The F-Prime Capital team conducts extensive primary market research on the global fintech sector. We closely track and benchmark the performance of established and emerging fintech companies, some of which belong to our portfolio of investments.

2021 was a record year for fintech investments and exits and there has never been a better time to look at the sector’s performance and take stock of the tremendous disruption that has occurred over the last 10 years.

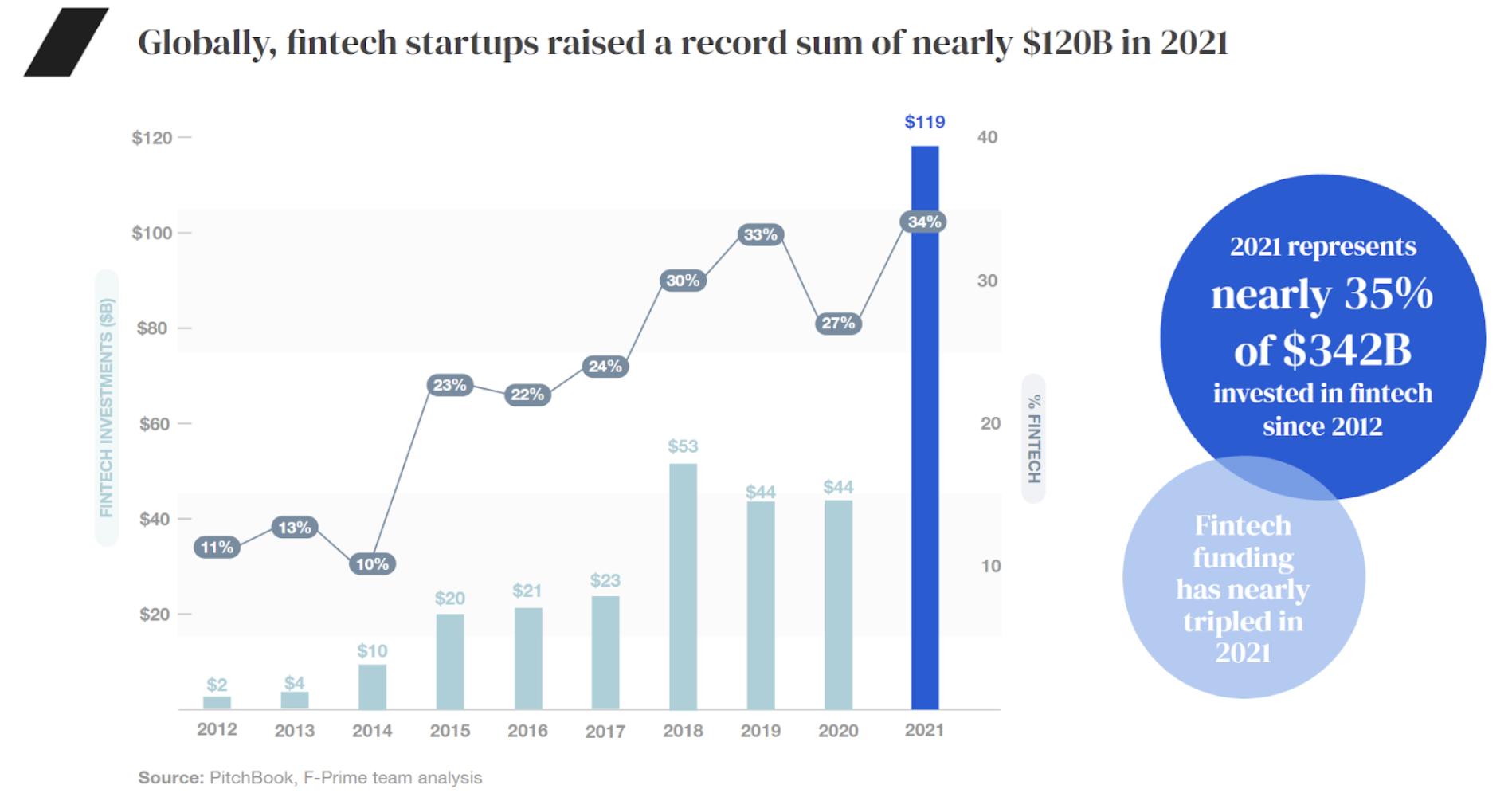

Fintech began as a sleepy niche of companies selling technology to financial institutions. Venture capital investments averaged a mere $1B per year. The last five years have seen an explosion of disruptive startups. What began as new, digital front doors to the traditional financial industry has developed into an entirely new financial infrastructure. While payments and lending were first to ignite, fintech companies have captured market share across all financial sectors, including banking, insurance, asset management, and proptech. This fintech disruption has been fueled by over $283B of venture capital since 2015, including nearly $120B in 2021 (35% of decade’s fintech venture investments).

