Deal Engine is a travel software company with a mission to bring digital transformation to the travel industry. Utilizing proprietary AI and APIs, Deal Engine brings automation to travel, eliminating manual processes, and making sure people spend their time where they generate more value.

Sector: Technology

Announcing our Investment in Deal Engine

Our latest Seed round in the travel tech space

Almost three decades into selling flights online (thanks Travelocity!), the cobweb of infrastructure that supports the travel industry has not modernized to meet the complexity growing at the surface.

Code-share agreements, ancillaries, vacation packages, layers of wholesalers, and other “business innovations” have led to booking and customer service nightmares for passengers, agencies, and airlines themselves. A simple change or refund often requires a call to customer service (have four hours to wait?) that descends into manual reading and interpretation of fare rules, calls from OTAs to airlines for clarifications, tax estimations (you’d be surprised), and other unenviable manual tasks. As important as the Global Distribution Systems (GDS’s) have been in digitizing the travel market, the pandemic highlighted the challenges the industry faces when so many of its “normal” operational processes still require human artistry to Get Stuff Done.

We believe Deal Engine, which announced its $5.3M Seed round led by F-Prime Capital today, has an opportunity to be the travel industry’s agent for digital transformation. By building a new infrastructure layer that abstracts away the complexities of fare rules and travel policies with a powerful machine-learning based engine, Deal Engine enables their partners (OTAs, TMCs, or airlines) to automate the transactions that used to be manual. The most complex changes and refunds can now be executed with a simple API call, initiated by a customer service rep or the customer themselves with the push of a button. This capability has the potential to transform the post-booking customer experience, shifting focus from cost reduction to revenue generation — all while giving the consumer the amazing experience that online travel promises.

The leadership team at Deal Engine — including Alex Jara, David Gomez-Urquiza and Isabel Carrera Quiroga — possess tremendous courage and domain expertise to tackle such a massive problem in travel. They have not been shy about bringing their disruptive solution to the behemoths we all know and sometimes love, leading Deal Engine to serve a who’s who of players in the travel industry. Betsy Mulé and I are excited to be partnering with this team, which is doing the truly hard work of making travel better for all of us.

Shout out to Thayer Ventures, PAR Capital Management, Plug and Play Tech Center and Brook Bay Capital, LLC, who also participated in the round.

Hannah Arnold

Hannah is a Venture Partner at F-Prime and leads Business Development and Mortgage at Argyle. Previously she was on F-Prime’s tech investment team focused on early-stage FinTech investments. Prior to joining F-Prime, Hannah worked closely with startups in Johannesburg as an associate with Secha Capital, where she spent every day on the ground helping teams in Secha’s portfolio scale. She was a consultant with Bain & Company in Atlanta, where she served large tech clients and worked extensively with the Private Equity practice on deals spanning healthcare, e-commerce and industrials. She began her career working for non-profits in international development, where she saw firsthand the impact that innovative financial products can have on people’s lives. Hannah received her BA in Public Policy from Duke University.

The Alternative Asset Class Needs New Infrastructure — Who Will Build It?

