The State of Banking Report

The State of Banking Report

Over the last few years, we have tracked the public fintech markets’ post-pandemic peak, trough, and recovery, as well as deeper dives on the payments and wealth management sectors.

Today we are excited to release a new report on the State of Banking, available for download below and via the F-Prime Fintech Index. All roads eventually lead to a bank — a bank account, a loan, a payment — and no discussion of fintech is complete without a look at this sector.

For much of the recent fintech disruption, we talked about the unbundling of traditional bank services and the threats to their core revenue streams. Ten years in, incumbent banks haven’t gone anywhere — yet there are scaled players in nearly every banking product line. We have seen the rise of embedded banking, neobanks, open banking, and major shifts in share from bank credit to private credit.

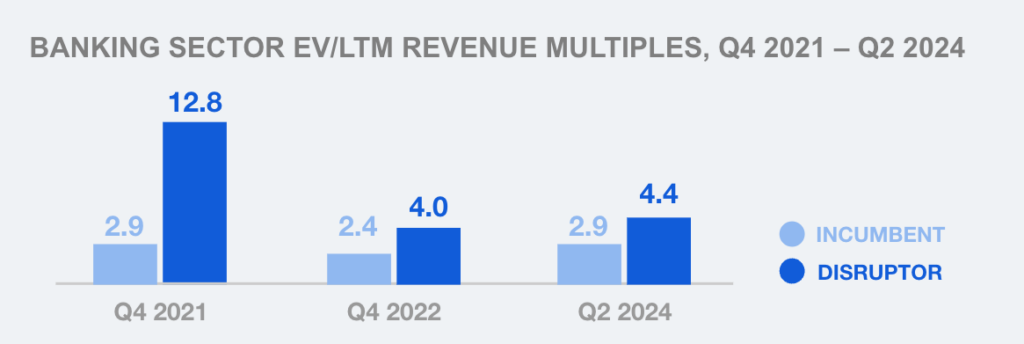

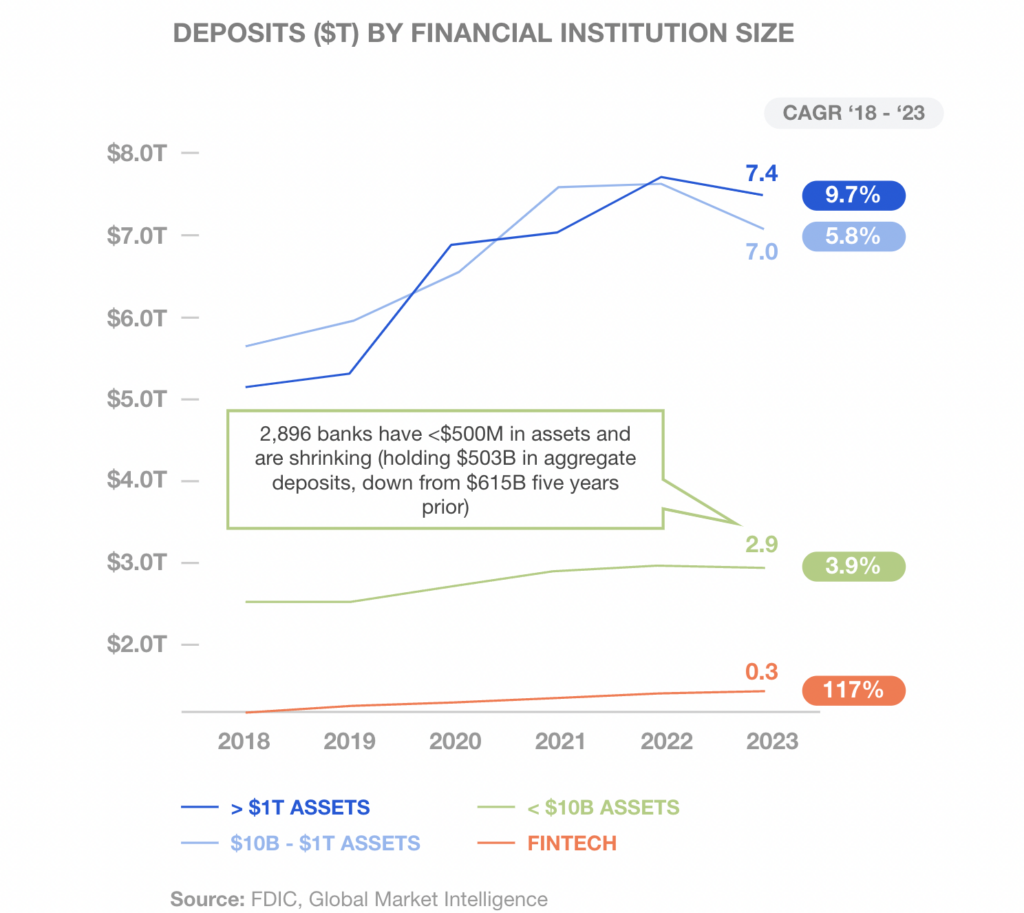

As the chart below shows, the valuation multiples of disruptors have aligned more closely to incumbent banks since the correction, but underlying performance depends a lot on where you sit. The approximately 3,000 banks in the US with less than $500M in deposits are actually shrinking, squeezed by the megabanks at the high end and the neobanks on the low end. More on that below.

