The 2024 State of Fintech Report

The 2024 State of Fintech Report

Assessing the industry’s rebound

For the fintech industry, it has been a wild couple of years. 2021 was a year of record-breaking valuations, revenue multiples, and VC funding. We then experienced an over-correction in 2022, with massive drops in valuations and multiples, and investors differentiating truly disruptive fintechs from those that merely provided a slightly better version of an existing financial service.

Access the full 2024 State of Fintech report here.

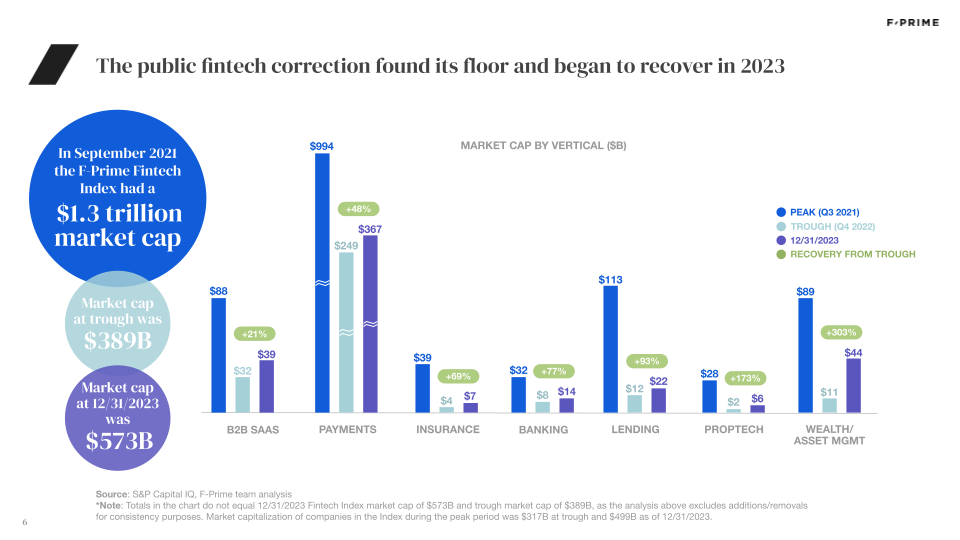

The F-Prime Fintech Index reflected this rise and fall. In 2021, we measured public fintech companies’ market cap at $1.3T. By the time it found its floor the following year, the industry was worth $389B.

Now, heading into 2024, we see the fintech market in the midst of a rebound, with public valuations and multiples improving as investors prioritize profitable, sustainable growth. By the end of December, the F-Prime Fintech Index’s market cap stood at $573B. Overall, the Index rebounded 114 percent in 2023, and continues to outperform the S&P 500 by 540 percentage points. Revenue multiples have also made a modest recovery, though public investors are rewarding capital efficient growth and structurally attractive gross margins over revenue growth.