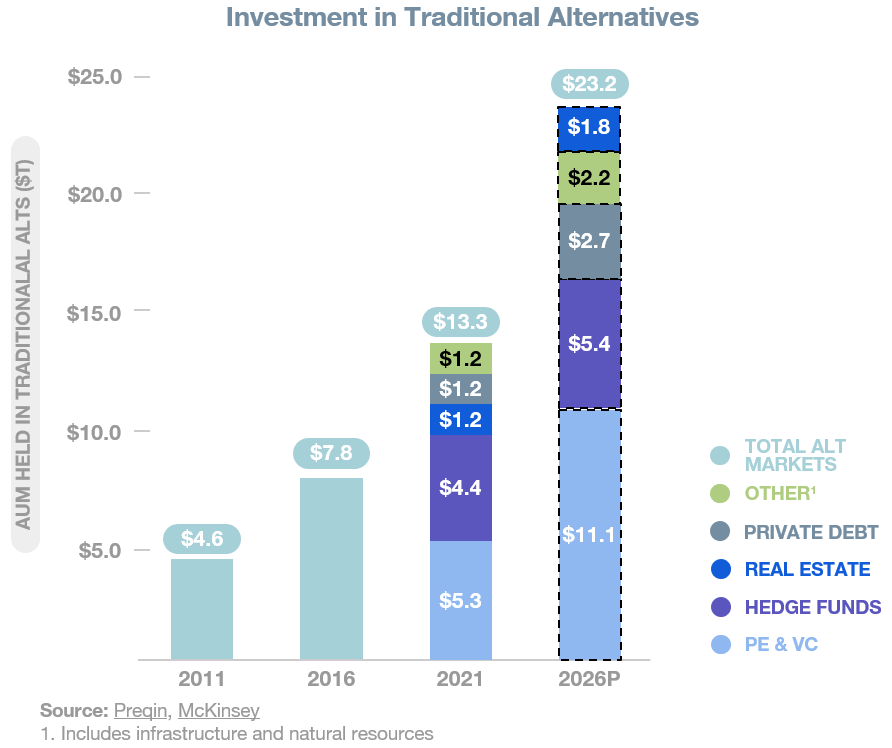

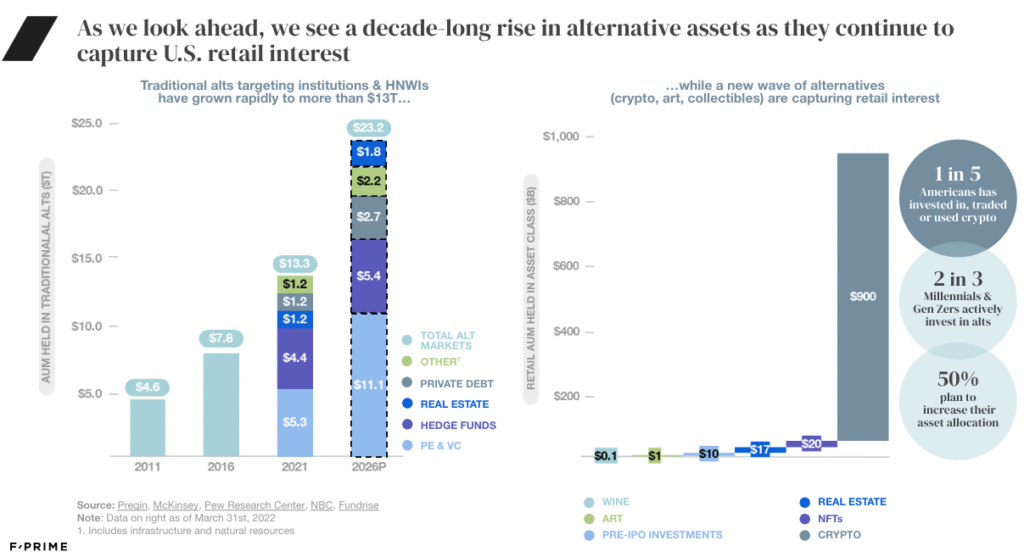

It took more than 30 years for alternative asset classes like venture capital, private equity and hedge funds to become must-have portfolio allocations, but they have finally arrived in force. Private investments in alternative assets grew to $13.3 trillion from $4.6 trillion over the 10 years ended 2021, and advisers now routinely recommend allocating 10%-25% of portfolios in these asset classes.

Liquid alternative asset classes are enjoying record inflows, and B2C-friendly distribution platforms like Moonfare, Fundrise and SeedInvest are building on-ramps for a new generation of investors.

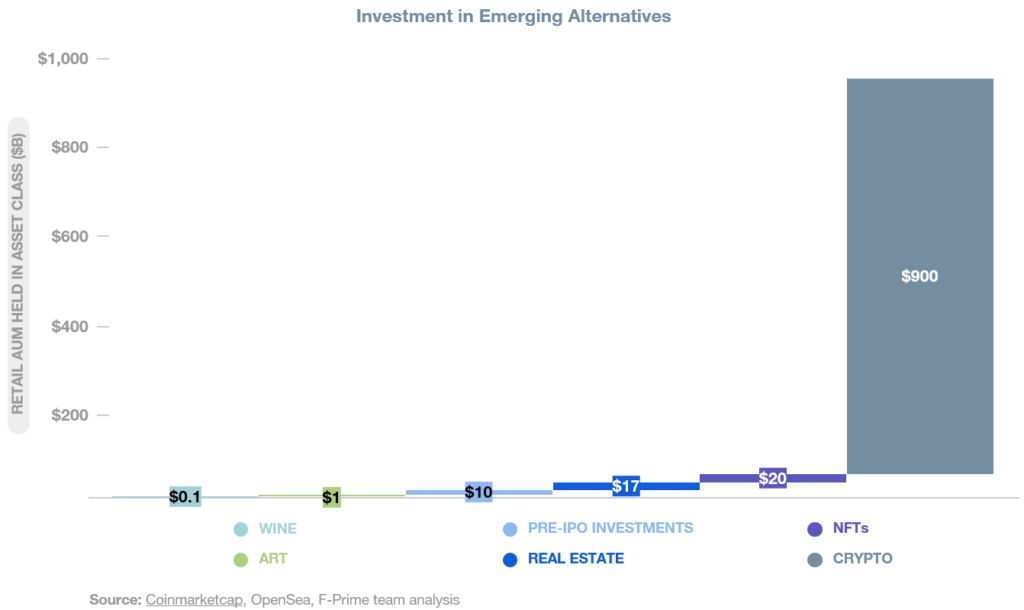

Just as these traditional alternatives are becoming a consistent part of the modern investment portfolio, a new era of alternative assets is emerging, fueling an even broader and more fragmented landscape for investing. Dozens of platforms have launched to fractionalize, package and distribute everything from farmland, litigation finance and P2P lending to art, wine and collectibles.

Crypto added fuel to this trend and quickly became a mass-market asset category. Together with more established alternative classes like venture capital and private equity, these new alternatives give retail investors unprecedented access to asset classes that either never existed (like crypto) or were previously limited to high-net-worth investors.

However, there is a problem in alternative assets: the lack of digital infrastructure. Traditional alternative assets like venture capital and private equity at least have an ecosystem built to serve them, but that infrastructure is aging and built for a narrower base of institutional investors, like endowments, pension funds and large family offices.

As these asset classes scale and diversify their investor bases, they need a serious upgrade to modernize the fund manager/GP and investor/LP experience. The situation for emerging alternative assets is far worse. Today, investment platforms cobble together their operations — sourcing, brokerage, reporting and custody — while investors endure fragmentation throughout their journey of discovery, account creation, execution and reporting.

Let’s start with traditional alternatives

Yes, it’s oxymoronic to call alternatives “traditional,” but after more than 70 years, over $13 trillion in AUM and 10%-25% portfolio allocations, it’s hard to say that venture capital, private equity, private credit and real estate are novel forms of investment.

Investment performance for “traditional alts” is even highly correlated with public equities. The most enduring distinction is the accredited investor requirement (just 10% of the U.S. population), but Reg CF, Reg A+ and a myriad of platforms like SeedInvest and WeFunder are prying open that door as well.

As these asset classes scale, fund managers are systematically diversifying their investor bases beyond institutional investors like pension funds and endowments. The old and labor-intensive processes built around 30-year tech stacks from FIS Investran, State Street and Citco will not scale to 100,000+ financial advisers and millions of accredited investors. What’s more, the user experience is so bad, you would not want to scale it: PDFs, manual bank wires and clunky investor portals are the current “state of the art” here.

