Financial APIs are driving an overdue wave of innovation.

Over the last few years, open finance has become one of those vaguely defined fintech buzzwords. But with increasing regulatory movement in the US and nearly 70 million consumer accounts now interacting with financial APIs, it has become more relevant than ever.

Open finance has its roots in open banking, which refers to the use of application programming interfaces (APIs) to build applications fueled with consumer banking data. While largely invisible to consumers, open banking innovation has powered the novel ways that consumers now borrow, build wealth, and move money. The shift towards open banking has long been underway in the US and has paved the way for new open finance applications to flourish.

We define open finance similarly to open banking, but more broadly: the use of APIs to build applications that supplement consumer banking data with other information, defining users’ financial lives across their profiles of wealth, debt, insurance, sources of income, and more. The reason that open banking regulation is so exciting is that it’s the first step towards a world of open finance, where consumers can more fairly access financial products designed for their unique needs.

A Brief History of Open Finance

One might trace the origins of open banking in the US back to 1997, when Microsoft, Intuit, and CheckFree formed a combined open API standard known as the Open Financial Exchange (OFX). But open banking really started to catch on post-Great Financial Crisis when the US government enacted Dodd-Frank and created the Consumer Financial Protection Bureau (CFPB).

Now, after more than a decade, Section 1033 of Dodd-Frank — referring to consumers’ right to access their own financial data — has taken the main stage. In October 2023, the CFPB proposed the Personal Financial Data Rights rule. If it’s finalized in the fall of 2024 as anticipated, the rule would implement Section 1033 and codify open banking in the US.

The Rise of Financial APIs

A key driver in the adoption of open finance is the proliferation of financial APIs, and their superiority over earlier screen scraping technology. Drawbacks to screen scraping include connectivity issues any time a website experiences an update or outage, and heightened risk for financial institutions who are unaware who is scraping their consumer data and for what purpose. Instead, APIs dictate how systems can securely and efficiently exchange discrete data elements — and are the key enabling technology for open finance.

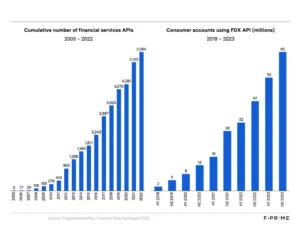

The adoption of APIs in financial services has accelerated over the last few years, as institutions have come to realize the heightened security, efficiency, and customer experience associated with them. At the same time, recent CFPB proposals are continuing to shepherd financial institutions toward a world of open APIs, enabling consumers to easily port financial data between providers. The Financial Data Exchange (FDX) emerged as an industry group whose open API standard incumbents and fintechs alike have rallied around. It is estimated that the FDX API now touches 65 million consumer accounts, up from 2 million just four years ago.

The Evolution of Bank Cooperation

The 2000s and 2010s saw a substantial debate over the right to access consumer financial data. At the time, data holders (namely banks and other incumbent institutions) cited IT costs imposed by data aggregators scraping their websites, while data users (like fintech applications) asserted that they were merely accessing consumer-permissioned personal data to better serve the end user.

Case in point: For several days in 2015, J.P. Morgan and Wells Fargo restricted customers of Mint (a then-popular, now-sunsetted account aggregator) from accessing their bank account information. Banks pointed to technical concerns such as data security and server capacity, though competitive threats loomed too. Even when institutions didn’t fully restrict access, they had other tactics at the ready: strict security standards, time-of-day restrictions, increasingly granular user permissioning, and costs for access.

