Dispatch: Building the Data Integration Layer for Wealth Management

Dispatch: Building the Data Integration Layer for Wealth Management

Over the last ten years, investing in wealth management has become decidedly more exciting on the back of TikTok “finfluencers” and direct-to-consumer brands like Robinhood, Titan, and Public. An estimated $45B of venture capital flowed into wealth startups over the last decade, with B2C startups receiving 80% of late-stage capital raised. Robinhood almost singlehandedly disrupted $1.4B of retail brokerage commissions when incumbent brokerages matched Robinhood’s free stock trading (see F-Prime’s Wealth and Asset Management sector report for more).

However, gems are often found on the seemingly sleepier sides of markets, and we see some of the most exciting startups solving problems in the traditional world of financial advisors (aka WealthTech). At F-Prime Capital, we have had the opportunity to partner with the founders of exceptional WealthTech companies, including Quovo (acquired by Plaid), Vestwell, FutureAdvisor (acquired by BlackRock), and Canoe Intelligence. We are also thrilled to have just led the Seed round in Dispatch (fka OneAdvisory).

We wanted to share why we feel WealthTech is so interesting right now and why Dispatch has an opportunity to become a core part of the modern wealth management tech stack.

Why financial advisors?

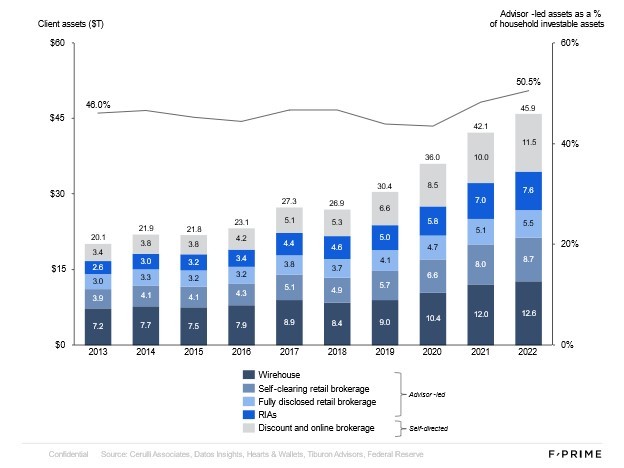

Easy: that’s where the money is. Just over half of retail investable assets are managed by ~300,000 financial advisors. Second, it is an industry that only gets bigger. Advisor-led assets under management (AUM) has grown a steady 8-10% over the last 10 years; up from $17 trillion in 2013 to $34 trillion at the end of 2022.

Why now?

The wealth management industry is experiencing a fundamental need for automation. While investing has become more automated over the last 10 years, most client-facing activities have not. Client onboarding, account opening, investment analysis, and reporting still involve an enormous amount of people and paper. We see four key drivers of automation, each presenting opportunities to rebuild the industry’s technology infrastructure.

Breakaway RIAs: Registered Investment Advisors represent the fastest-growing segment of wealth management. In 2022, nearly 1,300 advisors left traditional wirehouses (e.g., Morgan Stanley, Merrill Lynch, Wells Fargo, UBS) to follow the independent RIA route, taking an estimated $200 billion AUM with them. Alongside the breakaways, private equity is powering M&A across the industry – we estimate there were almost 1,000 RIA acquisitions in 2023. New RIAs want modern tech stacks (they are giving up those huge back-offices) and acquisitive RIAs want one modern tech stack, not one for each acquired firm. These trends require integration, digitization, and automation.

The rise of alternatives: Financial advisors were always a relevant channel for private equity, credit, and real estate funds; however, they are now the star of the show. Private funds need retail investors to continue growing, and financial advisors have embraced the idea of 25-30 percent allocations to private funds, substantially above the current five percent client average. It’s the perfect match, yet the infrastructure is missing. Client onboarding, capital calls, and reporting are all paper-based and advisors pay a high administrative price in exchange for the long-term commitment from their clients. We have written more here and here about the rise of alternative assets and the need for a new tech stack.

Generational wealth transfer: Financial advisors know they are on the verge of a stunning $70 trillion generational wealth transfer over the next 20 years. In anticipation, new wealth management firms like Titan and Facet are targeting those low-balance Millennials. While we expect both old and new firms to win their share, the one thing we know for certain is that Gen Y and Z want digital tools first, humans second. Most traditional wealth management firms will need major upgrades in their digital client onboarding, engagement, and reporting.

Artificial intelligence: We are just beginning to see AI extend into wealth management, but it is exciting to anticipate the impact it will have on client onboarding and servicing, as well as financial planning and advice. The combination of public and private LLMs can radically change the way clients interact with their advisors (and their chatbots). We wrote more about AI in financial advisory here.

Introducing Dispatch

Financial advisors recognize this need for automation, and numerous startups have emerged to address it. The typical financial advisor today uses 10 distinct financial advisory platforms, up from five just two years ago. The tech vendor landscape has truly exploded as well. As Jess Bost has noted, a picture is worth a thousand words:

At this point, the solution has become a part of the problem. There are so many fragmented point solutions and duplicative sources of customer and investment data, that just maintaining data integrity and synchronization has added manual work and risk of errors. Client onboarding into ten separate tech platforms robs advisors of the very productivity they hoped to gain by adding a new tech tool. While an all-in-one tech platform could in theory solve these problems, that is simply not going to happen in an industry with a complex value chain (asset managers, advisors, custodians, servicers, et al.), all-in-one platforms built through M&A, and a highly fragmented advisor base.

The talented co-founders Rob Nance, Madalyn Armijo, and Rafi Lurie started Dispatch to address this fundamental problem of data management. Dispatch automatically (i) ingests client data from tax returns, financial statements, IDs, etc., (ii) enters it into advisor tech platforms, and (iii) perpetually maintains data synchronization across the advisor tech stack. Where a custodian offers API access, Dispatch will also automate account opening.

This is one of those deep infrastructure solutions that solves an enormous pain point, offers an immediate ROI, and can run in the background as the integration layer for customer data. The more integrations they support, the more valuable they become to the industry.

We have never been more excited to be investing in wealth management and feel fortunate to have partnered with Dispatch. The team thinks big, cares deeply, and executes relentlessly. The next few years are going to be great!