Modernizing the infrastructure for traditional alts

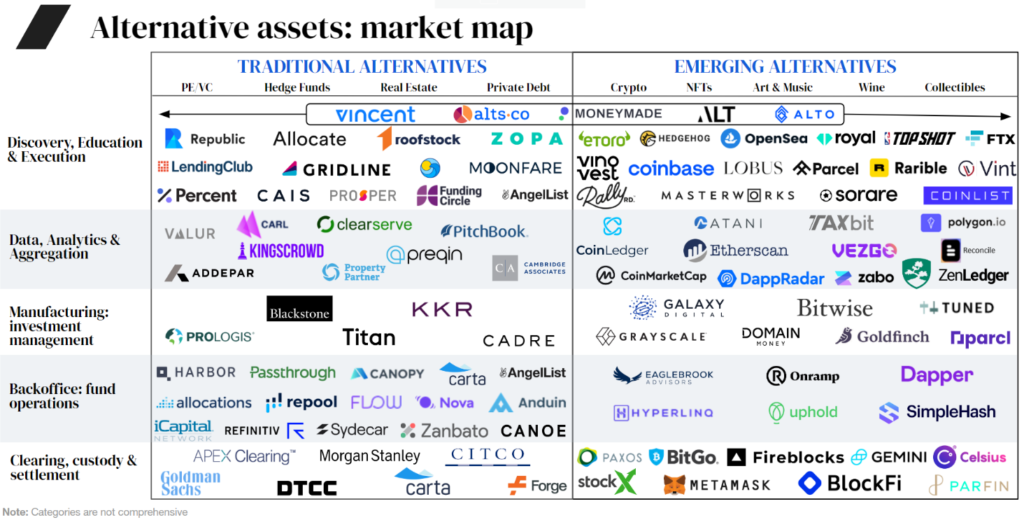

Fortunately, entrepreneurs are tackling the problem posed by antiquated infrastructure for traditional alternative investments.

User experience: A natural entry point is the GP-to-LP (general partner to limited partner) user experience. Fundraising, LP onboarding, subscription documents, CRM and capital calls are highly visible user experiences that can be digitized and improved without touching the underlying fund infrastructure. Startups like Canopy, Flow, Asset Class and Sydecar offer delightful experiences to VC and PE fund managers and their LPs.

Back office and fund operations: For every dollar spent on the user experience, more than 5x is spent in the back office on accounting, investment monitoring and fund administration. Fund managers will not migrate off SS&C, State Street and BlackRock/eFront easily, but modernizing these processes with software that integrates external and internal resources, reduces double entry, maintains a single source of truth and automates reporting is critical to scaling.

Owning this also means a long-term sticky relationship. Aduro, Sudrania, Carta and Juniper Square have all made inroads in this backbone of the alternative asset class.

Data, analytics and aggregation: Ask an alternative asset fund manager about analytics and you’ll probably get a blank stare. That’s because LPs have long suffered quietly with their fund performance PDFs, thinking it was their responsibility to extract structured data and analyze investment performance across dozens of funds.

Tools like Addepar and Canoe Intelligence have helped, but today’s startups need to build API-first structured data models that make LP analytics a first-class citizen.

Network effects: Finally, for startups that build and execute well, there is an obvious opportunity for network effects.

Much like how Carta did this for startups and investors, we will see network effects build among GPs and LPs. Eventually, we will hear an LP ask a GP to “please use X because I already have my other fund investments there.” This position must be earned and is still likely to be winner-take-most, not all. But it is still an exciting reason for startups to build in this area.

The rise of alternatives

As traditional alternative assets have matured, a new menu of alternatives have emerged, offering all investors (retail and accredited) access to novel, fast-growing and less correlated asset classes. Some of these have always been available to wealthy investors but are now being fractionalized and virtualized to grant access to retail investors.

Examples include private credit, project finance, art, music and wine. Others, like real estate and collectibles, were already available to retail investors but are now more accessible and liquid than ever. Lastly, crypto, an asset class unto itself, has given all investors a new asset with a variety of novel and unfolding value propositions.

Any one of these emerging alternative assets is relatively minor, but in aggregate, they are worth about $1 trillion (despite recent sell-offs). They have attracted more than 120 million users globally and given birth to more than a 100 distribution platforms.

While they present less correlated investment return potential, another tailwind is that they tap into investors’ growing desire to have a personal connection with their investments, which could be values based or stem from intellectual curiosity. This hybrid investment-personal activity became clear with Kickstarter and Indiegogo, and these new alternative asset platforms scratch a similar itch.

The missing infrastructure for emerging alternatives

Very little of today’s infrastructure is suitable for these emerging alternative classes. Incumbent custodians like Pershing and National Financial do not custody the assets; brokerages like Charles Schwab and Morgan Stanley/E*Trade do not allow trading of these assets; financial adviser platforms like Orion and Black Diamond do not integrate with new platforms, exchanges and funds.

Consequently, investors and platforms have had to cobble together their own tools and infrastructure. Active investors can have 10 or more accounts, one for each platform on which they invest, all with separate account funding, tracking and reporting. Trading platforms have had to vertically integrate from customer acquisition to custody — think leasing secure and disaster-resistant warehouses for physical assets, or self-custody for many crypto tokens.

Here are five areas that need to be developed, and startups are beginning to go after them:

Discovery, education and execution: After a point, markets usually see aggregators emerging to tame fragmentation and provide consumers with consolidated gateways. Fidelity and Charles Schwab do that well for traditional asset classes, and players like Vincent and MoneyMade have just begun to do something similar for these newer alternative classes.

More importantly, investors need a single account from which to invest. While traditional brokerages could expand into these markets, it is more likely that an existing platform like Coinbase or one of the discovery-centric aggregators will act first and expand into a full-service, multiasset-class brokerage.

Over-the-top aggregators like LiquidFi and Stacked are headed in this direction, too, and modern retail fund structures like Titan are also positioned well.

Data, analytics and aggregation: This industry needs a Morningstar. When the mutual funds industry surged in the 1980s, Morningstar helped standardize and normalize the criteria for evaluating mutual funds. It gave retail investors confidence and financial advisers cover.

It will not be easy to do the same across so many asset types, but consistent measurements of risk, volatility, liquidity and reputation are possible. For these asset classes to scale, they will need institutional capital, actively managed funds and financial advisers — and all of these depend on better data.

Data foundations exist in some asset classes — we have Coinmetrics and Kaiko for crypto; DappRadar for NFTs; and Art Market for art — but investors need a trusted source of normalized investment metrics across all the alternative asset classes.

