From Surge to Sobriety: The State of Robotics Investment in 2024

From Surge to Sobriety: The State of Robotics Investment in 2024

Updating our annual report

Over the last several years, the investment environment has been tough for robotics startups. Capital deployment has fallen and companies have closed as the general downturn in tech investment that started in 2022 hit the resource-intensive robotics particularly hard. We have tracked that decline — and identified green shoots of recovery — in our annual State of Robotics reports.

This year, however, the picture has changed drastically. Betsy and I were asked to speak about this changing environment at the RoboBusiness conference earlier this month, and as we near the year’s end we thought it would be worth sharing our findings with the wider community.

One of the key drivers of growth in the robotics sector has been the falling costs and higher performance of the technology’s building blocks — things like computing power, sensors, motors, and batteries. At the same time, accelerating advances in AI have been a tailwind for the industry.

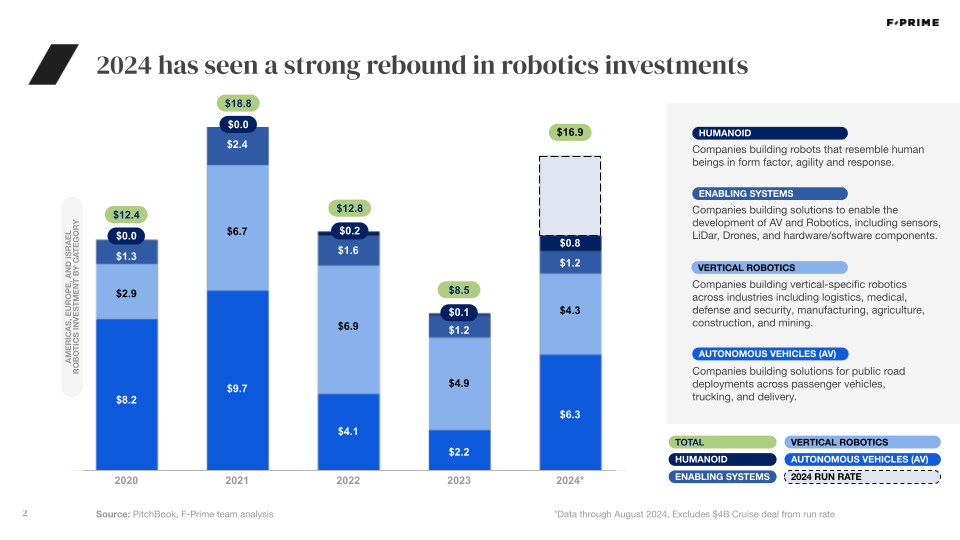

These trends are showing in the investment data. After a sharp pullback in 2022 and 2023, the first eight months alone of 2024 have seen an increase in investment over all of last year, and we expect the full year investment activity to approach the all-time highs seen in 2021. At the same time, companies at different stages and across different industries are seeing sharply different investment dynamics play out.

Where Is the Money Going?

We typically break robotics into three core segments; this year, however, given the increased industry interest and investment in humanoids, we have broken them out into a fourth category of their own. There was already close to $1B of investment in that category through August 2024, with companies like 1X, Apptronik, and Figure commanding huge funding rounds for general-purpose humanoid form factors. Investors include traditional VCs, corporate players, and AI darlings. Meanwhile, some big corporations (like Tesla and Boston Dynamics) are opting to build their own humanoids in-house, investing huge sums that may even dwarf the venture rounds that typically make headlines.

Meanwhile, after falling off considerably in 2022, autonomous vehicle investment once again accounts for the majority of robotics investment, driven by corporate mega rounds and coinciding with a number of legislative and business milestones. For example, Waymo reached 100,000 rides per week while companies like Aurora have been able to expand their operations to new states this year.

We’ve also seen a lot of interest in the software layer this year — particularly foundational models. Companies have attempted to build software for robotics for some time now, but often run into interoperability, scalability, and reliability challenges. Advances in AI are helping companies get closer than ever to overcoming those obstacles, but there are still challenges. Such models need to be inherently multimodal, understand relationships between physical objects and reason/react when the real world presents unexpected challenges. With improvements in multimodal large language models, everyone — startups, corporates, academics — is chasing the one foundational model to rule them all, though data scarcity and other constraints mean we are far from a “ChatGPT moment” for robotics.