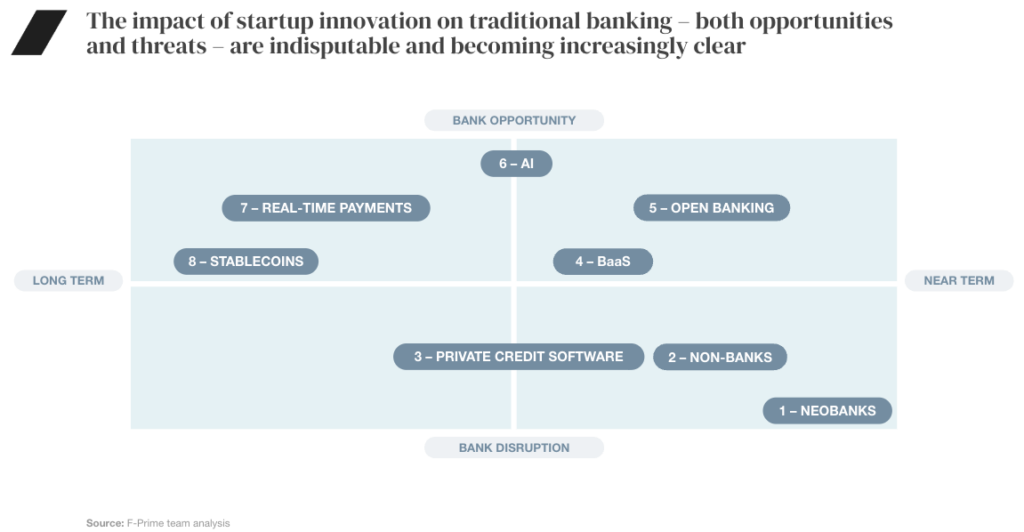

So what is driving these shifts in the banking landscape? We’re focused on eight key themes that are impacting banks and their customers right now, each posing varying levels of threat and opportunity for incumbent players.

In this article, we will highlight three of those trends: banking-as-a-service (BaaS), private credit, and stablecoins. To read about neobanks, real-time payments, open banking, non-banks, and AI in banking, check out the full report here.

1. Despite Regulatory Scrutiny, BaaS Is a Source of Growth for Smaller Banks

Banking-as-a-Service is as much a product of necessity as innovation. For hundreds of fintech startups and software companies, BaaS innovation has been critical to lowering the friction and cost of offering financial services to their customers. On balance, we think this has provided immense benefits to consumers and small businesses.

However, as noted above, nearly 3,000 US banks — the majority of banks — are losing deposits. Megabanks like J.P. Morgan, Wells Fargo, Bank of America, and Citibank have grown deposits nearly 10 percent annually, while neobanks like Chime and SoFi have each rapidly scaled to more than $10B in deposits each in under 10 years. BaaS has been a rare source of growth and operating efficiency for some smaller banks.