Investment management: Speaking of managed funds, the long-term weight of these asset classes will come from actively managed funds.

Actively managed funds account for about 80% of market capitalization in equities, and even more in fixed income, FX and commodities. Early movers like Grayscale, Galaxy and 21Shares have captured over $75 billion in AUM, and there is room for many successful players with a variety of strategies. This will be a fee-rich category.

Custody, clearing and settlement: The unsung heroes of investing are custody, clearing and settlement. Investors take them for granted in equities, debt and FX thanks to centralized institutions like the DTCC, CLS and CME, as well as the numerous incumbent financial institutions with clearing operations. Investors in the new alternatives cannot.

Investors in physical assets accept the risk that the platform they use to buy is also world class in storing and protecting their assets (also known as custody). Even when investors purchase fractionalized art or collectibles on sites like Rally or Vinovest, there is still the underlying risk of owning physical assets.

Crypto custody risks are those of self-custody (do not lose your physical storage device or private key), and if you use online brokerages like Coinbase, which do not carry SPIC insurance, your assets are not even legally yours in the event of a brokerage bankruptcy.

Clearing and settlement is better, though still fragmented with smaller custodians and transfer agents, which results in reporting and tracking complexities. The blockchain has played a valuable role in clearing and settlement for crypto and fractionalized assets, and will do so for other emerging alternative asset classes, too.

This fragmentation and lack of insurance is a natural part of an industry’s path to maturity, but to scale, we need to see diversification and consolidation right from the brokerage and execution layers through to the clearing and custody plumbing.

In the meantime, expect aggregators like MoneyMade and Stacked at least to fill the aggregation gap for investors, giving them visibility into their disparate holdings.

The opportunity for startups

Traditional alternatives are diversifying their investor base from a few thousand institutional investors to millions of accredited investors and their advisers, while an entirely new class of emerging alternative asset classes require entirely new infrastructure. Indeed, even as alternatives form a $1 trillion asset class, the sector’s platforms and their investors are cobbling together discovery data, reporting and clearing and custody where incumbent institutions have failed to step forward.

The alternative asset investment industry has never been more exciting, but it needs serious investment in new infrastructure to scale and improve the investor experience. Now is an exceptional time to build category-defining companies.

Originally published in TechCrunch. Read the full story here.

Introducing Ashby: The Data-Driven ATS

Meet the company on a mission to overhaul the applicant tracking system

My stint as acting Head of People at Juniper Square began after Thanksgiving weekend in 2019. No notice. No relevant experience to speak of.

My first task? Understand our company’s recruiting funnel and how to improve our effectiveness. I had never used our applicant tracking system (ATS) except as an interviewer. I logged in and began searching for the data and reports necessary to understand what was going on.

It took me a few hours and multiple email exchanges with customer success to realize this simply wasn’t possible. The software we called our ATS was just that — a “tracking” system — and not a reporting or operating system for this function. Data and insights are just as complex and important to recruiters as they are to sales reps, but our recruiting team was effectively operating blind.

In response, I took up an inordinate amount of our business operations team’s time by asking them to build us the dashboards we needed. We crafted a Looker instance, paid for a “data connector” add-on product charged by our ATS, but multiple months and dozens of hours later we were still wrangling data and trying to get things visible in a way that would be useful.

Since then, I’ve learned that this is an extremely common story. Ask any recruiting leader what would help them run their team more effectively, and data-driven insights will be high on that list. Today’s applicant tracking systems just don’t meet the needs of recruiting leaders.

It was around that time that I stumbled upon Ashby. After a single conversation, it was clear that this was the answer that I (and the rest of the recruiting industry) was looking for. Today, Juniper Square’s people and recruiting function is in far more capable hands than mine, and Ashby is critical to the company’s recruiting infrastructure.

An Underinvested Business Problem

At F-Prime Capital, we believe HR and People teams have been left behind by much of this generation of technology innovation, and have been fortunate to back incredible companies like Mathison, Hone, and Carrot Fertility who are working to correct this. Meanwhile, through investments like Benchling in life sciences R&D, OTA Insight in travel, and Logixboard in freight forwarding, we’ve watched software companies revolutionize industries through products with a superior ability to deliver data-driven insights. Ashby is the perfect intersection of those two themes, delivering an ATS with the data and insight recruiting teams have been missing. We’ve now been proud supporters of the company for more than two years, and are thrilled to announce our deeper partnership as lead investors of Ashby’s Series B.

Our investment thesis is quite simple: Fast-growing companies are continuing to raise the bar on talent quality, but also need to operate efficiently — especially in this time of constrained resources. This means recruiting teams are being challenged to deliver more high-quality candidates per unit of effort, and demonstrate the ROI of their work to their business partners. Being the operating system for any core business function is a recession-proof business, as the history of ATSs demonstrates.

Yesterday’s technology stack of expensive, siloed systems that lack strong reporting capabilities no longer cuts it. Ashby is a true full suite of best-in-class recruiting tools, from sourcing to scheduling, candidate management to candidate surveys, and of course, best-in-class analytics throughout the entire stack. It is the ATS of the future.

A Special Place

Having worked with the team for more than two years, my overall experience with Ashby can be summed up in two adjectives: fast and thoughtful.

Benji, Abhik, and team have assembled an incredible product development team that throws off product faster than nearly any company I’ve seen in my career. Just a few years after launching, they are quickly becoming a dominant service provider to the startup and technology community and have built better products across a wide range of recruiting business processes (sourcing, tracking, scheduling, and of course applicant tracking).

Ashby is also one of the most thoughtfully-run startups I have encountered. From their communication manifesto to their thoughts on productivity, they demonstrate that building a special company does not happen by accident, but through intention around how the work gets done.

I’m thrilled to be along for the journey. If you’re in the recruiting world, the formal launch of Ashby (not a moment too soon) coincides with today’s Series B. And even if you’re not a recruiter, keep an eye on this company — and their careers page. It’s a special place.

Ashby

Ashby exists to deliver a new standard of recruiting software to enable hiring excellence. It’s all-in-one recruiting platform enables high growth companies to hire more efficiently by combining features for the entire recruiting process, from sourcing to offer, with advanced analytics and automation.