Correction Still Rippling Through Private Markets

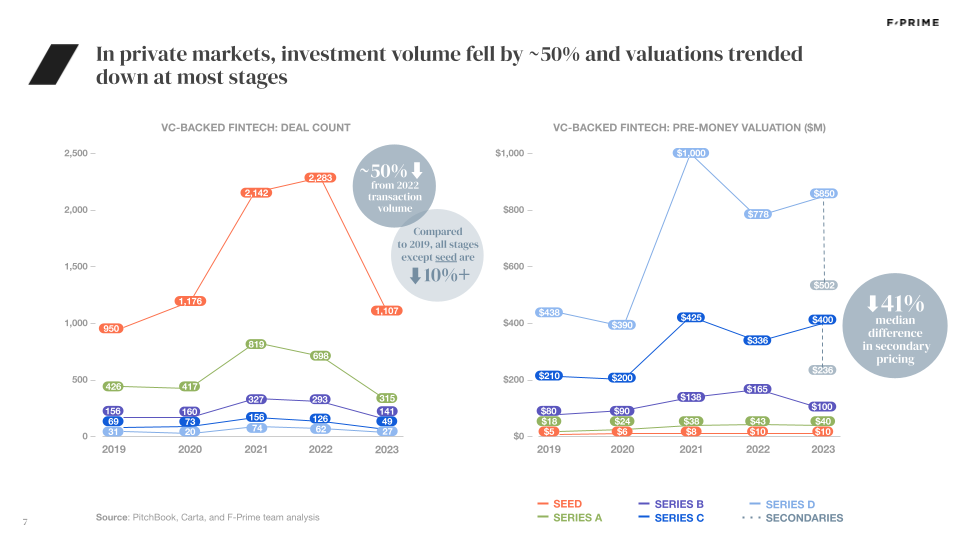

While the public markets are in recovery mode, the over-correction of 2022 is still affecting private markets. We saw investment volume drop by around 50 percent last year to 1,639. However, it’s worth noting that more private investments were closed in 2023 than every year in history before 2019. Fintech has become one of the largest sectors in venture capital, and that is not changing.

Post-Series B valuations took the biggest hit in 2022 and while they climbed slightly in 2023, it is misleading because only the strongest companies raised in 2023. Those that could wait, did, and tried to grow into prior round valuations. 30-40 percent discounts in secondary trading are a leading indicator of 2024 valuations for some late-stage private companies.

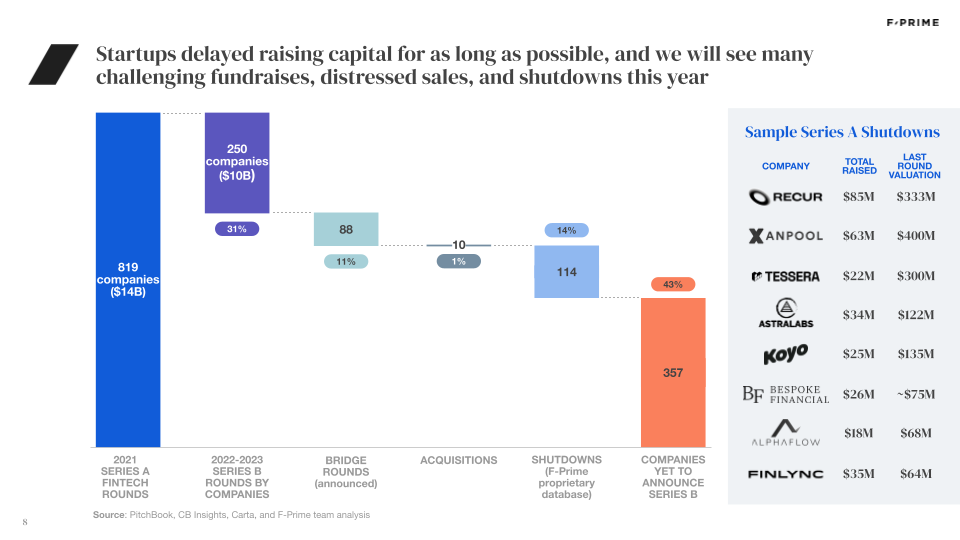

2024 will be a tale of two cities, with high-performing companies continuing to raise without difficulty, while others struggle. Of the 819 companies that raised a Series A round in 2021, 43 percent — more than 350 — have not yet announced a Series B, acquisition, bridge round, or shutdown. Bridge rounds can only extend so far and most will need to raise or find a suitable landing in 2024.

M&A Activity Did Not Bounce Back

2023’s $98B in fintech M&A pales in comparison to 2021’s $349B. While we expected heightened activity from private equity and strategic buyers in 2023, the first half of 2023 was extremely quiet. High interest rates hampered PE borrowing patterns, scaled fintech companies lost their high multiple acquisition currency, and strategic acquirers were focused on reducing their operational expenses. The collapse of Silicon Valley Bank helped no one. However, the second half of 2023 M&A was brisk and portends a more vibrant 2024.

Reg On, Risk Off

Throughout the history of finance, waves of excessive risk-taking tend to usher in an era of regulatory scrutiny — think of the 1980s junk bond market and the 2008 financial crisis, for example. Having reached the “excessive risk” period in 2021, fintech has now entered a period of regulation.

