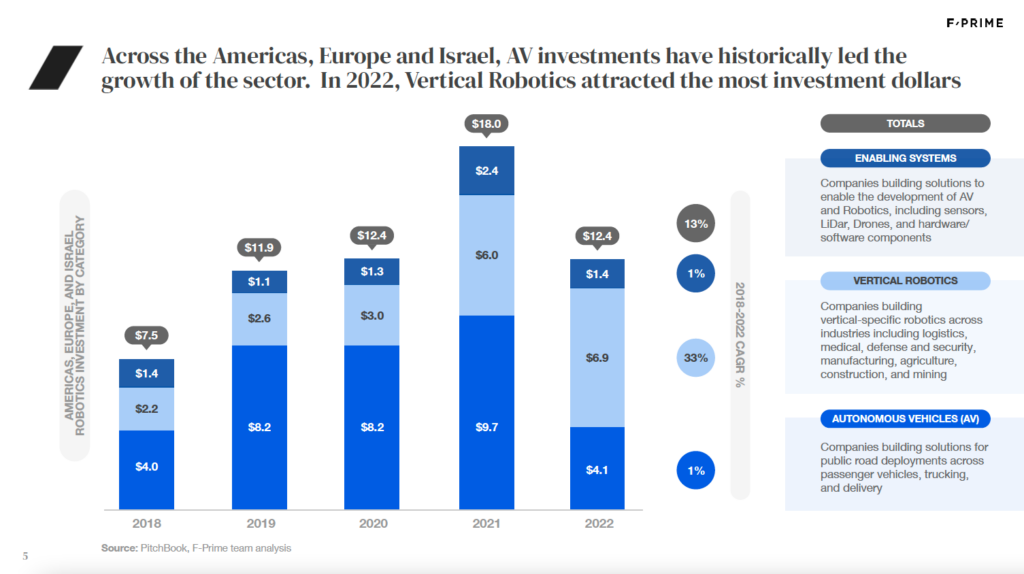

Across the Western markets, we identified three primary categories of robotics investments: Autonomous Vehicles (public roads only), Vertical Robotics (use-case specific and mostly industrial-focused – more on that below) and Enabling Systems (hardware and software components for developing a complete solution). Not surprisingly, the major driver of investment has been for AV companies, with more than 50 percent of investments flowing to AV in most years. However, with the sharp pull back of investments in 2022, AV was particularly impacted as investors began to question the path to commercialization for many of these companies.

While not a focus of our research, we expect Asia and China to play an increased role in the robotics industry. First, significant investment in technology in the region means that most sensors, robotic arms, and electronic components used in robotics will continue to be sourced from China. Furthermore, many companies in robotics — and particularly AV — are doing significant R&D work from China. Second, as robotics companies scale, China will continue to play an important role in the supply chain. While geo-political forces may change this role over time, the near-term alternatives are limited.

As an end-user market, Asia has also been an early adopter of robotics. For example, we’ve seen many companies focused on logistics robotics find success selling in Japan. Meanwhile, several Chinese automotive OEMs are already rolling out LiDar on production vehicles, while western OEMs are stuck in the planning phases. At the same time (perhaps as a reaction to geo-political tension) China is becoming a distinct ecosystem of its own for robotics. Across several use cases such as logistics, mining, and agriculture, there are a unique set of China-based players which primarily serve the local market.

You’ve heard about Vertical SaaS…what about Vertical Robotics?