For LatAm Payment Orchestration Startups, Market Fragmentation Is a Blessing in Disguise

In the vast and varied lands between Patagonia and the Rio Grande, a region entrepreneurs and investors like to call “LatAm,” there are 38 different countries using 39 different currencies.

Only 19% of Latin American adults own a credit card, and 70% of credit cards in Brazil, Argentina and Chile can’t be used internationally. Local payment methods account for 68% of online sales, and, depending on the region and merchant networks, merchants must integrate dozens of payment service providers. Meanwhile, cash voucher systems like Brazil’s boleto bancário and Mexico’s Oxxo payment network account for a significant share of Latin American consumer transactions.

Fraud is also a major problem for online merchants in Latin America. Since the onset of the pandemic, Stripe observed that fraud rates at businesses in Latin America were 97% higher than in North America and 222% higher than businesses in the Asia Pacific.

In fewer words: The payments landscape in Latin America seems hopelessly fragmented and riddled with fraud.

Meanwhile, the failure of one-click checkout startup Fast and questions about Bolt’s revenue suggest payment orchestration in the U.S. will remain dominated by the likes of Shopify and Stripe. Bolt and Fast wanted to bring Amazon’s one-click experience to all online vendors. After all, 75% of shopping carts are abandoned before payment, thanks in part to lengthy checkout processes.

But incumbents like Stripe and Adyen already dominate distribution channels, and they can easily extend a one-click solution. Meanwhile, checkout-only startups’ thin margins suffer under payment incumbents’ vertically integrated solutions, as well as from the “incentive wars” that payments, BNPL and checkout players wage on price-sensitive merchants.

So if one-click checkout startups are struggling to make headway against incumbents in the single-currency, highly digitized and concentrated U.S. market, it might seem impossible for a payment orchestration startup to succeed in the fragmented markets of Latin America.

However, we believe that fragmentation (and the absence of a Stripe-like incumbent’s dominance over the entire region) actually offers a huge opportunity for vertically integrated payments orchestration startups to capture a lot of value.

Macro tailwinds

In 2021, the number of new businesses opening Stripe accounts in Latin America rose by a whopping 518%. Even when you account for the post-COVID resurgence in business activity, that’s an unprecedented growth in opportunity for online payment providers.