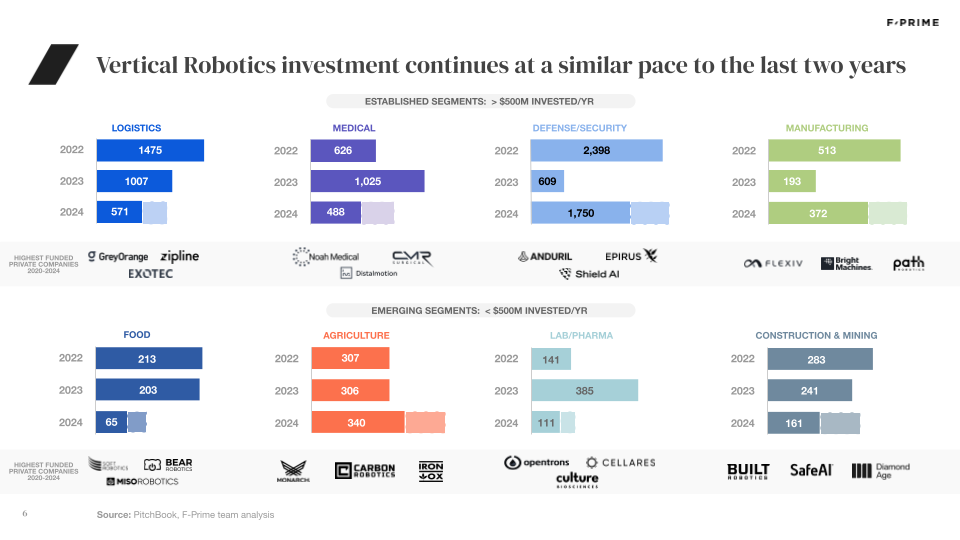

After briefly taking over from AVs as the main destination for robotics investment in 2022 and 2023, Vertical Robotics continues to grow steadily. Over the last year, in particular, we’ve seen big interest in applications for the defense and agriculture industries — see Anduril ($1.5B) and Saronic ($175M) for the former, and Monarch ($133M) and Carbon ($56M) for the latter.

By Stage

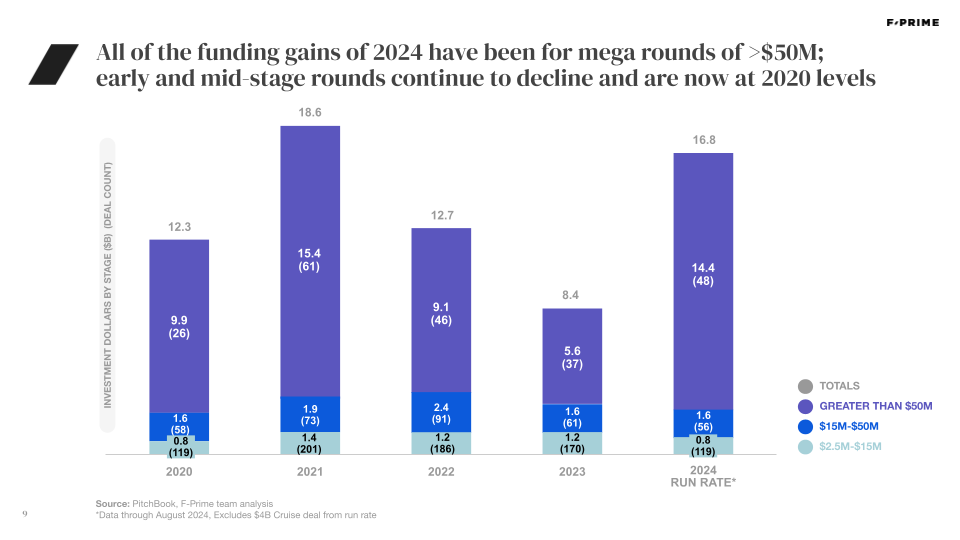

Though funding in the robotics sector has surged, the vast majority of capital has gone to large, mostly late-stage funding rounds. Earlier rounds are actually down year-on-year and back to 2020 levels. Those rounds are also a very small portion of the broader venture ecosystem. In robotics, earlier rounds account for 15 to 20 percent of total capital, while that figure is 20 to 30 percent for the broader venture ecosystem. The majority of the late-stage mega-round funding typically flows to AVs, defense and (this year at least) humanoids, the majority of early stage deals are focused on vertical robotics.