The F-Prime Fintech Index

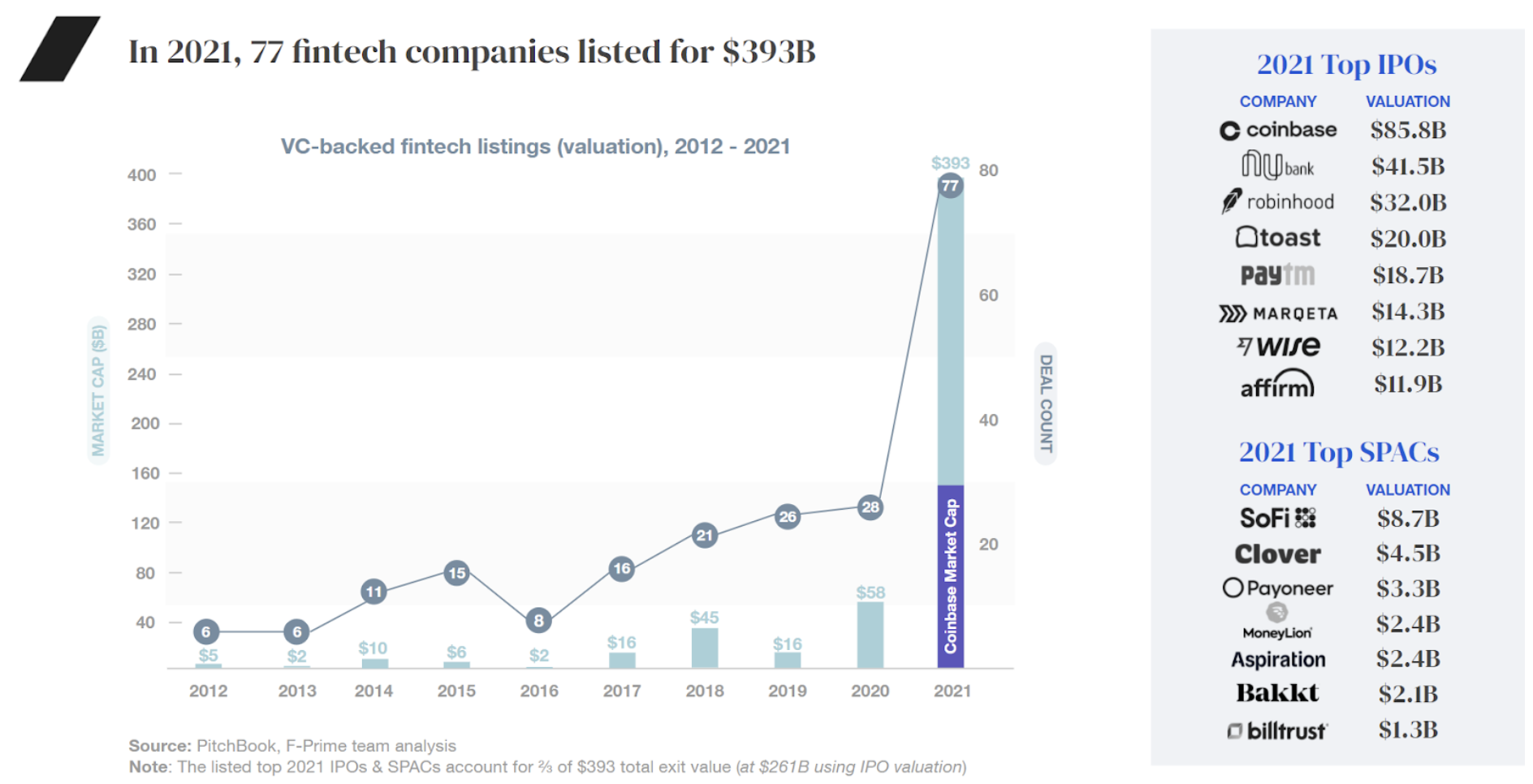

Perhaps the most exciting news for the industry is that we are finally seeing fintech companies exit with increasing velocity. In 2021, there were a record 77 fintech companies that listed for over $393B. Eight of the ten largest fintech exits in history took place in 2021, and public fintech companies have surpassed $1.3 trillion in market cap. For the first time since working in fintech, we have enough public fintech companies to create a meaningful tracking index.