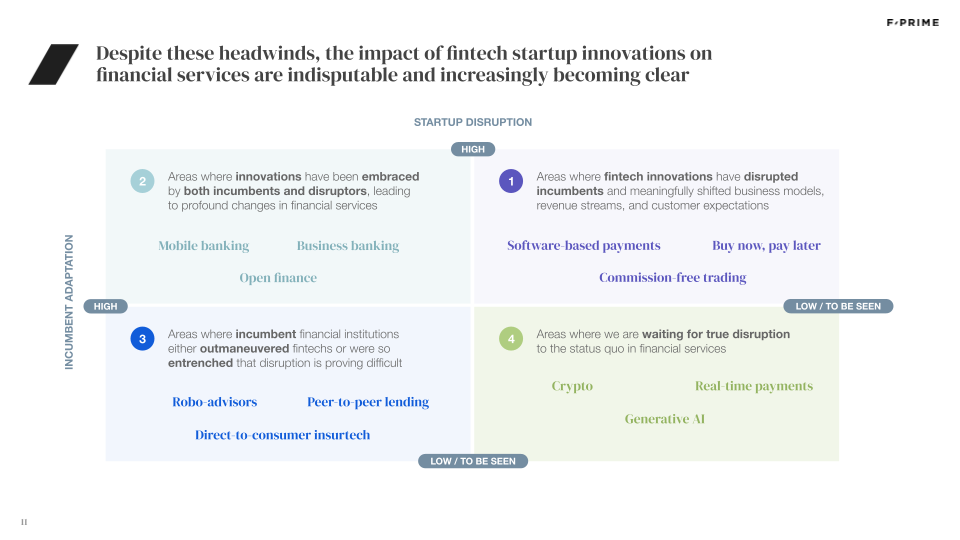

Flash forward to today: Incumbents have come around to the promise of open finance as the technical advantages of APIs — and their customer experience improvements — have become more apparent. Disruptors and incumbents are increasingly collaborating here, too: members of the industry group FDX include a healthy mix of incumbents (like Bank of America and Wells Fargo) and disruptors (like Plaid and MX).

API technology, regulatory encouragement, and shifting consumer preferences are all fuelling a wave of new open finance startups. So what would it look like if the promise of open finance were fully realized?

Open Finance in Action

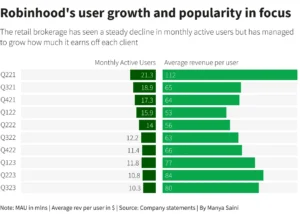

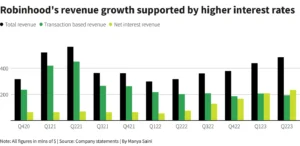

Many users already feel the benefits of linking their bank accounts with popular financial applications like Venmo, Coinbase, and Robinhood via Plaid. However, at F-Prime we imagine that same level of data access expanding to other areas of a user’s financial life.

A large population of consumers still don’t have fair access to credit. Lenders can use payroll API solutions like Argyle to verify sources of income or solutions like Trigo to validate a customer’s ability to pay rent on time. Financial institutions can use Method to aggregate a consumer’s outstanding liabilities and reveal where they can refinance at a lower price, or employers can use it to offer debt repayment benefits to their employees. In the insurance space, Canopy Connect can help agents surface existing insurance policies and help potential customers dig for more competitive options.

This wave of consumer financial data aggregators will leave institutions and fintechs looking for an “aggregator of aggregators” solution, either routing between providers to maximize uptime or to paint a more accurate financial picture of the consumers they serve. Meld is one example. Others, like Prism and Pave, take consumer data via these APIs and produce financial insights in pursuit of a more modern and comprehensive credit score.

Looking Ahead

It will be a while before that vision becomes reality — 1033 is still directional sentiment, not regulatory action just yet. The proposed rule also only covers a subset of consumer financial accounts: deposit accounts, credit cards, and digital wallets. It says nothing about payroll data, for example. Meanwhile, the thousands of regional banks, credit unions, and other smaller financial institutions that make up the United States’ uniquely fragmented banking landscape will struggle to keep up with the required technological standards.

That said, in the long term we can see the growing array of consumer financial data APIs coming together to a holistic, real-time, and accurate financial identity for every consumer. Easy access to financial services and more tailored financial products will result. We are excited to see the institutional response to the new regulations and technology currently impacting the market — but we are much more excited about the effect that open finance will have on the end user experience for millions of Americans.

Originally published on Fintech Prime Time.