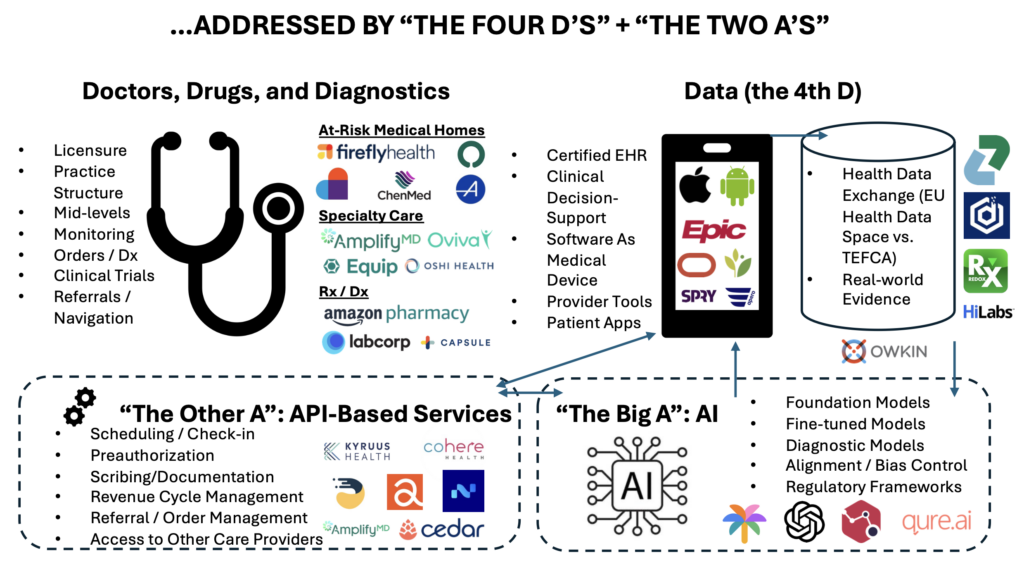

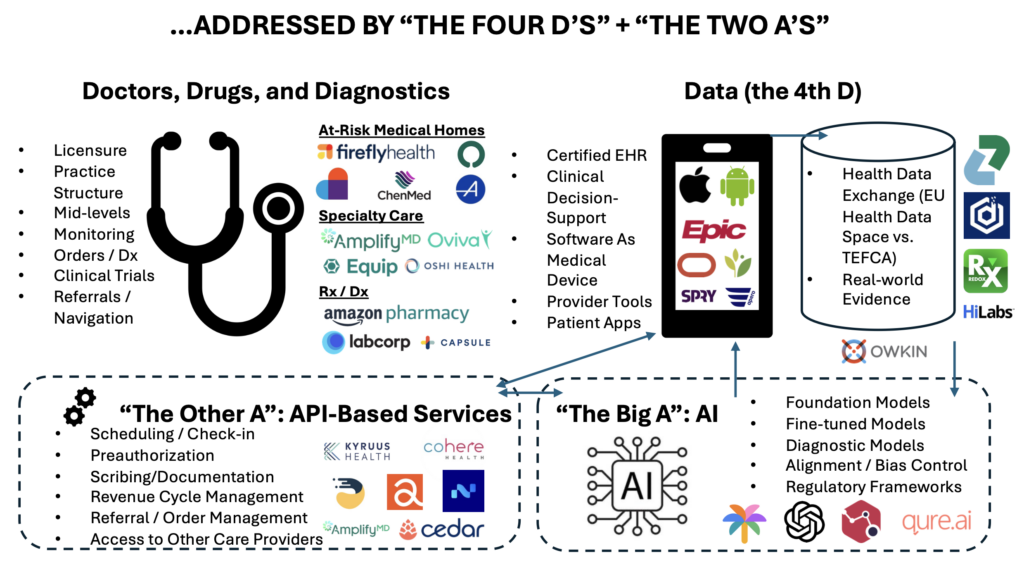

Building on the “Four Ds of Digital Health”, two key automation advancements are being incorporated to make an impact: artificial intelligence and API-based services.

A new digital care architecture is transforming healthcare by integrating the Three Ds of healthcare delivery (doctors, drugs, and diagnostics) with data, AI, and API-based services, creating a more accessible, personalized, and efficient system for both patients and providers.

The modern healthcare delivery system requires a new architecture, powered by technology and tech-enabled services.

Key Trends Demand Systemic Change

Myriad trends are rendering our traditional care delivery system ill-suited to today’s challenges:

– Provider supply constraints cannot meet rising demand

– A system built around acute care is not well suited to managing chronic conditions

– Digital interfaces give rise to new modes of engaging in patient care

– Financing is shifting from fee-for-service to value-based models

– Expensive breakthrough therapies proliferate in pharma, biotech, and medical devices

– Administrative burdens have grown exponentially requiring better infrastructure

The design requirement for a new digital care architecture is clear: care must be more accessible, always-on via multiple channels that mix digital and physical delivery, tailored to the specific care plan of each patient. This requirement cannot be met in a world where traditional delivery systems focus more on consolidation for negotiating leverage than on making care affordable and/or easy to access.

