State of Robotics in 2024: The Rise of Vertical Robotics

State of Robotics in 2024: The Rise of Vertical Robotics

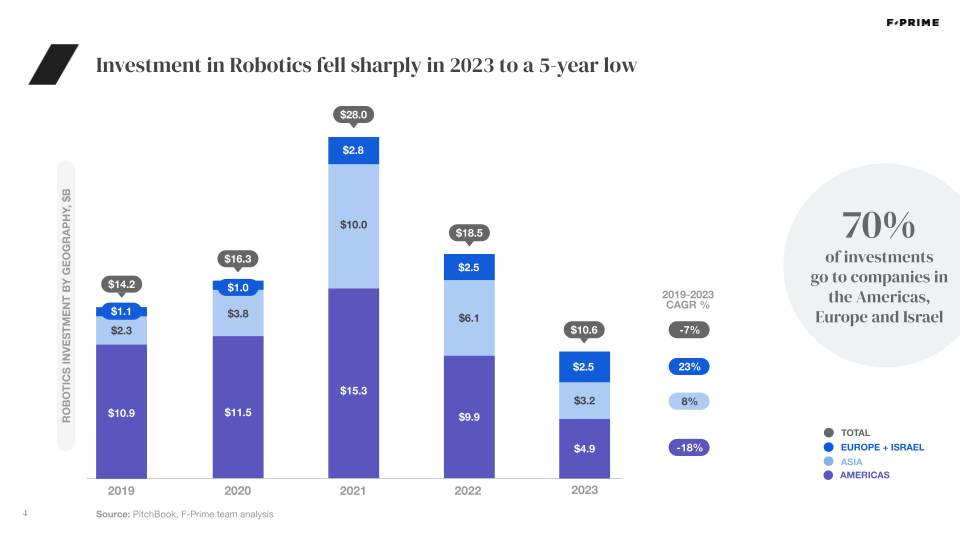

Venture capital investments in the robotics industry fell for the second straight year in 2023, down to $10.6B from $18.5B in 2022. However, within the downturn we find a number of indicators suggesting that the industry is, in fact, in an exceptionally strong position heading into the next five years.

That’s the headline for our second annual State of Robotics report. You can dive into the full report and its data here, and read on for our own analysis.

A Period of Transition

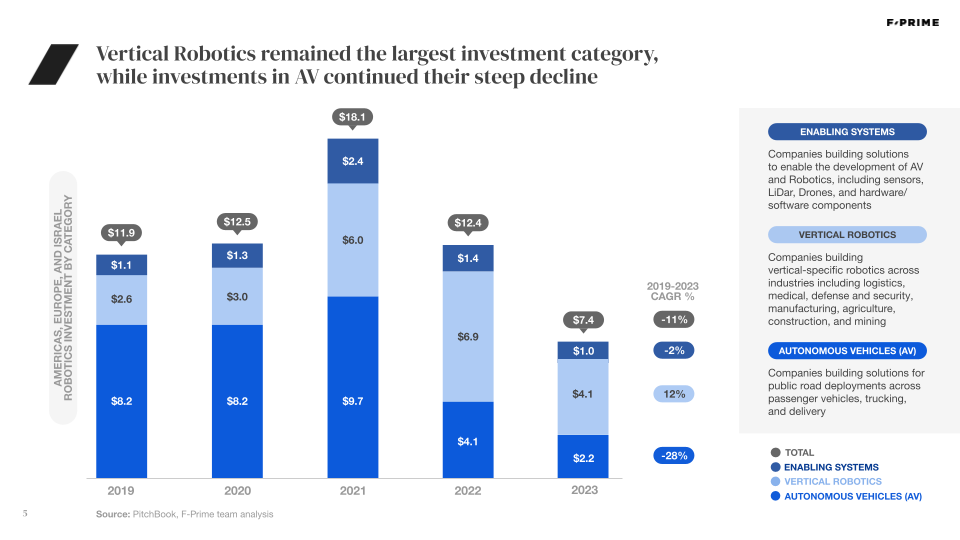

While the funding drop mirrors trends in the broader tech startup and venture capital ecosystem, it is more pronounced in the robotics industry as the torrent of capital investors once poured into the autonomous vehicle sector has dried up. AV companies raised $9.7B in 2021 — in 2023, they raised just $2.2B.