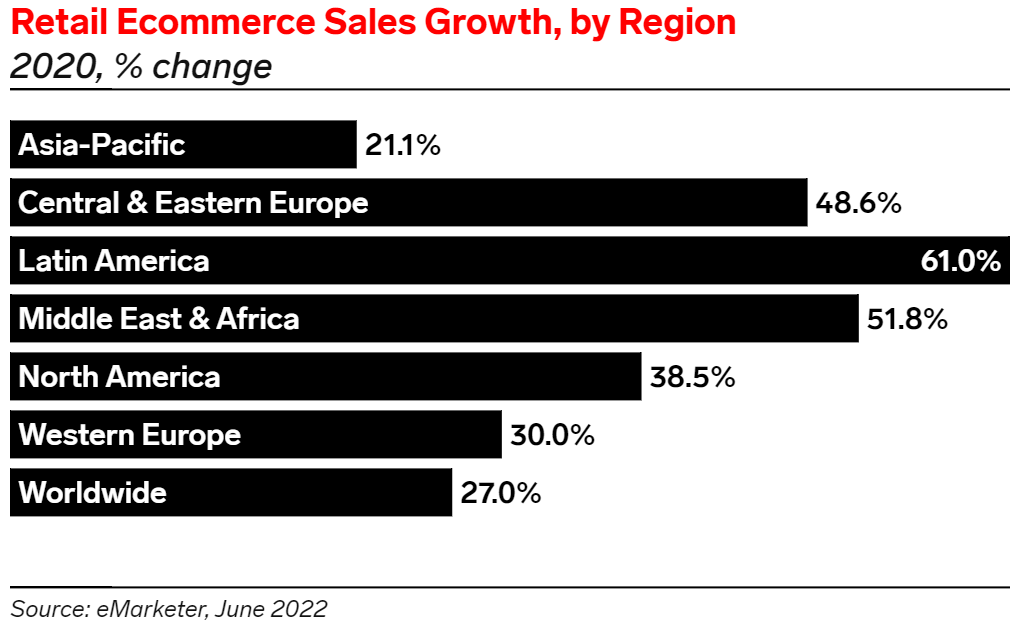

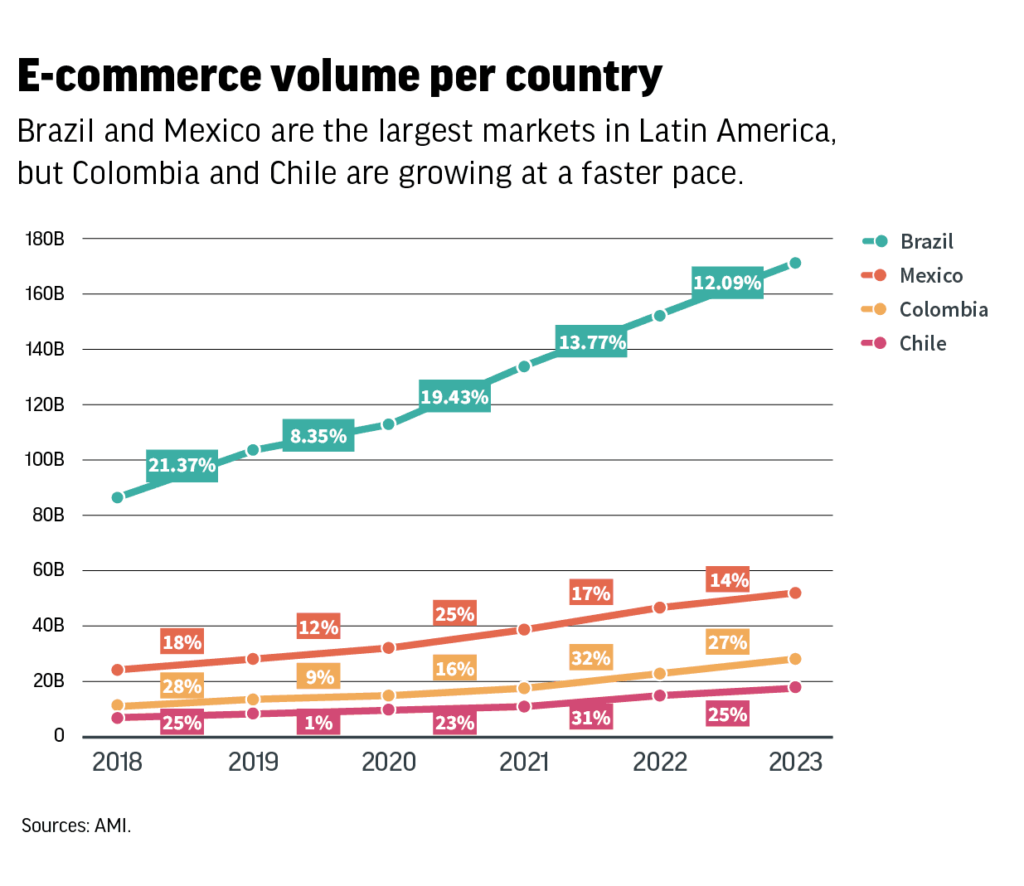

At the same time, the region’s e-commerce market is expected to reach $379 billion in 2022, representing 32% growth over 2021 and a CAGR of 25% through 2025, according to Americas Market Intelligence. That study suggests that the market will be worth $580 billion by 2024.

Together, Brazil and Mexico contribute about 60% of total e-commerce volume in Latin America, while Colombia and Chile are growing at a faster pace. And there’s still room for growth: Today, e-commerce only accounts for about 5% of total retail sales in LatAm.

Prerequisites for success

To be successful in Latin America, payment orchestrators must provide a robust value proposition that meets the unique conditions of the region. To help prevent payment fraud, a solution should aggregate multiple providers and data sources into a single decision engine. Balancing increasing payment acceptance rated with lowered fraud rates isn’t easy — a Stripe analysis found that the more fraud a business tries to prevent, the more likely they are to block legitimate charges in the process.

Payment orchestrators will also have to provide a single integration point for merchants, replacing the current labyrinth of local payment integrations. Smart routing technology will make switching volumes and PSPs easier and reduce costs that come with legacy acquirers and payments collectors. It would enable transaction abstraction to deliver split payments and settlement, as well as partial payments where one transaction is split across multiple sources, like vouchers and cards.

A single payment orchestrator would provide unparalleled opportunities for reporting, allowing merchants to visualize trends in payments, customers, orders and risk; understand where they can optimize; and compare their performance to peers and competitors. Third-party integrations with everything from point-of-sale and CRM platforms to rewards and loyalty programs would offer further use cases for merchants.

The current state of play

We count roughly 10 local payment orchestration players in Latin America right now and all of them are in the early stages. All approach the problem of fragmentation from a different angle, reflecting the fragmented nature of the payments landscape in the region.

For example, U.S.-based Spreedly has integrations with more than 100 payment gateway providers and third-party API endpoints worldwide. At last count, roughly 10% of its customers were based in Latin America. Meanwhile, local payments orchestrators like Plug, Tuna, Yuno, DeUna and Retry currently provide between 20 and 30 integrations.

We also have Compra Rapida and Trinio, one-click checkout startups similar to Bolt and Fast; Protego is a chargeback protection provider; Rebill has recurring billing services; and Destaxa is an offline payment orchestrator.

The technical work of building the tech and integrations in the space isn’t exactly rocket science, but working with so many merchants, acquirers, alternative payment methods, platforms and countries can feel like navigating a complex asteroid field. As a result, early exits are attractive for super payment gateway players: ZooZ sold itself to PayU in 2018; Payoneer acquired Optile in 2019; Paypal acquired GoPay in the same year; and Checkout.com took over a tiny 14-person startup called ProcessOut in 2020.

However, we believe there is an opportunity to build large, independent players in the payment orchestration space. To break out of the crowd and win the category, a successful venture would have to balance a high payment acceptance rate against low fraud and low costs and figure out the right incentives to onboard merchants with ease of product integration and configurability.

Fragmented markets like Asia, Europe and especially Latin America are more attractive than the U.S. precisely because of the heterogeneity of payment methods and currencies. While companies like Spreedly and Primer have already raised significant warchests to chase opportunities in the U.S. and Europe, the race in Latin America has just begun.

Originally published in TechCrunch. Read the full story here.

Generational Shifts Drive New Fintech Innovation and Investment

Our latest deep dive in the Wealth and Asset Management sector

Over the past few years we’ve witnessed the rapid rise of the wealth & asset management (WAM) sector. Broad media coverage of meme stocks, cryptocurrencies, and the IPOs of first-movers like Coinbase and Robinhood have heightened public attention on the work of innovative founders who are building in this space. There are now well over 3,400 startups disrupting this fintech category, yet the status quo still reigns in wealth management. As we highlighted in our inaugural State of Fintech Report, nearly 94% of annual brokerage revenue is still generated by incumbents.

The past five years have seen the largest brokerages go commission-free on trading, Robinhood surge to 7.6 million daily average revenue trades, and the rise of robo-advisors to the tune of $350 billion under management. However, the market, technology, and demographic forces that underpin our third State of Fintech sector deep-dive were set in motion years ago. And the ‘who, what, where, and how’ of wealth management have changed significantly.