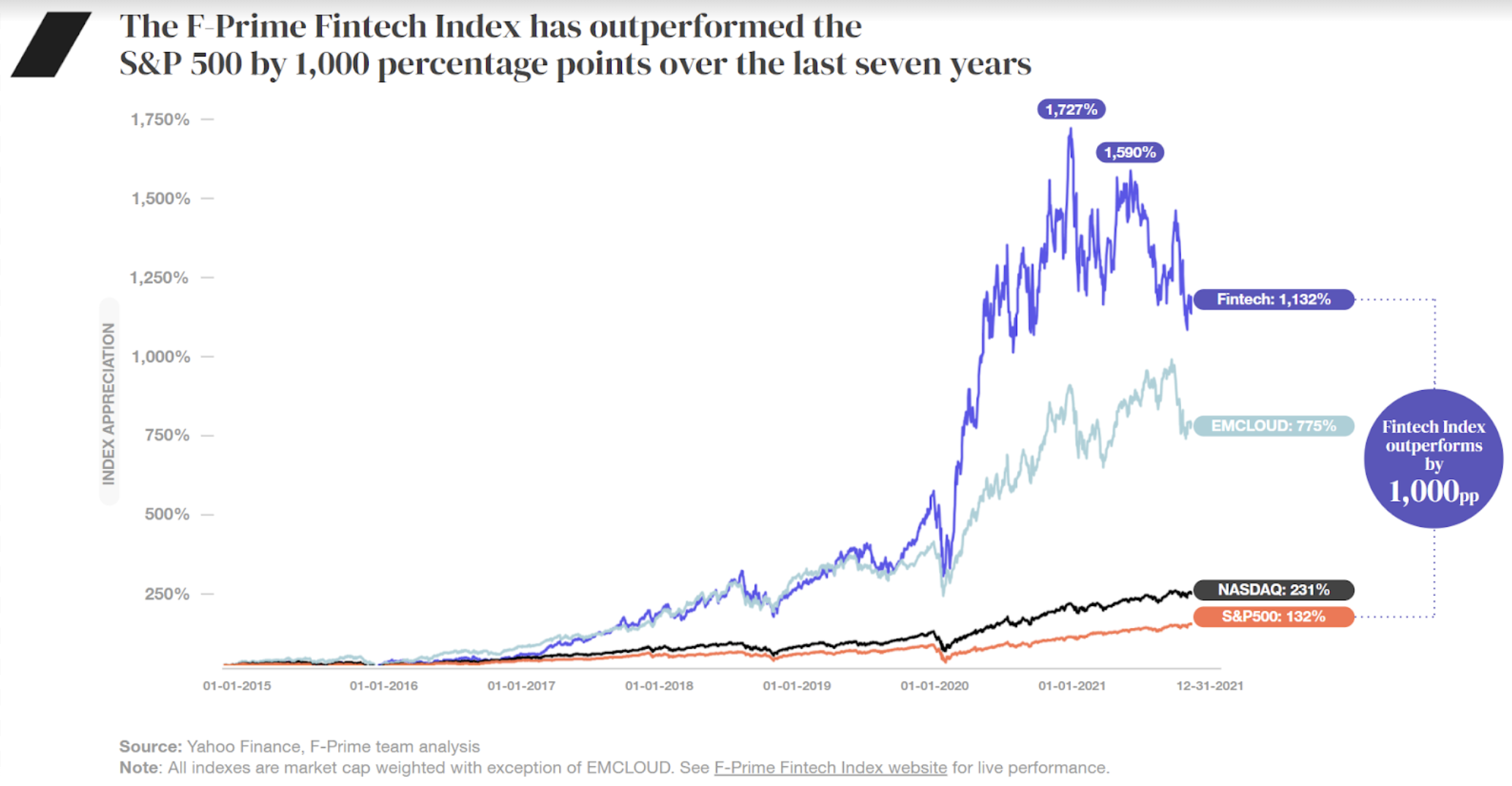

Today, we are excited to reveal the F-Prime Fintech Index. The F-Prime Fintech Index is composed of publicly traded companies powering the disruption of financial services. It features fintech companies listed after 2000 that meet our criteria for market capitalization, revenue growth, listing exchange, and daily trading volumes. For a complete description of our methodology, please visit the F-Prime Fintech Index website. The F-Prime Fintech Index companies trade at 11x average revenue multiples and have realized 62% average annual revenue growth. The F-Prime Fintech Index will enable all of us to benchmark the development of this rapidly-maturing sector and closely track the leading disruptors.

The F-Prime Fintech Index has surged 1,132% since 2015 when three leading companies (Block fka Square, Shopify, and PayPal) were listed. This gain compares favorably with the NASDAQ Index, up 223%, and the S&P 500, up 119% in the same period. The F-Prime Fintech Index has outperformed the S&P 500 and the NASDAQ by nearly 1,000% and 900%, respectively.

Tracking the State of Fintech

To accompany the launch of the F-Prime Fintech Index, we have also published a State of Fintech report. This report details the drivers of the disruption and depicts the striking advances made by fintech startups. Today we have published an overview of the industry and a deep dive into the payments and banking sectors. Soon, we will release an analysis of other sectors, including insurtech, asset management, crypto, proptech, and more.

