Data in VC, Part 3: Looking to the Future

Data in VC, Part 3: Looking to the Future

In my last two stories about how venture capitalists are using AI, we discussed how investors are currently leveraging data science to help source and make decisions about potential investments, including why VCs have been slow to adopt AI. We also explored the results of a survey that highlighted how, where, and why data scientists on VC teams are using AI, and what effect it’s having on the work of the firms they work at.

Given this work, I’d like to close out this series with a short overview of three potential futures we see for AI in VC, each with vastly different outcomes for the industry.

Future #1: Leveraging data will create a sustainable competitive advantage

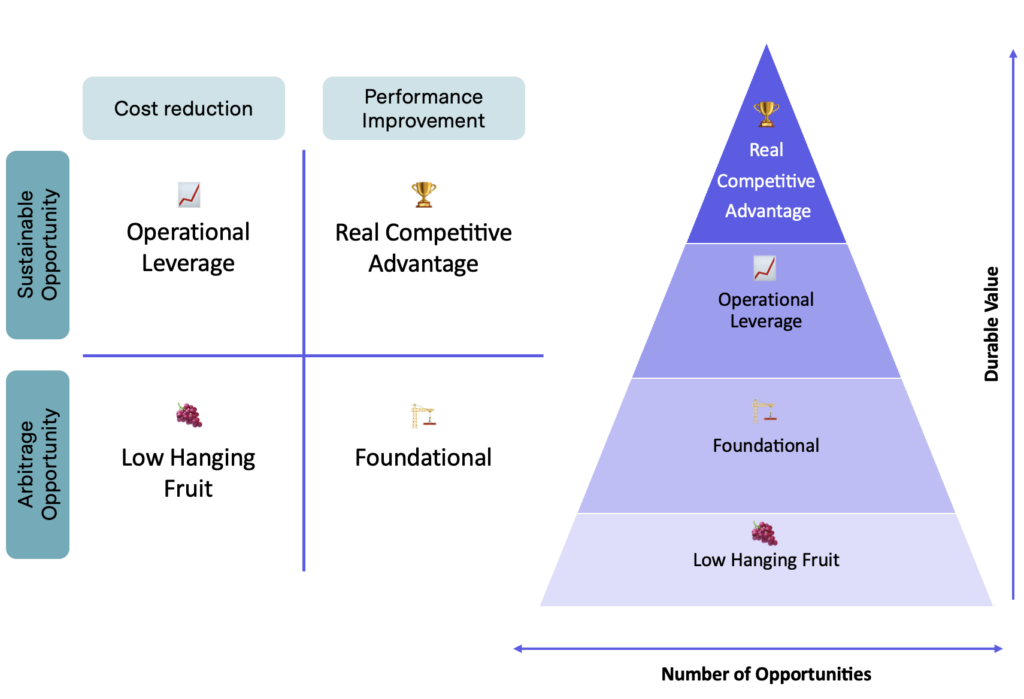

In this scenario, we assume that it is genuinely possible to find real competitive advantage over other firms using AI. Firms who see the biggest advantage will identify narrow areas in which to use AI to directly impact their differentiation from others. To identify those areas, recall our four-tier framework to help categorize the different types of opportunity AI poses to venture firms:

In this scenario, any firm that invests in the upper two quadrants will be able to build or sustain a competitive advantage over its peers. As a reminder, here are some examples of efforts that fall under those categories:

Operational Leverage: Aggregating and synthesizing data for easier company analysis, automating data entry, consolidating relationship data for more informed outreach, synthesizing portfolio health report.

Real Competitive Advantage: Creating predictive models for niche investment themes, algorithmically finding ways to expand networks, automating insights extraction from diligence documents, identifying emerging trends faster than competitors.

It’s worth noting that the lower two quadrants, which cover everything from email automation and common data vendors (low-hanging fruit) through CRM and network mapping (foundational) will be table stakes in the near-to-medium term.

Regardless of which future we find ourselves in, efforts that offer operational and competitive leverage should be the most important pieces of a VC data scientist’s job. In this specific future, the list of tasks above could be mixed, matched, and tailored to a fund’s specific strategy, making them less generalizable but highly valuable when aligned with a firm’s unique strengths.

VCs have a lot of different directions to take their automation and data efforts but under this scenario, firms that fail to make strides in those two categories will also fail to gain a competitive advantage. Right now, our industry is focusing too much on the “low-hanging fruit” opportunities, which would explain why our survey showed that firms are not seeing a lot of tangible impact from AI at the moment. The takeaway here is that firms should be bold and make strategic bets in AI — and do so sooner than later because, as we’ll see in our next hypothesis, timing will likely be important.

Future #2: In the short term, there will be an advantage for first movers

As we’ve discussed, there is a lot of friction in VCs’ work processes, and AI offers a unique chance to remove a lot of it. However, under this scenario, the ability to autonomously aggregate and synthesize company data for analysis, automate data entry, and other “operational” opportunities will become commoditized over time. As a result, the only real advantage will go to the VC firms whose data scientists move first.

This scenario assumes that there is no durable, long-term differentiation to be found for firms that invest in AI efforts, even those we categorized as “real competitive advantage.” The only advantages will play out over the short term, and will only flow to those who invest early and move fast. The advantage will be short-lived, however, as best practices spread through the industry and those efforts become commoditized.

Future #3: All AI efforts in VC will become commoditized

This hypothesis is simple: all potential applications of AI in VC will be relatively easy and quick to implement, and will offer no durable advantage over others. In this scenario, the only “losers” will be firms that fail to invest in AI at all.

If you believe in this outcome, you believe that all tooling that VCs can build for themselves will be based on similar systems and ideas, and there will be a low ceiling on how creative industry players can get with them. The result would be a race to the bottom, where everyone builds similar tooling with few competitive rewards on offer beyond mere survival. The result will be a VC landscape similar to the one we currently live in, where there will be little to differentiate funds other than brand and fund size — capital remains capital, regardless of who’s handing it over.

Regardless of how the future of data in VC plays out, the truth underlying all these realities is that data (and specifically data science) is going to play a role in the future of our industry. The degree of the potential advantage will vary widely for those who invest, but the main losers will be those funds that don’t incorporate data and AI into their workflows at all.