Data as a Key Component of Care Delivery

Data deserves a full seat at the table alongside the traditional Three Ds of healthcare delivery: doctors, drugs, and diagnostics. Indeed, there now are Four Ds of Digital Health. Without accurate, robust, and real time data, it is not possible to get the care you deserve. When care can be personalized, the quality of the data is as important to patient health as everything else.

So, the era of asking “where does it hurt?” and starting from there no longer works because without rich information about your medical history, diagnostic testing, and the full complement of medical records that have accompanied your lifetime of care, practitioners cannot give you the best that medicine has to offer in a way that is convenient, reliable, and efficient. In many cases, your genetic profile, your family history, or insights from prior episodes of care are vital to ensuring that you get the right procedure, the right drug, and/or the right care recommendation.

This goes beyond the testing and data requirements of a given specialist. Yes, GI docs need to know inflammatory marker levels before creating a care plan, and cardiologists need real-time data on cardiac function and fluid status to fine-tune heart failure therapy. But, these providers also need to know what is going on for a patient across the care continuum, including plans and histories of the patient related to conditions other than the specific one they are treating. Similarly, primary care physicians need to know what is happening for a patient in all of these areas, particularly when there are multiple chronic conditions at play. Powered by AI tools noted below, physicians now access patient data via concise, cogent summaries of care episodes without wading through the “PDF graveyard” inside their EHRs (if they have that information available to them at all).

The “Department Store” Model Doesn’t Work

Health systems have responded to data challenges by suggesting simply that all the information should be housed in one medical record in a healthcare environment completely controlled by that one entity. Think of this as the “department store model.” Macy’s had one of everything, so you didn’t need to go anywhere else. Yet, consumers wanted more. They wanted a wider variety of brands, lower price points, and diverse channels. Hence, Amazon came along and former department stores are now being converted into housing for the elderly.

It’s a similar dynamic with health delivery. Large health systems seem to say, “Just never leave my four walls, and everything will be ok.” They hoard data if not required by the government to share it and their technology partners embrace this model. And this works for them. With everything under one roof, they can charge more for everything. Yet, research shows that as health systems get larger, the cost of any one service goes UP not down, while quality deteriorates. Adding insult to injury, patients cannot access these systems readily, due to a combination of supply constraints and process inefficiency. The bill for this inefficient model is borne by society broadly, via higher prices paid by employers, patients, and whoever prints T-Bills in the U.S. Treasury. Remarkably, even when everyone is using the same medical record, outcomes are not better with respect to cost or quality. Even with all the data in one place, the “department store” is still under-gunned compared to the power of the marketplace to deliver cost and quality to the end user (the patient).

A Better Solution: Unbundling Care Delivery, Powered by The Four Ds and Two As

Care delivery needs to evolve so that each patient is seen by the right provider at the right time, in a way that is convenient for patients.

Today, care is bundled in the form of large health systems, in part because the data is disparate and unbundled [1]. Once the data is put in one place and is comprehensive, accessible to anyone at any time, care delivery can be unbundled in a way that enhances value. When companies like Zus Health make data ubiquitous (mediated by privacy and consent) we can step away from data hoarding, mediated by health systems and their legacy technology vendors.

This allows an actual market to develop, so that healthcare can finally benefit from the economies of scale and the power of technology in ways that bear fruit in most other industries. The power of markets to generate new value propositions, breathtaking levels of cost reduction, and delightful consumer experiences is well known. Just look at anything you do with Amazon or e-commerce, buoyed by fintech and advanced logistics, we live in a world where almost anything feels possible in the retail environment.

Health care certainly is different than that. Most patients do not have the knowledge to make accurate shopping decisions in the healthcare context, but that’s changing given the proliferation of AI tools which depend crucially on access to data. Additionally, when data is unified, care can be unbundled, which means that you can seek advice from any care provider, liberating you from the slog of what primary care has become in large health systems today, allowing you to access new modes of care that are better tuned to the realities of life today.

What kills patients is not so much acute episodes or infections, important as those care moments can be, as chronic diseases, best addressed by persistent, more available solutions.

This looks like comprehensive primary care that is more convenient for you because it sits in the palm of your hand, available all the time, provided by companies like Firefly, Oak Street, or Aledade. These “medical homes” take risk for total costs, so they invest in a longitudinal relationship; as “health fiduciaries,” they are accountable both for health and cost. These entities manage their patients proactively, developing rich user experiences for accessing care virtually or in-person and navigating the system on behalf of their patients, including partnerships with specialized care providers. If a patient has an eating disorder, the medical home can ask Equip to address it; GI issues can be handled by Oshi; while patients on a fertility journey access Carrot. This type of dynamic and integrated care provision is made possible when all participants can read from, and write to, the same dataset and coordinate seamlessly. Unlike an all-in-one department store like the Mayo Clinic, this model provides an open network, where a marketplace can emerge with richer, more tailored and higher value services, mediated by an organization accountable for your health and your budget. Fluid data enables this.