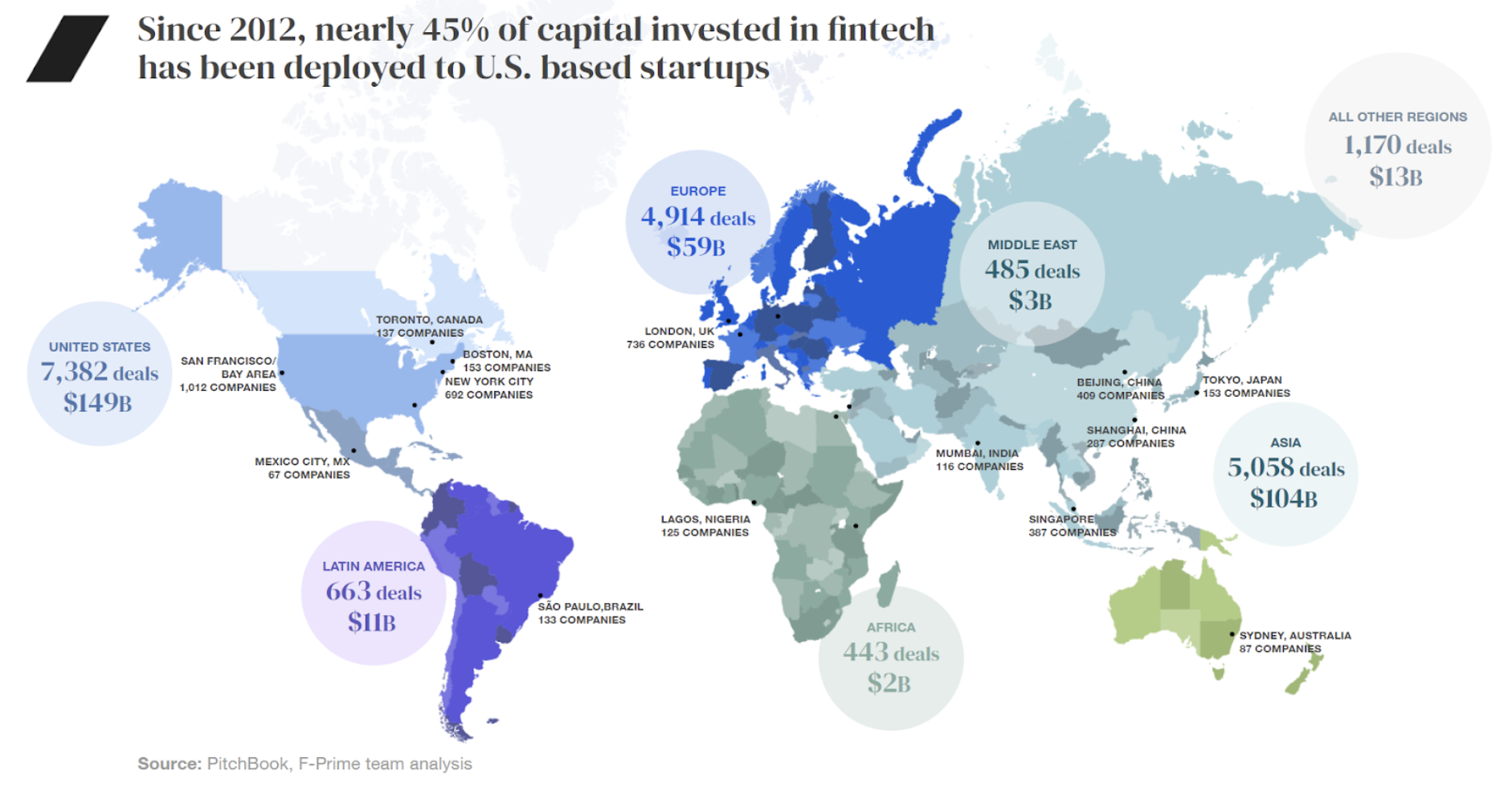

Fintech has become one of the most significant segments in tech venture capital over the past five years, rising to nearly 35% of total tech venture funding in 2021, up from 11% in 2011. In 2021, fintech funding hit unprecedented levels, nearly tripling the 2020 value of $44 billion. The sector has surpassed the $100 billion+ funding mark in a single year for the first time and is increasingly going global.

There have been many forces fueling the growth in fintech funding. Some growth is simply a function of early startups raising larger, later-stage rounds with private capital markets ready to provide capital. In 2021, a record 312 deals fetched $100 million+ or more and fueled the creation of 157 new fintech unicorns. Globalization is another factor as fintech companies in Europe, Latin America, Africa, South East Asia & India follow early successes in the U.S. and China. Covid plays its role, providing a strong tailwind behind consumer adoption of digital payments, banking, and commerce.

However, a more profound explanation is that the early startups that did the heavy lifting of building API-first financial infrastructure laid the foundation for future startups to launch financial services faster and at lower costs. Thanks to companies like Marqeta, Plaid/Quovo (an F-Prime portfolio company), and SynapseFi, it has never been easier to launch a fintech company or embed financial services in non-fintech offerings. Indeed, as financial services have been digitized and embedded into other offerings, the very definition of fintech has expanded to include software vendors to hospitals, travel agencies, hotels, and restaurants.

