Future Of Financial Advice – More Co-Pilot Than Autopilot

Future Of Financial Advice – More Co-Pilot Than Autopilot

When you put “wealth management” and “genAI” in the same sentence, most minds jump straight to some version of “autonomous finance.” However, that’s a concept that would have to overcome significant trust hurdles with advisors and the public to gain widespread adoption. According to research by Vanguard, the personal connection and trust that exists between financial advisors and consumers drives about 40 per cent of the value in any advisory service.

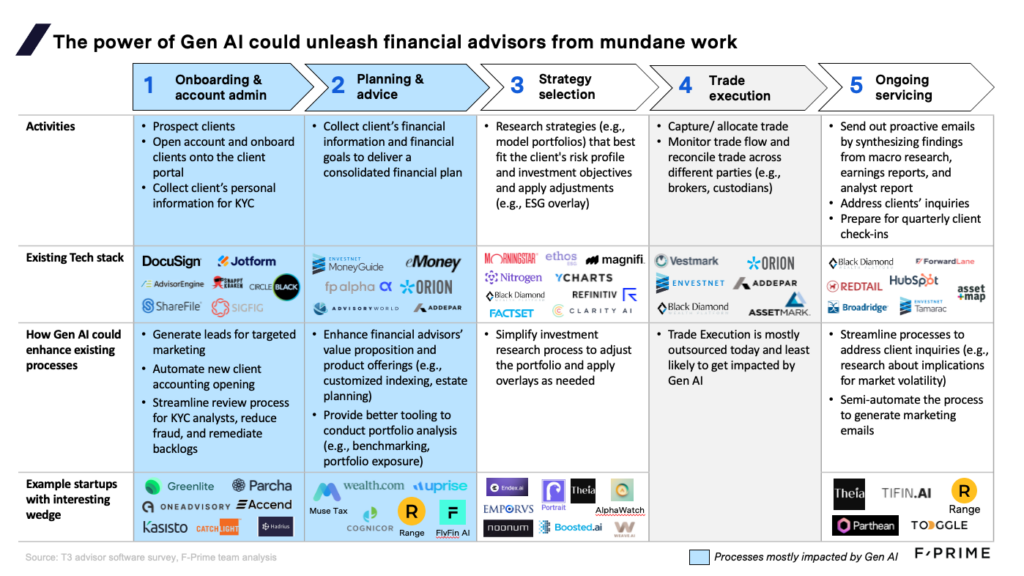

Over the last 10 years, advisors have started to transition from “stock pickers” to client relationship builders. As a result, new inefficiencies have emerged in the value chain: advisors now spend their time collecting and synthesizing information across a sprawling and outdated tech stack to help clients make decisions.

So, while generative AI isn’t going to put our money on autopilot any time soon, it has the potential to save advisors’ time by handling the more repetitive and labour-intensive aspects of their jobs. As a result, advisors will be free to build deeper relationships and trust with an expanding client base.

The current state of play

Most financial advisors juggle five different tech platforms every day:

Many of the steps outlined above involve pulling together disparate information, often supported by different tech stacks, and synthesising it all to generate insights – a unique strength of generative AI technology is that it can quickly process large amounts of data.

Freeing financial advisors from mundanity

Generative AI will enable the construction of new “co-pilots” for financial advisors. Seeking to cut costs in an environment of fee compression, firms are eager to automate routine tasks. Those tasks include reviewing legal documents, opening accounts, preparing client presentations, adjusting asset allocation, requesting query service, addressing ad hoc questions, and other activities beyond their core role of advising clients, which currently take up 36 per cent of advisors’ time. Put another way: the average advisor spends more than two hours “behind the scenes” for every hour they spend with clients.

One way that CIO offices have attempted to streamline these processes is through the creation of in-house research databases. However, advisors still burn much of their workday conducting research, digesting information, and surfacing the most relevant insights in response to specific questions by their clients. It’s important to remember that most of those clients are seeking intuitive responses from a human they trust, rather than highly technical or precise answers.