In response, fintech startups are racing to manage these three dynamic forces:

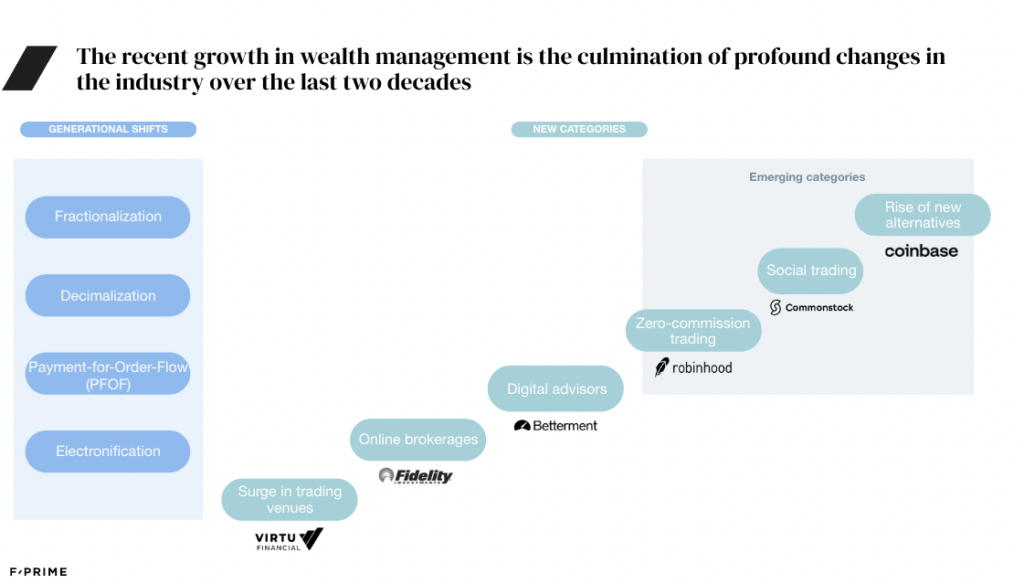

Becoming more accessible. Much of the recent growth in the wealth management ecosystem can be attributed to profound changes in the industry over the last two decades. After electronification and decimalization modernized the trading system early on, payment for order flow practices accelerated investment app development and lowered costs of trading. Most recently, fractionalization of illiquid assets has made ownership more accessible by removing hefty capital requirements.

These changes paved the way for recent advances in the industry such as commission-free trading, popularized by Robinhood during its launch in 2013. Robinhood ignited a generation by altering retail investors’ behavior with active trades, while offering a more intuitive, gamified user experience – surging to 23 million funded accounts by 2021. Similarly disruptive robo-advisors, which empower investors to automate investing and money management, are on the rise – with the top 10 robo-advisors holding an estimated $350 billion in assets under management. Lower-fee and low-touch robo-advisors are better equipped to serve populations previously underserved by traditional high-touch financial advisors.

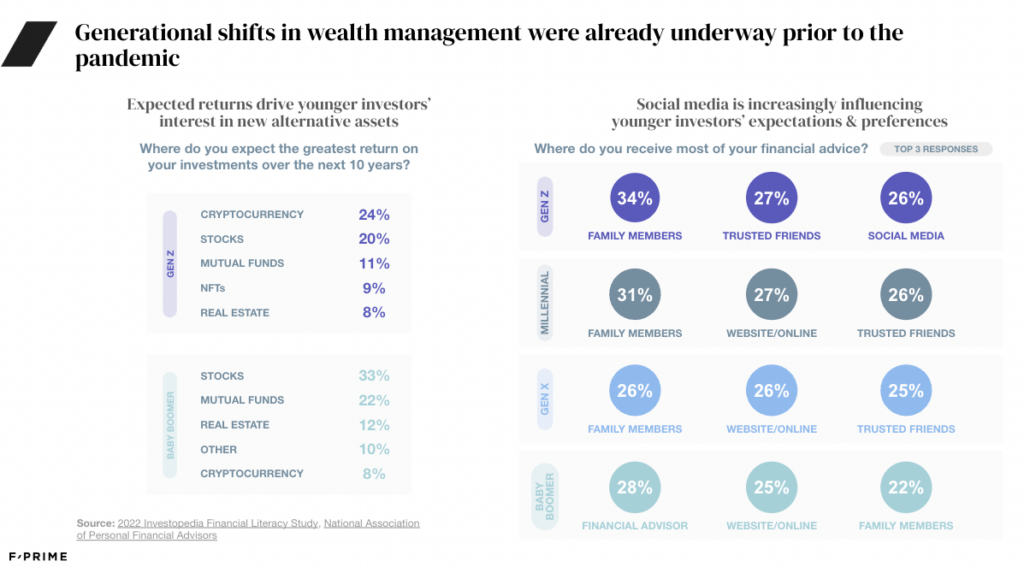

Recasting the wealth & asset management model for younger generations. As Gen Z and Millennials amass or inherit wealth, they bring a new set of expectations and preferences. Not only do younger investors more actively trade than older generations, but with longer investing time horizons, they also align their portfolios to riskier asset classes. When asked where they expect to see the greatest ROI over the next ten years, Gen Z was bullish on cryptocurrency (24% of survey respondents) while Baby Boomers were understandably more reliant upon stocks and mutual funds (33% and 22%, respectively).

Similarly, millennials and Gen Z seek advice and consume content differently than prior generations. For the first time, a generation relies heavily on social media content, including memes, to make investment decisions: 26% of Gen Z name social media as the source from which they receive most of their financial advice. On the other end of the spectrum, Baby Boomers now seek access to tools to manage wealth decumulation, assess health/wealth trade-offs, and manage extended retirements. However, having had a lifetime to accumulate wealth, their top source of financial advice continues to be traditional financial advisors (28%).

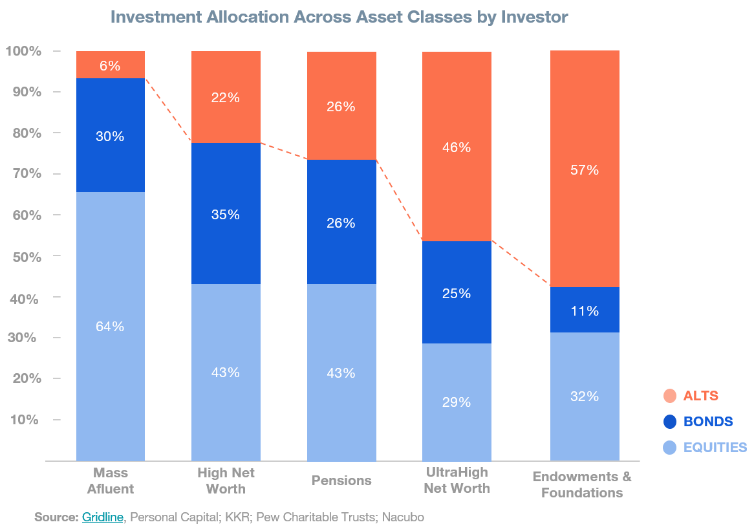

Reallocating portfolios to encompass ‘alt’ investments. Alternative assets are on the rise in two meaningful ways: traditional alts are increasing both in terms of retail access and recommended portfolio allocation, and the breadth of alternative assets is also expanding to the likes of crypto, wine, and fine art.