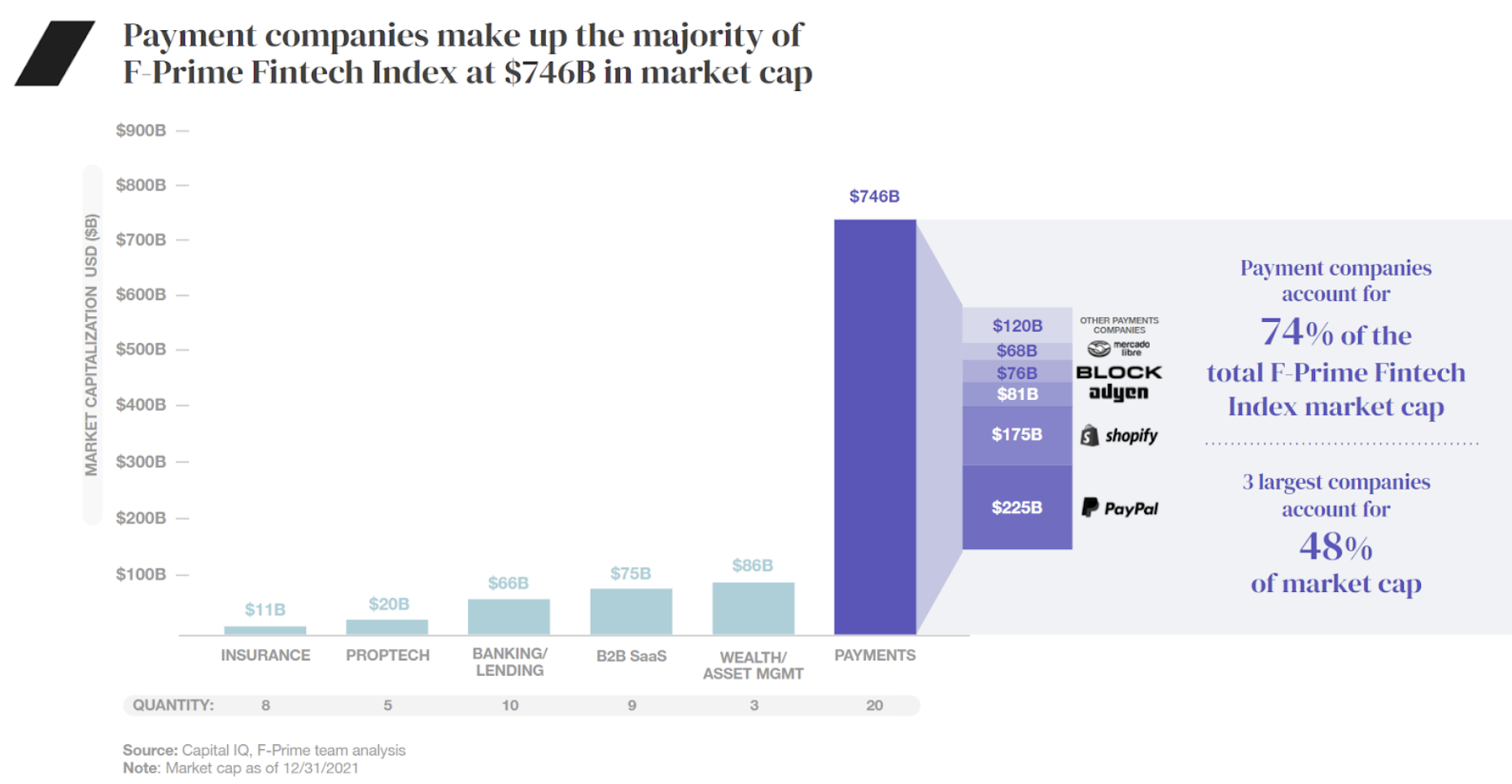

Nowhere has disruption been more sweeping than in payments — the primary driver of fintech growth. Payments startups have attracted more than $118 billion in investments over the past decade. Natively digital payment processors like Paypal, Block, Stripe, and Adyen have captured a 32% share of total U.S. digital payments volume.

The digitization of payments has led to a new class of software-first payments companies adding other financial products to their platforms. Public markets have rewarded these high-performing payments players with high valuations. Leading payment disruptors accounted for 74% of the F-Prime Fintech Index by market cap as of Q3 2021.