Generative AI can swiftly perform the synthesising legwork for an advisor, who can then spend more face-to-face time with the client, create suggestions, and ponder implications for their personal portfolios.

Some incumbents (such as Morgan Stanley) are taking the time to build these solutions in-house. However, legacy tech debt means that they usually take a long time to build – for example, Bank of America spent 10 years and $100 million to build its proprietary Merrill One Wealth Management platform. Others are understandably open to partnerships – see JP Morgan’s and TIFIN’s initiative to develop AI-enabled fintech companies. Meanwhile, startups such as Parcha envision a co-pilot that goes beyond answering questions and can instead complete tasks autonomously.

Many startups have built compelling AI-enabled products for advisors: Muse finds tax deductions and credits; Toggle assists advisors with investment research and addresses client questions based on the firm’s proprietary research; Greenlite and Parcha AI assist wealth management companies with KYC review and fraud reduction; and OneAdvisory is automating the collection of client data and account opening while maintaining data synchronisation across the advisor tech stack. In the past, companies such as DriveWealth helped fintech players build investment products for their end users. Going forward, we see a similar opportunity for API-based solutions that help fintechs build GenAI-enabled co-pilots for wealth managers.

Over the last five years, a few trends have emerged that create opportunities for GenAI-enabled wealth management solutions:

Growing data pools: The amount of data available to wealth advisors (from their internal systems, partners, third parties, and elsewhere) has significantly increased over the past decade. If advisors can quickly understand and harness this data they will be well-positioned to optimise financial planning for their clients, and offer tailored products and data-driven advice.

PE involvement: A wave of consolidation in the wealth management industry, with significant participation from private equity firms, would suggest an easier go-to-market path for startups by selling to a single decision maker who oversees many advisors. A GenAI solution that gives advisors more time to reach new customers would be an attractive tool in a PE firm’s search for cost-cutting and efficiency-boosting tools.

End-to-end options: We have also seen the emergence of end-to-end RIA tech stacks from companies like Farther Wealth, Zoe Financial, and Savvy Wealth. Financial data is currently fragmented across a broad advisor tech stack, which hampers the ability to take advantage of GenAI in this field. However, an end-to-end solution could create a proprietary data lake to effectively power GenAI tools. These platforms also have no legacy tech debt, reduce per-head-cost of growing an advisory business, and could therefore accelerate AI adoption in the industry.

Increasing budget share: Finally, wealth managers are spending more on software – an extra 10 per cent of wealth managers’ budgets have gone to third-party tech purchases since 2018, mainly to replace the industry’s 20-to-30 year-old existing stack. This means that advisors have cause and budget to seek out new solutions, and a wedge with generative AI could be a great catalyst to switch.

Implications for wealth management

While it’s still early, it is clear that generative AI will have a profound impact on the wealth management industry. Here are a few potential effects we see:

– Automated creation of individualised client summaries and tailored performance reports en masse, portfolio synthesis for advisors prior to client meetings, and much more – all powered by GenAI;

– With more time on their hands, advisors will expend more effort on deepening and expanding their client base. Co-pilots will also cut the cost of service delivery, reduce the duration of client meetings, and make room for more self-serve and bespoke services;

– By allowing fewer advisors to serve more customers, AI-enabled tools should also expand margins for the larger companies in the F-Prime Fintech Index over time. Meanwhile, GenAI would expand the capabilities for the industry’s best wealth managers, allowing them to win significant market share. However, poor-performing managers may lose clients as they flock to high performers with increased capacity; and

– Finally, as the cost of advisory services decrease, financial advice will continue on a trend of democratisation.

In 2022, we released a report highlighting the trends affecting the wealth and asset management sector. When we release our next report, we expect generative AI will have planted seed across the advisor value chain.

This story originally appeared in WealthBriefing.