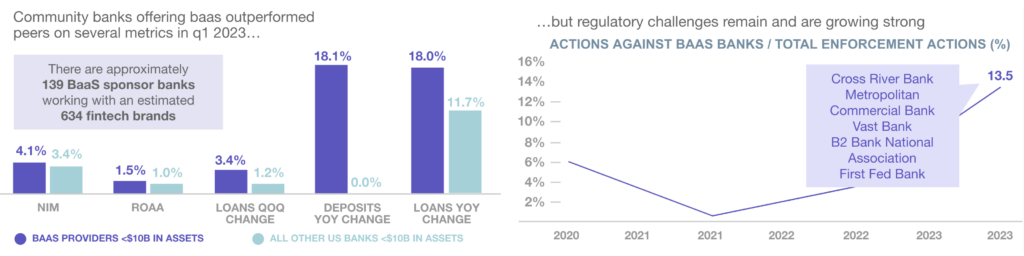

Smaller banks that have turned to BaaS models have typically restored growth, improved operating performance, and built product differentiation. Banks with less than $10B in assets that provide BaaS services outperform their non-BaaS peers on key metrics. For example, in 2023, BaaS-providing banks grew deposits 18 percent year-on-year (vs. zero percent for non-BaaS peers) and achieved a 1.5 percent return on assets (vs. one percent for peers).

As all readers know, despite the benefits of BaaS, regulators are very concerned about the risks and understandably so. Abstracting KYC, onboarding, and other compliance tasks away from banks via BaaS middlemen was already drawing regulatory scrutiny before the messy collapse of Synapse in the spring. It is clear regulators would prefer banks work directly with startups, not through BaaS intermediaries, and no matter what they must retain ultimate accountability. Going forward, banks with well-developed BaaS programs will have to navigate an increasingly risk-averse regulatory environment.