As the AV sector falls victim to an over-emphasis on technological ambition and under-emphasis on commercial viability, Vertical Robotics companies are attracting a new wave of talented founders, investment capital, and corporate interest. AV companies raised around 70 percent of venture capital invested in robotics in 2019, but by 2023 that figure had fallen to less than 30 percent — much of which is now focused on trucking. Meanwhile, Vertical Robotics companies’ share of investment in the industry has grown over the same time period. While the Vertical Robotics sector also experienced an overall decline in investment in 2023, it has experienced net growth over the last five years, from $2.4B in 2019 to $4.1B last year. In 2023, logistics and medical robots saw the most activity.

Vertical Robotics companies target industrial use cases with end-to-end solutions, typically augmenting tasks performed by humans and thereby enhancing the productivity of existing labor. Examples include pick-and-place robots in fulfillment centers, or autonomous vehicles moving crops on a farm or in a nursery.

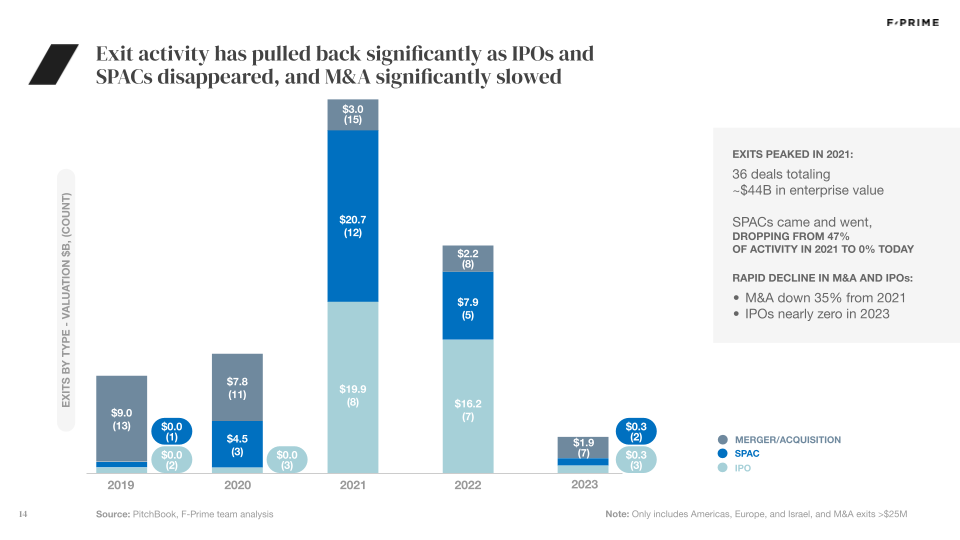

Exits also slowed in 2023. Deal volume and deal value both dropped to a five-year low in the robotics industry. The drop in deal value was especially tough — as a whole, robotics deals in 2023 were worth less than 10 percent of the exits in 2022. Of the 46 companies that went public via IPO or SPAC (remember those?) since 2019, as of the end of 2023 only eight trade as independent companies with market caps above $250M.

