Toast, the Restaurant Industry and an Exceptional Case for Vertical Payments

Toast, the Restaurant Industry and an Exceptional Case for Vertical Payments

Two weeks ago Toast announced its $400M raise on a $4.9B valuation, and for the first time, I feel that people outside the restaurant industry realized just what an amazing company Toast has become. It is an exceptional example of vertical payments and well on its way to becoming an industry platform.

At F-Prime Capital, we invested in the first institutional round of capital in 2015, and before and after, we have looked at dozens of other industries for vertical SaaS + payments opportunities. Few combined the magic ingredients that made Toast so successful. We got a lot of things right about the restaurant industry in our original investment thesis and got lucky on others, but overall we have learned so much more about building vertical software businesses.

This post is about why the restaurant sector has been an ideal industry for vertical payments and how Toast executed against it so well. I hope it also helps founders building vertical payments businesses in other industries to distinguish good from great verticals, how timing matters and how to judge how high the ceiling can be. I’ll organize the rest of my thoughts into Market, Team, and Timing.

In the beginning…

As with all breakout successes, the story starts with a great team and great execution. Chris Comparato, Steve Fredette, Tim Barash, Aman Narang and Jonathan Grimm are superb operators and have built an amazing team around them. They were united first by Steve Papa, Founder/CEO of Endeca, where they helped build Endeca to a $1.1B sale to Oracle. Then Steve backed them as their primary investor until 2015 at Toast. Talk about founders giving back and creating new founders.

Rock, paper, scissors. Market, team, timing.

It does not happen without a great team, but never underestimate market and timing. They make the difference between good and great companies.

Market

#1. High velocity sales cycle meets architectural shift to the cloud. Restaurants form and fold all the time. Successful restaurants add new locations. On average, 10,000–20,000 new restaurants start every year. Selling into the restaurant industry gives a startup a lot of shots on goal, often without the need to displace any vendors. In addition, the restaurant industry tended to refresh on-prem point-of-sale (POS) systems every five to seven years. That was both an indictment of on-prem, server-based software, but also a natural result of POS terminals obsoleting as technologies and security improved (e.g., EMV).

That said, Toast launched as all industries were moving to the cloud and this refresh in the restaurant industry was going to be different. Square had already introduced cloud + tablet-based POSs in 2009 to coffee shops and mom-and-pop stores, and nearly all quick-service and full-service restaurants would refresh to a cloud-based solution. Enter Toast with a purpose-built, all-in-one cloud-based solution.

#2 Era of the Payment Facilitators (Payfacs). By 2012 when Toast launched, the payment facilitator (Payfac) model was flourishing and this allowed Toast to redefine the POS business model and literally alter the competitive playing field. By embedding payments into their software stack, they were given two levers for charging customers — SaaS licenses and payments interchange. Restaurants were going to pay someone interchange, but now Toast could give them their core software platform for running the restaurant while also monetizing the payments. Providing an all-in-one solution offered value to both the restaurant and Toast.

A bonus of vertical payments in the restaurant industry is the low-risk profile. Compared to a marketplace like Etsy or Stripe’s broad customer base, restaurants are relatively easy to KYC, chargeback risk is low and transaction monitoring is more predictable.

#3 Geographic density leads to viral growth. Consumer businesses search for viral growth, but few enterprise businesses enjoy the same, though there are notable exceptions (e.g., Atlassian, Slack, Asana). Early on we found that achieving density in a city actually stimulated organic growth and higher sales productivity. Restaurant owners dine at other restaurants. Waiters and waitresses move from restaurant to restaurant. This was a remarkable phenomenon to watch and a beautiful characteristic of the restaurant industry.