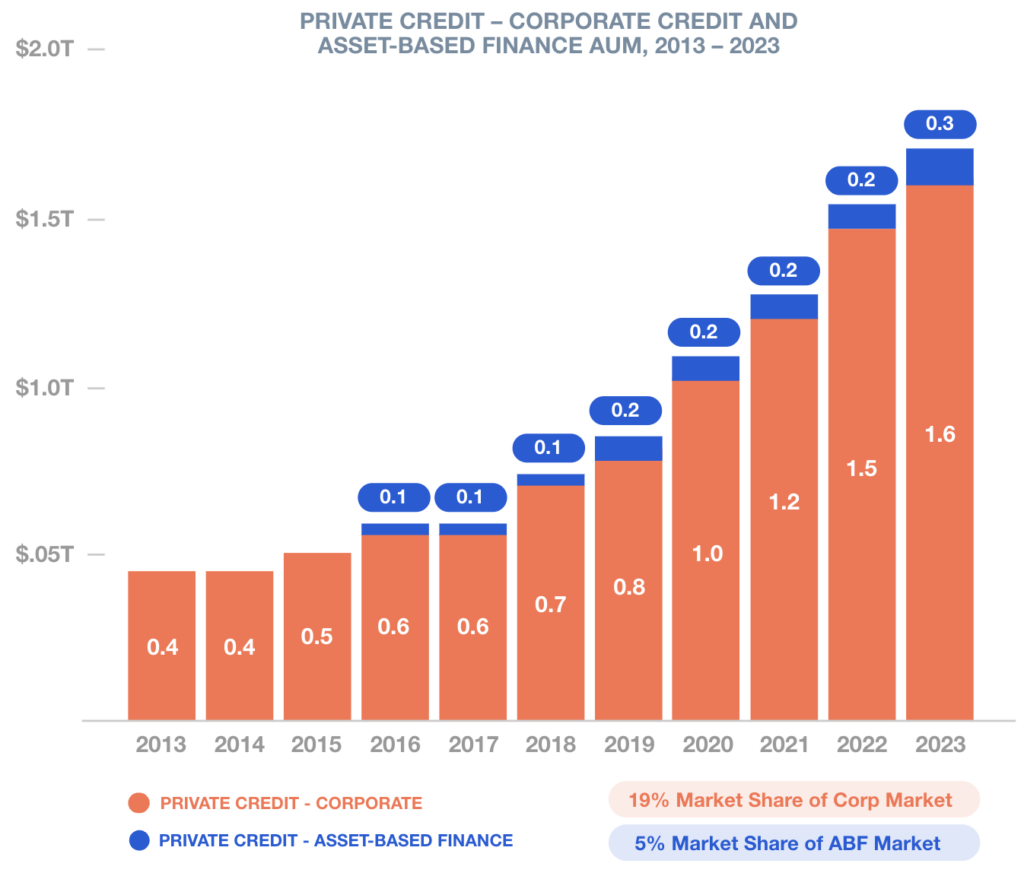

2. The Rise of Private Credit

The market for non-bank sources of capital has been rising, driven by decades-long market shifts, including bank consolidation (and the corresponding decline in the number of banks) and post-2008 regulation requiring banks to increase reserves and reduce balance sheet risk. Private credit players have stepped in to fill the void, becoming an increasingly important source of capital for consumers and small and medium-sized companies. However, they need purpose-built tools to digitize, automate, and scale their underwriting and portfolio monitoring — creating an opportunity for startups to build new software infrastructure to support the asset class. Rising players include include deal syndication and funds flow platforms like PactFi, diligence and deal closing platforms like Finley, and underwriting, portfolio monitoring and compliance platforms like HighFi and Cascade.

3. Stablecoins — Finally, A Killer App for Crypto?

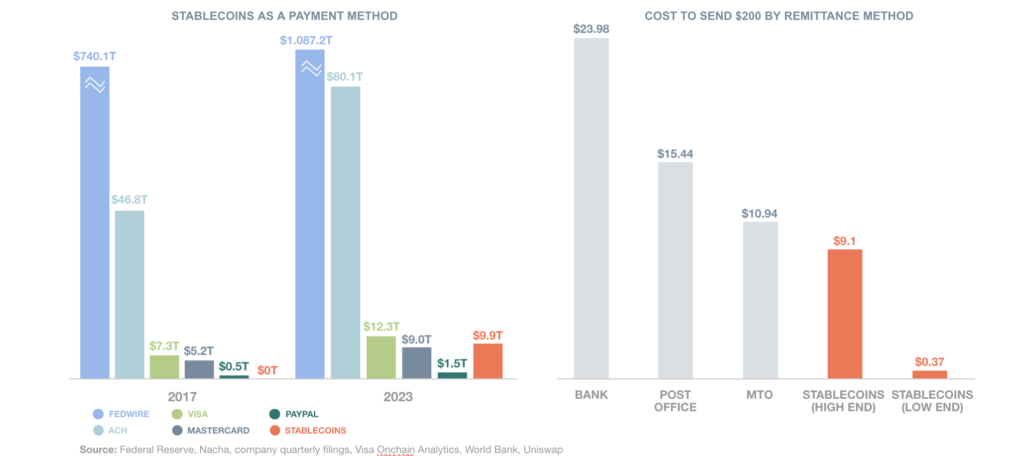

Under its original vision, crypto would provide the ultimate low-cost payment network. However, thanks to the inherent volatility of Bitcoin and other cryptocurrencies, they struggled for many years to gain traction beyond their status as an alternative asset class.

The promise of stablecoins — cryptocurrencies fixed to the value of a more stable fiat currency — is that they can deliver on crypto’s original promise of a cheap, efficient, permanently accessible global payment network. And over the last six years, we’ve seen them rise to rival other payment networks like Mastercard and VISA. Notably, many of these stablecoin transactions are technical settlement transactions vs “real-money” transactions like e-commerce and cross-border trade, but the direction of travel is clear and the volumes are impressive.

Large banks are also launching their own stablecoins — J.P. Morgan was the first to launch a bank-backed cryptocurrency in 2019, and says it now handles $1B in daily transactions. Use cases include payments between clients in wholesale payments businesses, and treasury and liquidity management. Meanwhile, PayPal launched its own dollar-pegged stablecoin last year, providing a potential payment option for e-commerce and point-of-sale transactions, as well as peer-to-peer cross-border payments facilitated by Xoom.

It remains to be seen whether we will have a world of a few dominant, liquid fiat-backed stablecoins or numerous company-backed stablecoins but either way, the world of commerce could look very different in 10 years. We’re excited to see the infrastructure built to enable it.

Originally published on Fintech Prime Time. Download the full State of Banking report here.