Relationships between BaaS providers and charter banks are under scrutiny, as are private fund managers and retirement products that include cryptocurrency. Financial service providers are being urged to adopt risk management practices around its buy now, pay later products, and there is downward pressure on debit interchange fees. These are just some of the regulatory actions that impacted fintech this year — check out the report for a full list of the most important pieces of regulation we’re watching heading into 2024.

Reflecting on a Decade in Fintech Innovation

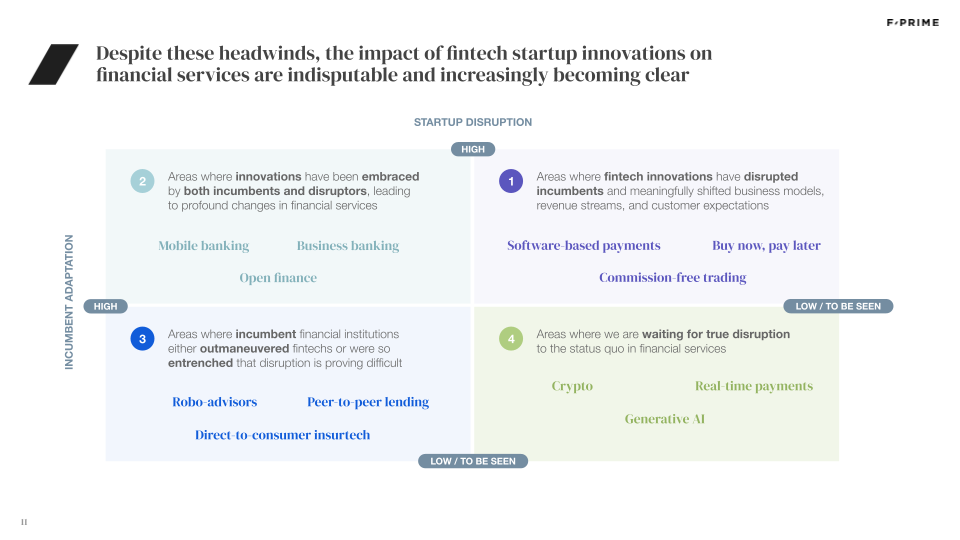

A decade into the fintech era, it is becoming clear where startups have disrupted existing financial services and where they were outmaneuvered or outlasted by incumbents.

Startup-led innovations like software-based payments (Stripe, Toast, Flywire), BNPL (Affirm, Klarna), and commission-free trading (Robinhood) genuinely disrupted incumbents and meaningfully shifted business models, revenue streams, and customer expectations. Elsewhere, incumbents embraced the very innovations startups introduced, leading to broad industry adoption more than disruption. For example, mobile banking and consumer-permissioned API access to financial data are now the norm.

In some sectors, incumbents “found innovation before startups found distribution.” For example, Betterment and Wealthfront pioneered robo-advisors, yet incumbents now control 80 percent of the market.

We should verbalize what you’re reading between the lines here: fintech startups have changed the industry in countless ways, but financial services incumbents are doing just fine. The top five banks have added $580B in market cap since 2003, and the top brokerages added $5.8T in client assets in the last five years.

Finally, the book is still being written for crypto, real-time payments, and GenAI.

Reasons for Continued Excitement

The industry is now operating at scale, with more than half of the 49 companies in the F-Prime Fintech Index posting over $1B in revenue in 2023. Yet these companies still only scratch the surface on their potential, capturing less than 10 percent of total US financial services revenue. There is still so much room to grow.

Even scaled fintechs — that billion dollar revenue club — are just getting started and growing an average of 45 percent annually, more than three times the rate of public incumbents. We expect the IPO window to open in 2024 for scaled fintech companies like Stripe, Klarna, Circle… and hopefully many more. We will add them to the F-Prime Fintech Index when they meet our published criteria.

Go deeper: Access the full report via the F-Prime Fintech Index here.