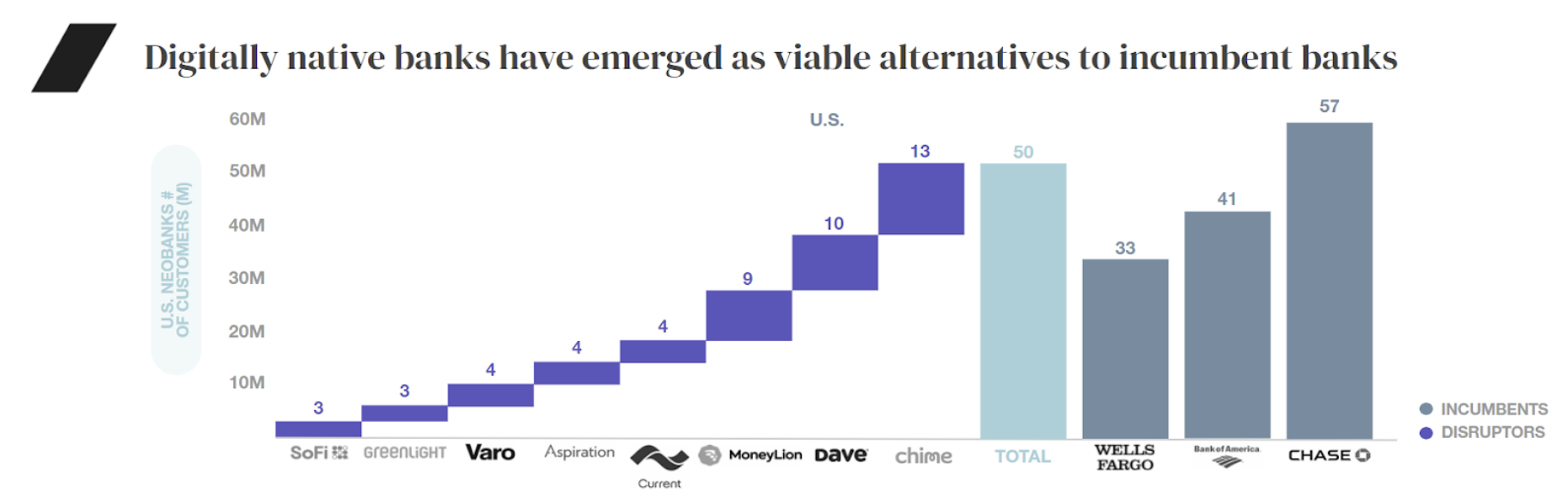

Akin to the rapid adoption of digital payments, we are seeing an acceleration of digital banking adoption spurred by the pandemic. This trend has fueled the rise of a new class of digital native banks or neobanks which have emerged as viable alternatives to large-scale banking institutions.

Consumers are attracted to neobanks by the digital experience, fee transparency, and novel features such as early-deposit access, overdraft protection, and multi-currency cards. Interestingly, many of the top neobanks did not start as banks but led with consumer-friendly services that leveraged a customer’s existing bank account.

While digital banks are still small by assets, they have attractive unit economics (low acquisition costs, growing revenue per user) plus efficient hyper-growth. Given their customer profile, they have significant room to increase their revenue base over their customers’ lifetime.

The rise of neobanks and gains by megabanks has ultimately squeezed regional and community banks, which have seen a 27 percentage point drop in new account openings since 2017. In response, many are increasingly collaborating with fintechs to accelerate their digitalization and personalization capabilities. And in turn, fintechs are leveraging the bank partner’s charter and earned reputation to accelerate their growth. We anticipate seeing more banking-Fintech collaborations to accelerate bank transformation, especially for regional/community banks and credit unions.