Team

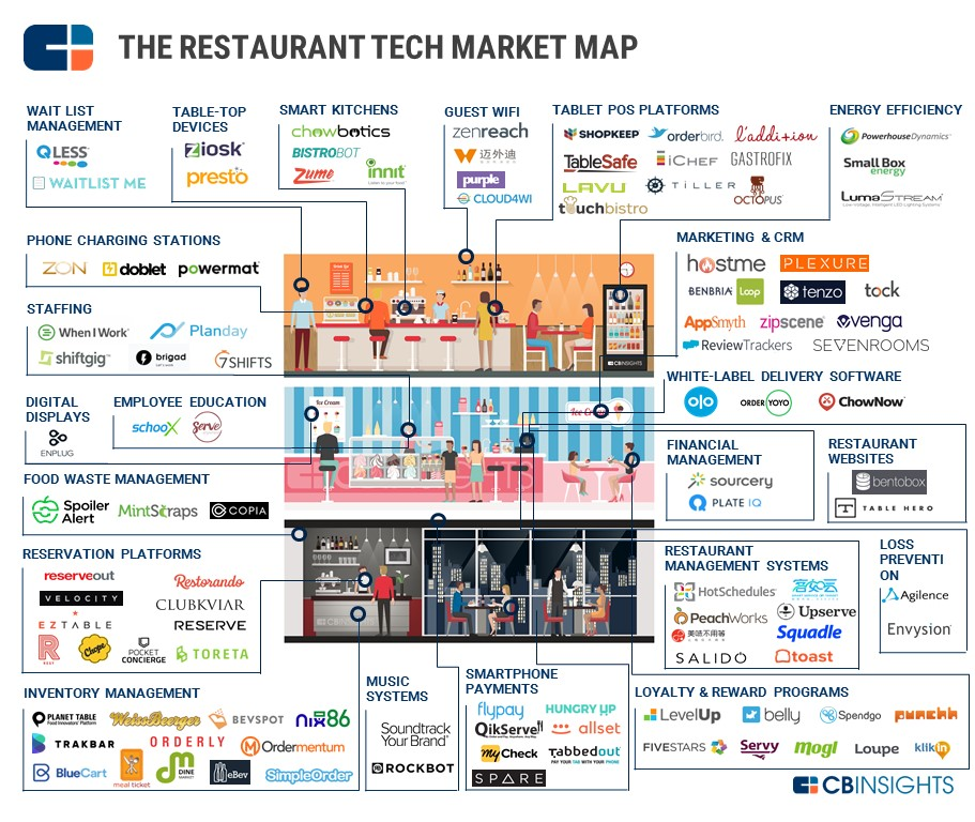

#4 I will be a platform when I grow up. With the shift to the cloud, Toast had the chance to re-define the product category from standalone POS terminals to a true software platform with APIs and a world of best of breed partners and applications. Not only did this allow Toast to offer more value to restaurants, but it planted the seeds of its own enhanced role as a platform layer in the industry.

#5 An enterprise team for an enterprise-grade market. I’ve found that quick-service (QSR) full-service restaurants (FSR) have just the right amount of enterprise complexity. Managing one, if not many locations, presents ample complexity, including: menus, cook stations, staffing, customer CRM, inventory, procurement, etc. Coming from Endeca, the Toast team built with an enterprise software mindset and an obsession for customer success. This is one of the main reasons it’s been difficult for Square to move upmarket.

I say ‘the right amount of complexity’ because I have found other attractive verticals, like hotels, are sufficiently big beasts, built around all-encompassing property management systems and are hard to displace without feature parity. Too much complexity and a startup has a hard time penetrating.

#6 Android, not Apple. Many of Toast’s competitors went to market with Apple tablets. They were the rage and looked beautiful. But we all know the cost of that brand. Toast understood that Android-based devices would follow a much faster cost curve while offering an order of magnitude more options for supply and configuration. While that choice seemed obvious to Toast, not all competitors saw it that way, including Revel and Touch Bistro.

Timing

#7 The restaurant sector got hot. It didn’t hurt that venture firms would go on to invest $3.4B in restaurant tech startups starting in 2014. Led by online delivery services like GrubHub and DoorDash, hundreds of startups formed to serve restaurants, both enabled by cloud-based POSs, which permitted easier integrations, and reinforcing the role of POSs as the new platform layer.

#8 Access to cheap capital. What a time we’re living in. Good teams understand the capital markets. Toast recognized that it could raise a lot of capital based on its strong unit economics, impressive go-to-market execution and large market opportunity. When you see an opportunity to be a platform, it is rational to press your advantage and gain market share.

The Future is Bright

As exciting as the first five years have been, the restaurant industry is still in the early innings of its shift to the cloud and vertical payments. Older, incumbent vendors like NCR and Oracle/Micros constitute most of the POS market.

This first phase has so much upside left. Mirroring the phenomenon I described of density leading to viral growth, the restaurant POS will have a winner-take-most outcome. Even incumbent vendors enjoyed that. Peak market shares were ~30% for NCR and 21% for Micros, with Toast on its way to winning its own significant market share.

The second phase involves the POS as a platform — the software central nervous system for the restaurant. Toast already has become a hub for third-party applications like staffing and inventory management. In five years, restaurants will not have two, three or four tablets on the counter for GrubHub, DoorDash, Caviar and others.

At the same time, Toast and others will offer additional services themselves. Toast acquired payroll provider Stratex and launched Toast Capital in December. I’m especially excited to see the suite of FinTech services Toast will offer to restaurant owners and employees. The POS is a fraction of the addressable market at each restaurant. As a public company, Square has continued to grow net revenue 60% Y/Y even as it surpasses $1.5B. The unit economics of QSR and FSR are several times more attractive than the smaller retailers that comprise Square’s customer base.

The restaurant industry has proven to be an ideal market for vertical payments and the ceiling for players like Toast is very high.