Exit Outlook

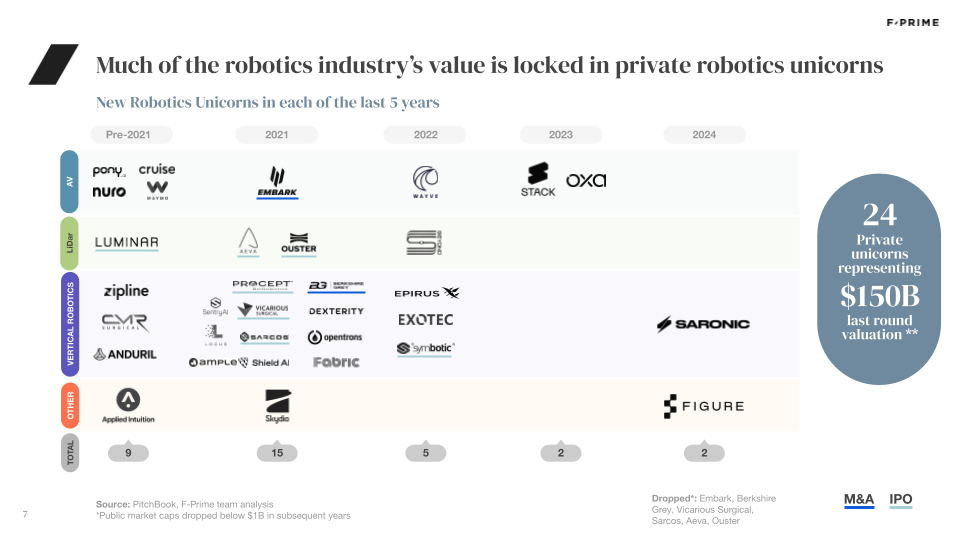

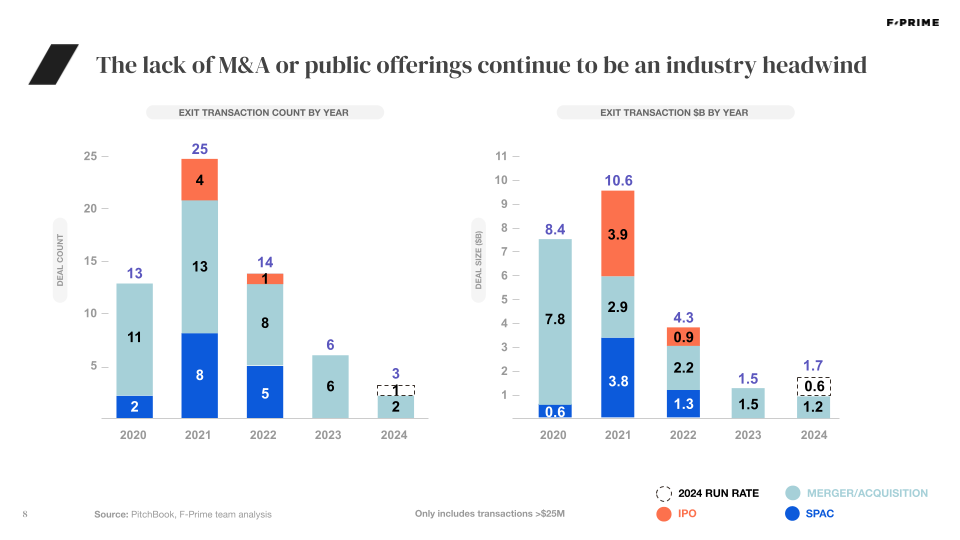

A dearth of successful robotics exits has created a lot of uncertainty around potential returns in the category, and those companies that exited via SPAC or IPO prior to the slump have performed poorly in the public markets. Much of the robotics industry’s value remains locked up in private unicorns, and a lack of M&A or public offerings continue to be an industry headwind. And amid all the mega-rounds, we have also seen many well-funded robotics companies shut down or undergo restructuring over the last 18 months. High profile shutdowns include Zume ($446M raised), PrecisionHawk ($139M), Phantom Auto ($95M), and Ready Robotics ($44M).

Advice to Founders

The long term tailwinds behind robotics are unmistakable. At the same time, attracting early-stage investor dollars to build a robotics business is getting increasingly challenging. Crossing the gauntlet of delivering high ROI, customer traction, and technical defensibility can be challenging in the early days of any venture-backed business, though it is particularly challenging in robotics where capital needs are higher and product iteration cycles are longer. Founders must be laser focused on hitting commercial and technical milestones at every step of the journey, while being realistic about the funding environment. Fortunately, for those who manage to cross the gauntlet, there are significant investor dollars looking for opportunities to help build generational businesses in robotics.

Check out the full State of Robotics report here.

“One of the key drivers of growth in the robotics sector has been the falling costs and higher performance of the technology’s building blocks — things like computing power, sensors, motors, and batteries. At the same time, accelerating advances in AI have been a tailwind for the industry.”

— Sanjay Aggarwal