Historically, alts have been an exclusive domain for institutions and accredited or high net-worth individuals (with AUM nearly tripling to $12 trillion over the last decade) but are now increasingly accessible to retail investors who eschew the traditional 60/40 stock/bond split in favor of a more diversified portfolio. And not only are these ‘traditional’ alts – among them private equity/debt, hedge funds and real estate – becoming more accessible, investments in cultural assets like art, music, wine, and collectibles are rapidly growing as well. Two in three Millennials and Gen Zs invest in alts – among them crypto and NFTs – with 50% planning to increase their asset allocation in this direction.

Where in the World is Wealth and Asset Management Going?

A wave of new wealth players aim to address generational wealth and asset management shifts. Like Robinhood’s early days, many platforms have gamified the investing or savings process. Social trading platforms and ESG-focused players are addressing emerging preferences to obtain investment information from friends and influencers, as well as to focus on aligning investments with sustainability initiatives.

A historic wealth transfer (estimated at $70 trillion) is underway between the generations. Fintech startups understand this transfer presents vast opportunities to establish a high-margin niche with the fastest-growing segment of new investors, while serving older populations with retirement and wealth decumulation solutions. The market is expanding its reach to pull in younger investors and broadening to develop innovative fintech products and services that will drive growth despite today’s economic uncertainty.

The downstream impact is a deeper investment in this space. More personalized recommendations will require AI-powered advancements. More comprehensive access to alts will require a new tech stack and infrastructure. User experience must keep pace. These will remain battlefields for fintech companies, and a boon for retail investors. And the next fintech battlefields will not be limited to the U.S. – they will be global. Fintech startups are emerging to address the faster-growing global investor base in regions including LatAm, Asia, and Africa.

Latchel

Latchel is an award-winning property management technology company that empowers property managers to provide unbeatable customer experience with streamlined maintenance operations, and top-tier resident amenities. With built in layers that elevate the resident experience, property managers are also able to increase their revenue by implementing the service as a resident paid amenity. Renters get better service levels that average a 4.8/5 star rating, and property managers can increase both operational efficiency and overall profitability.

Latchel: The Operating System for Property Management

How Latchel saves property managers and owners over $1,850/unit a year

Today, there are more than 310,000 US property managers spending over 45% of their time hearing about broken toilets, calling technicians to fix chipped walls, and scheduling plumbers to unclog drains – day-to-day maintenance. Maintenance is one of the most cumbersome and tedious parts of their jobs, and Latchel aims to solve this pain point by taking over all the property management’s maintenance tasks and more. We are thrilled to be partnering with Ethan Lieber, Will Gordon, and Jullian Chavez for their $16.7M Series A as they create the new operating system for property management.

How Latchel Saves Property Managers and Owners Over $1,850/unit a Year

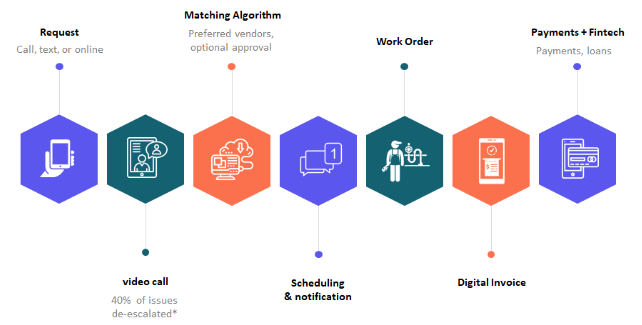

Latchel takes over all aspects of a property maintenance function. Latchel is free for property managers and charges tenants $15-18/month, similar to other utility bills. When tenants have an issue, they message Latchel, which tries to fix the issue initially over video. About 40% of maintenance issues can be solved by video without hiring a costly service professional – saving property owners 1.2 visits per tenant per year. For maintenance requests that are not resolved over video, a freelance technician is dispatched to the unit to fix the problem. A 24-hour help center is available online, over the phone, or via text, and both the tenant and property manager are able to track the progress of requests via customized dashboards. Once the job is completed, Latchel invoices the property manager and facilitates payments to the technician. The whole process saves property managers many hours a week in headache and coordination.

Tenant Maintenance Fulfillment Process

Why We Invested in Latchel

Real estate has lagged in digitization relative to other sectors, and F-Prime has been investing in all areas of proptech ranging from digital mortgage closing with SnapDocs, short-term stays with Avantstay and homeownership investment with Unison. As we surveyed the industry, we noticed the arduous process tenants and property managers go through when dealing with routine maintenance requests and once we dug into the numbers, it was immediately apparent how much value Latchel provides to property managers. On average, they see a 20% increase in revenue by switching to Latchel. Latchel is therefore able to close hefty five-figure deals that we traditionally only see with enterprise SaaS companies, while helping properties achieve 4.8/5 resident reviews. Per our analysis, helping property managers outsource maintenance is a $4B+ opportunity in the U.S.

We believe Latchel has the opportunity to become the central operating system for property management. In the coming months, we see the opportunity to layer on additional fintech and concierge products, like lending and home services, to give an even better experience to tenants, landlords, and vendors.

As part of the round, John Lin and Abdul Abdirahman will be joining the Board and John Raguin, Venture Partner and former CEO of Guidewire, will also be joining as an advisor. Thank you for welcoming F-Prime Capital as a partner in your journey!