Signs of Endurance

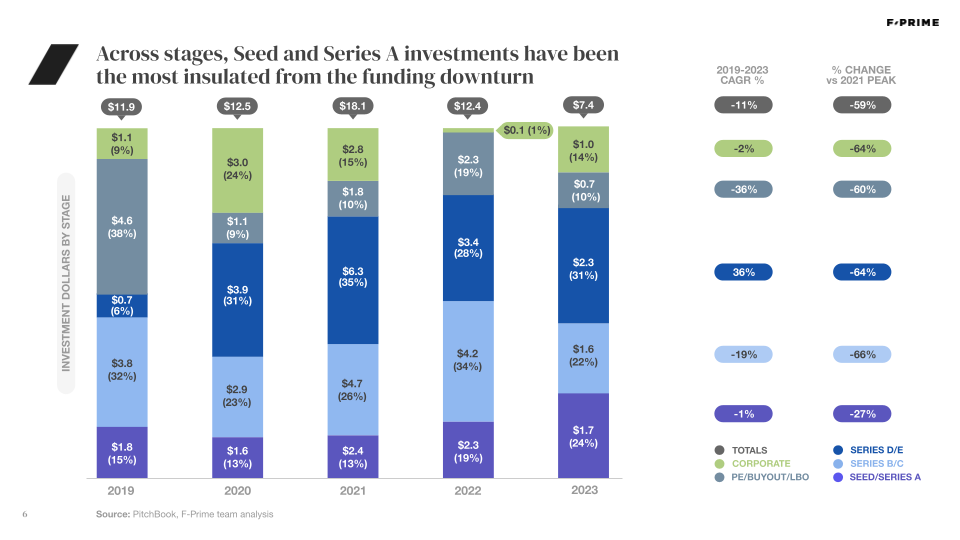

Despite the overall decline in funding for tech startups, investing in robotics at the early Seed and Series A stages held up better than late-stage investing over the last three years. This is reflective of investor excitement about the tailwinds creating opportunities in the sector, including rapid advancements in AI, falling hardware costs, and labor shortages. In turn, these trends are driving more experienced and talented founders to create robotics businesses. Startup accelerator Y Combinator, a longstanding bellwether of early stage investment activity, included robotics as one of the focus areas of its 2024 cohort. The last few years’ robust early stage activity will drive increased later-stage investment as companies mature and achieve commercial milestones.

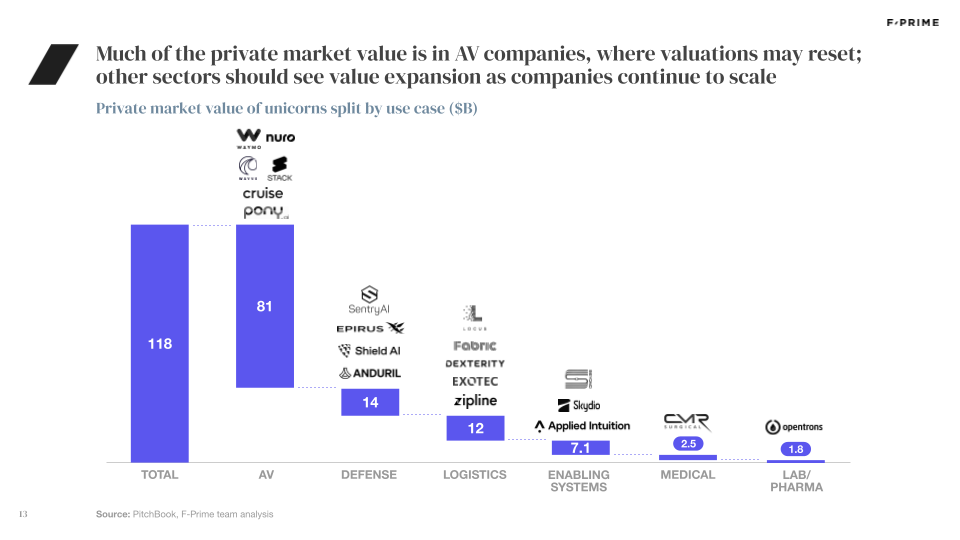

Meanwhile, given the challenging exit market of the last 12+ months, there is still a significant amount of value locked in private robotics companies. There are currently 20 private companies which have raised at valuations north of $1B, with an aggregate last-round valuation of $118B. While much of the value is in AV companies, where valuations are likely to reset, there is still an attractive backlog of robotics startups capable of driving significant exit value going forward.

That exit backlog will create a massive tailwind for the industry in the coming years. The IPO window will reopen and established businesses will seek to reinvent their product offerings through the acquisition of Vertical Robotics players, sharpening the opportunity in the eyes of many investors. Over time, the virtuous cycle of company creation and exit will accelerate.

The past year has been a wake-up call to the entire venture ecosystem — and particularly robotics. Hype-driven investment cycles inevitably come to an end, while those focused on business fundamentals endure. Investors today are looking for differentiated solutions which transform massive addressable markets, but they must also deliver superior financial results. The industry’s tailwinds have positioned it to be one of the driving sectors for venture returns in the coming years — though plenty of work remains to deliver on the financial promise of robotics.