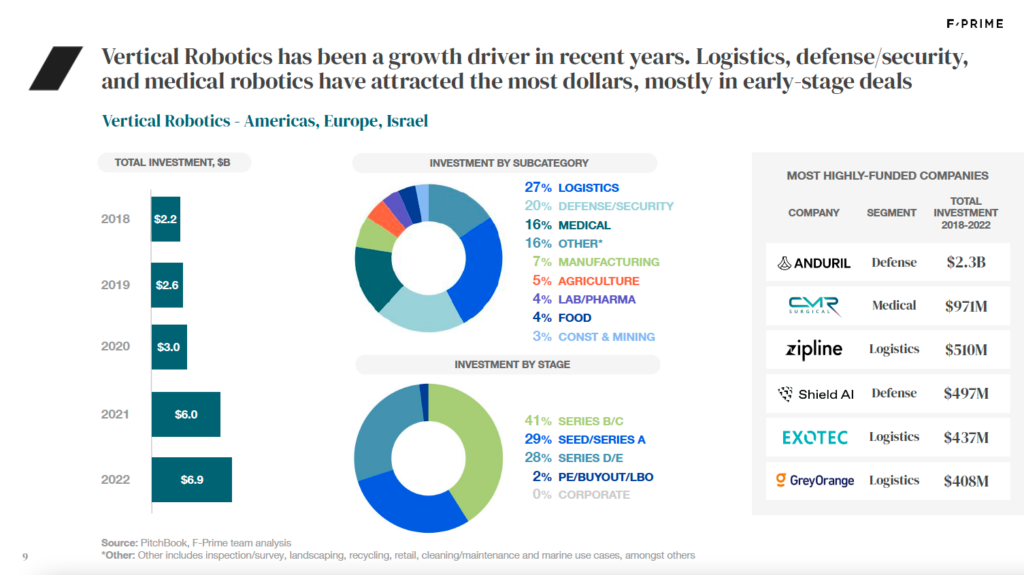

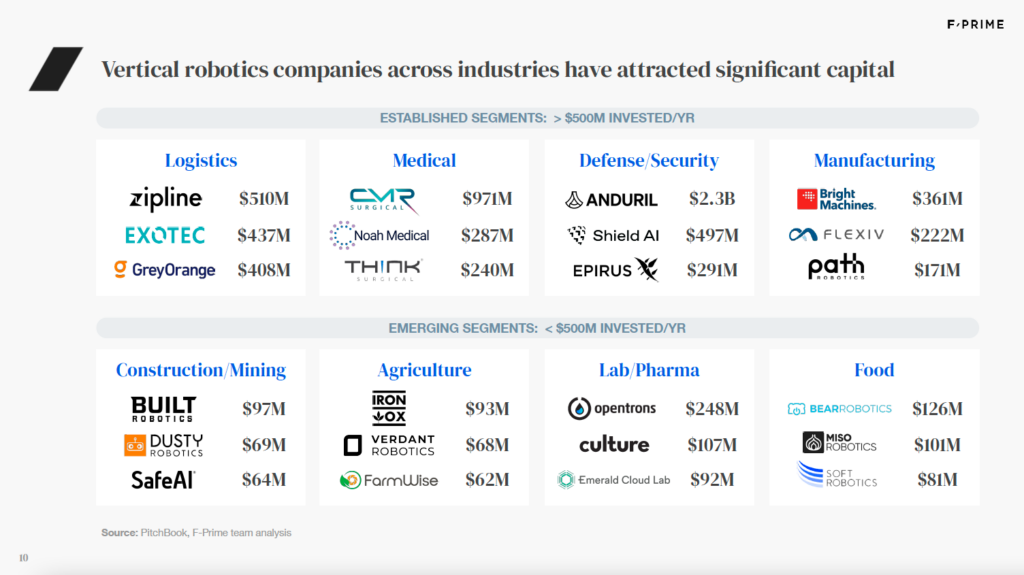

One of the more exciting trends in the industry has been the growth of Vertical Robotics, with the sector seeing significant growth in 2021 and defying the overall VC market by growing again in 2022. Vertical Robotics focuses on very specific use cases across a range of industries, including logistics, medicine, defense, and manufacturing.

Vertical Robotics is interesting for many reasons. First, companies can focus on very specific use cases within industries, bounding the problem statement to make it more suitable for robotics. Second, entrepreneurs can leverage deep domain expertise to better understand customer pain points and develop more effective go-to-market strategies. Finally, macro tailwinds of escalating labor costs and labor shortages across industries create strong willingness for customer adoption.

At the same time, Vertical Robotics is still in its infancy. Most dollars invested to-date are in early- stage deals, and other than in a few industries, the success stories are still to be told. Some areas, such as logistics, medical, and defense, have seen a disproportionate share of dollars invested and exited. Others, such as construction, mining, and agriculture, are still in the early stages of company formation and development of scalable businesses.

Is anyone making money?

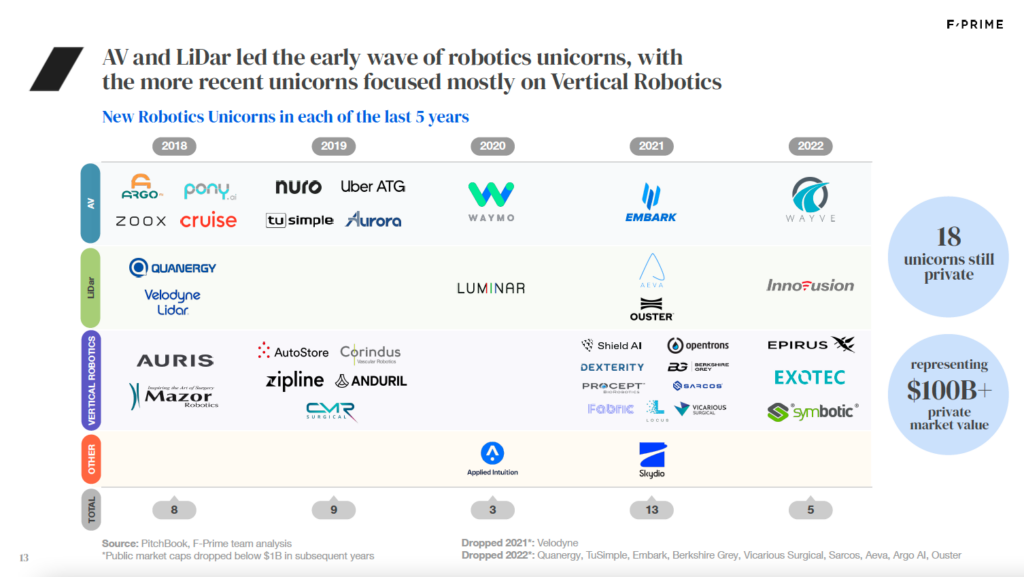

The critical sign of sustainability of any area of venture are whether dollars invested are yielding multi-fold increases in dollars exited. On this measure, while signs are positive, there is work to do. From a valuation perspective, there have been 38 robotics unicorns over the last five years. Of those, 14 had public offerings, five were acquired, one shut down (Argo), and 18 are still private.