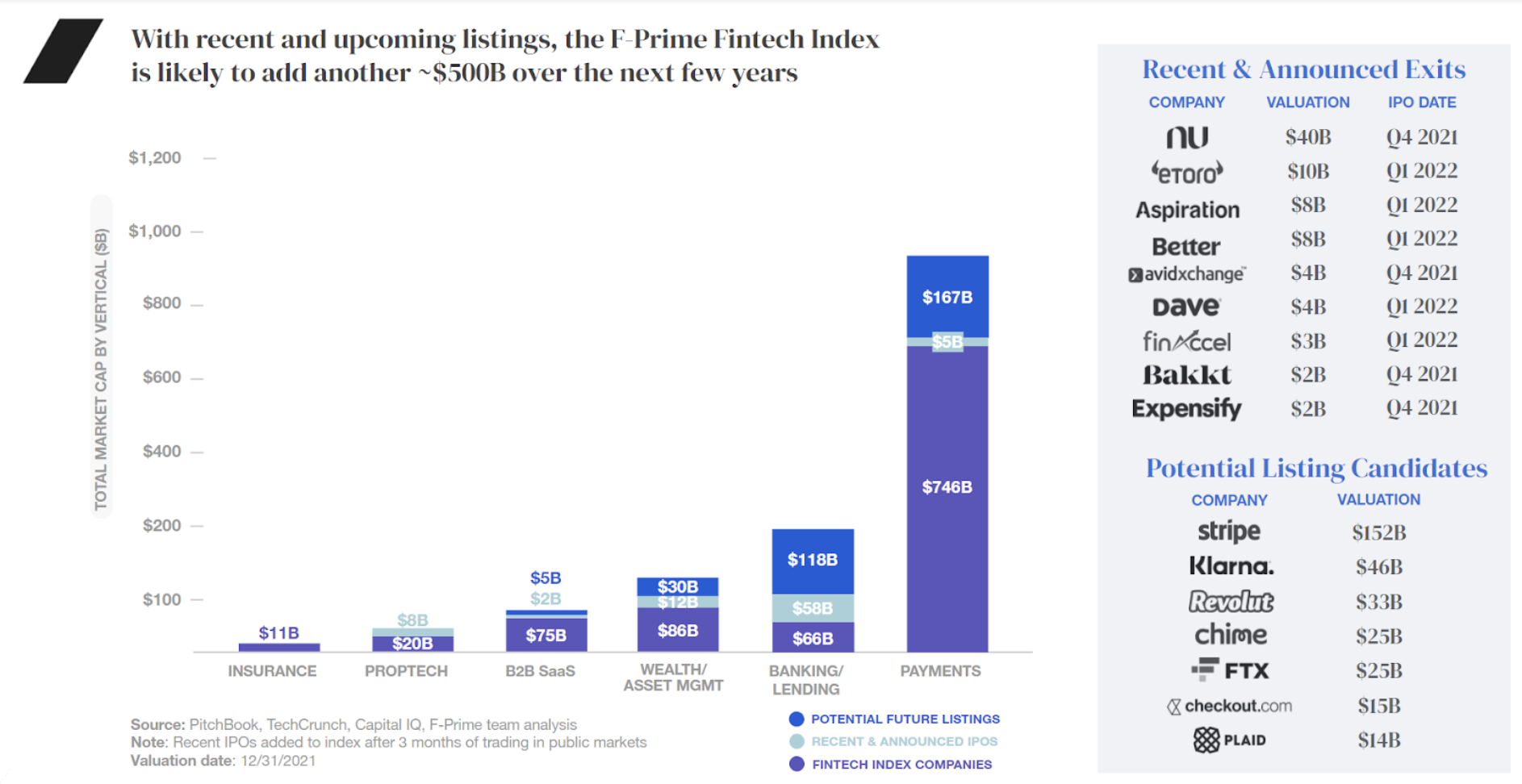

The fintech market is unlikely to cool soon – there are over 200 private fintech unicorns ($1 billion-plus valuation) globally – many of which have already filed to go public in the coming quarter or two. We will use the F-Prime Fintech Index to track the performance of these companies in capital markets and anticipate adding nearly $500B to the index over the coming few years as fintech companies list.

Despite their remarkable rise, venture-backed fintech startups have also collectively captured ~10% or less of the financial industry revenue with plenty of room for growth.

Read F-Prime Capital’s State of Fintech report and visit the F-Prime Fintech Index website for more information. We welcome feedback and thoughts from the Fintech community as we continue to refine the Index. To reach the F-Prime Fintech Index team, email us and follow our Twitter/Linkedin to stay updated and join a future discussion.