The four Ds of digital health will unlock new opportunities for quality and cost improvement and many of the startups featured at the HLTH conference illustrate this. The Four Ds themselves, however, are not enough. That is why I am adding to the framework The Two As of Automation.

The Two As of Automation: “The Big A” and “The Other A”

Automation is about making sure that work is performed reliably, consistently, and in a cost effective way. With automation, care providers and the companies they work with can get things done at the touch of a button, or – better yet – without pushing a button at all.

So, what are the Two As of automation? These can be broken down into “The Big A,” the one everyone can’t stop talking about, which is artificial intelligence. But true transformation of the care delivery system also requires “The Other A,” API-based services. Pranay Kapadia, CEO of Notable, previewed this post and explained that “agents” perhaps could be their own “A” in this framework; they straddle the line between APIs and AI and represent a key innovation vector.

When data is unified and care can be unbundled, then every care provider can operate independently. Doing this efficiently requires automation, which scales best with a marketplace of B2B services to get all sorts of work done.

There are enormous staffing shortages in health care that drive outrageous costs for human beings to do tasks essential to our care. However, increasingly, many of these tasks actually can be done at scale by others just as an Uber ride to the HLTH convention involves APIs for payment (Stripe/Braintree), navigation (Google Maps), and communication (Twilio).

Similarly, every healthcare provider will be able to access via APIs for high-quality and scaled services in areas like scheduling, pre-authorization, patient payments, clinical decision support, remote care management, Rx delivery, and referrals to a plethora of other care providers, who themselves are able to take part in a seamless care journey because everyone can access and contribute to the same datasets. Devoted CEO Ed Park, commenting on a draft of this post, noted that what makes The Two As important is that they can accomplish specific tasks right when they are needed, such as a doctor confirming that a pre-procedure checklist has been completed or a patient finding out precisely where to go for a lab result [2].

Embrace The Failure of Imagination

As Chris Dixon has shown, new innovations usually run into the obstacle of humans’ inability to really comprehend all that technology can do once it has been invented. When the telephone was invented, people at first said, essentially, “Wow, that’s cool, but no one will use it because the telegraph already handles everything.” When the TV was first built, no one could think of anything to do with it initially other than film plays with one camera. No one thought about multiple cameras or going outdoors, let alone adding special effects. It was a failure of imagination, which tends to accompany any new breakthrough technology.

Healthcare now faces the same failure of imagination. Why shouldn’t the care plan sit not just on your smartphone but also on your watch to remind you when it’s time to take medication, to tell you when your activity levels do not align with your exercise goals, and to reach out proactively with a loving AI-driven voice to ask you how you’re doing and give you the opportunity to share your experience, gain reassurance, and make sure you are moving in the right direction with your behaviors, which are as vital to your health as anything? I don’t know what will come of a world where data and care can be unbundled and fully synchronized, but I’m quite sure it will involve profoundly beneficial innovations.

Modern healthcare organizations will innovate based on access to complete data. They will depend vitally on rapidly emerging foundation models and AI tools to support care delivery. Furthermore, a proliferation of services can be integrated into their platforms by technologists using a simple line of code that references these multifaceted services.

The Four Ds and The Two As will bring us a health care future that is unrecognizable today. Crucially powered by privacy and consent, each patient will be able to choose a medical home that is always-on and available, which can help navigate a marketplace of specialized providers/services/apps based on individual care plans.

All-in-One Care To Integrate Digital and Terrestrial Delivery

The goal is a seamless, all-in-one care experience that is delivered via a broad marketplace of providers who can offer tailored care to our individual needs; just ask Lionel Richie.

Many people have comorbidities, which require thoughtful guidance and planning from knowledgeable care providers, which is the heart of primary care. But these care providers do not need to operate inside the bowels of large medical buildings that are hard to find without access to complete information about your care, including the care that has been provided to you outside of their own four walls.

There will be a plethora of data sources that will complement these decisions, including “omics” and diagnostic data and even data from wearables and patient reported outcomes. Today, this data often frustrates care providers because they lack the training to utilize it effectively and do not have the time to incorporate it into your care planning. Hence, they will depend on AI to do the long slog of reviewing data tirelessly, understanding implications for the care plan, looking for deviations of key measures from safe thresholds, and then making the work easy for the care provider to integrate into the care plan and provide the patient with the right advice and new recommendations to keep us all on the right track .

If the goal is to Live to 100, or Die Trying, this will be achieved only with a modern digital care architecture that is convenient and low cost. This system must harness the full power of AI to continuously monitor your health while you enjoy life, only interrupting you when necessary to keep you on the right track. Health equity demands that healthcare is made radically more accessible, effective, and affordable. A world where data has a prominent role, treated as essential to your care as a doctor, lab, or pharmacist, is a crucial first step. However, only with automation powered by AI and API-related services can anyone keep up with the demands of healthcare and deliver the quality of care you deserve.

So, let’s build a new health system where anything a provider or a patient needs is accessible via automation, powered by the data that is crucial to each person’s health. With the right infrastructure at our disposal, all it will take is some imagination.