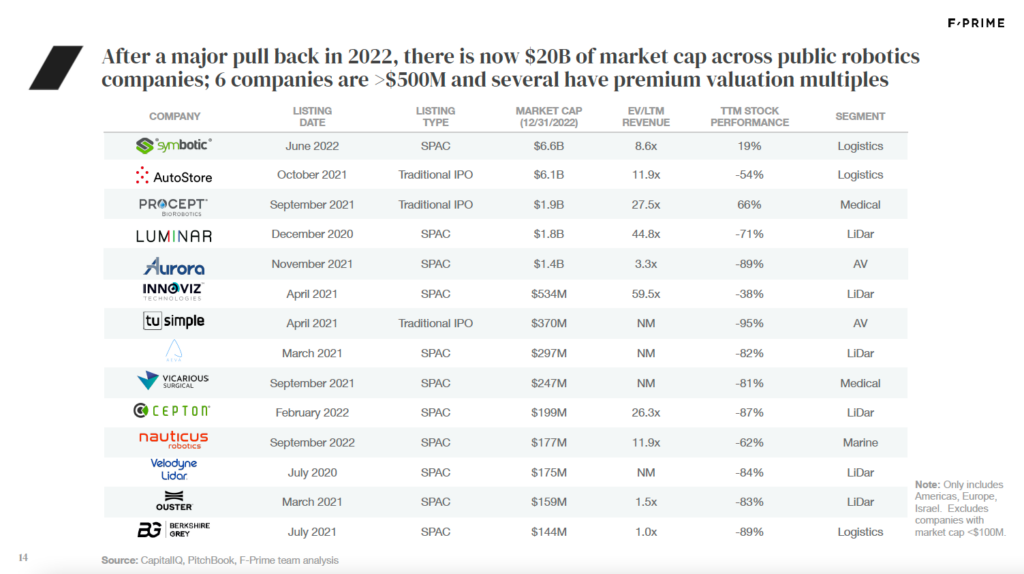

On the public side, many companies took advantage of the SPAC frenzy in 2021, though today only three still trade above $1B market cap, and the aggregate market cap of VC-backed robotics companies which went public is only $20B. M&A has generally been more productive, with $20B of overall exit value, though it is highly skewed toward the five unicorns which were acquired. Of the 18 companies that are still private, last round valuations sum to more than $100B, though some may ultimately struggle to justify their valuations.

In total, of the $60B or so invested in western markets over the last five years, there is $140B of realized and unrealized exit value, plus upside from the earlier stage companies that are still maturing. Considering that investors own only a fraction of a company at exit, one would ideally see a multiple of at least 4-5x exit value compared to invested dollars, and as more companies mature, hopefully we will get there.

The more important exit trend for robotics may be the reversion to valuation based on business fundamentals, rather than hype. AV arguably fell into the latter camp, but Vertical Robotics feels much more like the former. Many public robotics companies trade at valuation multiples that rival those of the best SaaS companies, and a similar trend can be seen in some recent private funding rounds. In the long term, robotics exits will be driven by those companies that demonstrate the ability to scale commercially.

But hardware is hard, isn’t it?

One area of conventional VC wisdom has curtailed robotics investing: ‘never invest in hardware.’ Hardware businesses are too costly to build, product cycles are too long, and eventually they are susceptible to commoditization.

While these things continue to be true to an extent, the market is rapidly changing. Most robotics startups today rely primarily on off-the-shelf hardware, with the innovation focused on how they leverage modern advances in computer vision and machine learning. Moreover, rapid prototyping enabled by 3D printing helps create faster iteration cycles. This combination helps shorten product development times and reduce costs. At the same time, the equipment financing market is starting to warm up to venture-backed robotics companies, helping to mitigate capital requirements for production build-outs. Finally, entrepreneurs are getting more savvy about identifying use cases where robotics can deliver rapid time-to-value, and which don’t require multi-year science projects to solve.

Robotics businesses will always be ‘harder’ than building software businesses — but that also means they have a much stronger moat. Many companies have few truly direct competitors, especially when you look at Vertical Robotics start-ups. Even businesses that look similar on the surface are often solving very different use cases once you dig a layer deeper.

Danger, Will Robinson?

Investment in AV was a catalyst for a new generation of entrepreneurs and engineers to cut their teeth in robotics, and they are now leveraging that know-how to build startups that solve real customer pain points. It is true that many investors will look at the data on robotics and remain unconvinced — for them, there are too few successful exits, not enough high dollar-paying acquirers, and hardware businesses are still too hard. But the direction of travel and growing set of opportunities is unmistakable. Robotics is still in its early days as a focus sector for VCs, but the sheer breadth of activity, quality of entrepreneurs, and emergence of market leaders is starting to create a virtuous cycle.

We at F-Prime are extremely bullish about the opportunity, and we urge you to join the ride!