Fintech Is Operating at Scale, With Huge Growth Potential

Fintech Is Operating at Scale, With Huge Growth Potential

Over the last 10 years, investors poured more than $370B into fintech startups across the globe. As a result, we now have a sector comprised of many companies operating at scale — and with plenty of room to grow. In our recent State of Fintech report, my colleagues and I took stock of the sector’s progress over the last decade, identifying the companies that have reached (or are about to reach) enterprise scale.

As a Sector, Fintech Is Now Operating at Scale

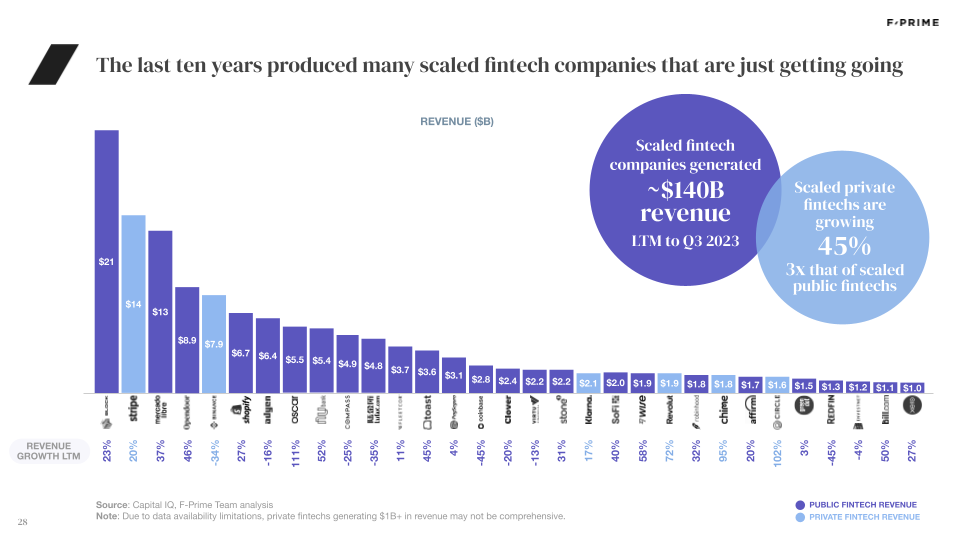

A decade ago, Coinbase did not exist; now, it generates $2.8B in revenue a year, and is one of 25 companies in the F-Prime Fintech Index whose revenue exceeded $1B in 2023. That’s more than half of the companies in the index.

Having achieved scale, the larger companies in the F-Prime Fintech Index are still growing rapidly. Public companies like Oscar Health, Nubank, Wise, and Bill.com are posting LTM revenue growth in excess of 50 percent. Toast brought in $3.6B in revenue in 2023 — 45 percent more than in 2022. Meanwhile, a contingent of privately listed companies like Circle (102 percent) and Chime (95 percent) are nonetheless operating at a similar scale to their public counterparts with $1.6B and $1.9B, respectively. The 10 fastest-growing companies in the F-Prime Fintech Index are growing at 54.1 percent, whereas their counterparts in the Emerging Cloud Index are growing at 33.3 percent.

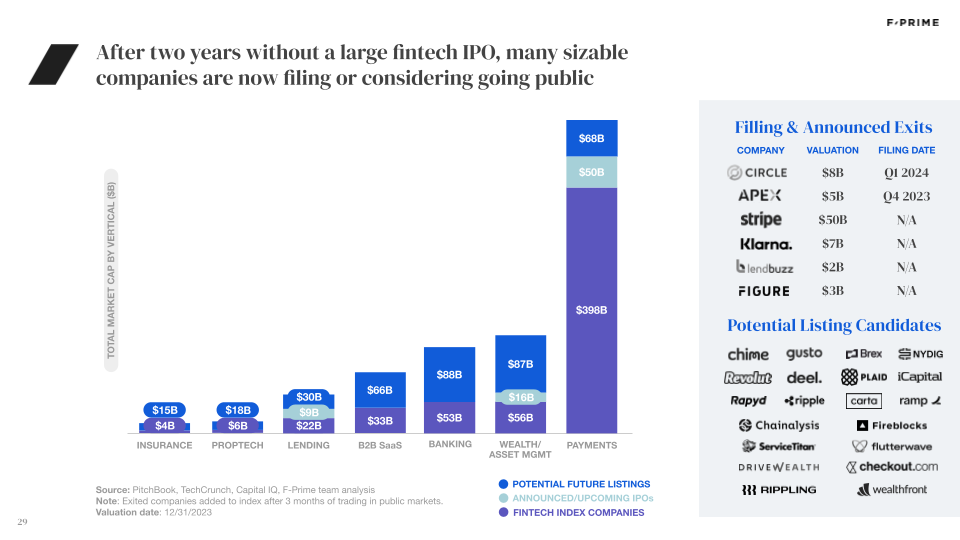

Plenty of Scaled Fintechs Remain Private

Outside of the public markets, we find a cohort of scaled fintech companies that have reached a high level of maturity, but continue to operate privately. Stripe is a great example. The company has raised more than $9.1B from private investors, with the latest coming in around $6.9B. However, it earmarked a sizeable portion of the round to pay employees’ personal tax liabilities for expired shares, due to Stripe’s long tenure as a privately held startup. The company is subject to endless speculation about when it will finally go public. Others in this category include Klarna, which brought in $2.1B and is reportedly considering a public listing, and Revolut, which has $1.9B in revenue.

Overall, startups are staying private longer. According to Nasdaq, the median age of a company at its IPO in 1980 was six years. In 2021, the median age was 11, thanks in part to the increasing volumes of capital flooding into the private markets. However, companies like Stripe, Binance, Klarna, Chime, and Circle represent a crop of scaled fintechs that are reaching the limits of the private markets, and will soon find themselves with no option but to go public. The fintech floodgates are about to open even further.

Scaling Fast

Beyond the largest players, the F-Prime Fintech Index also lists a group of companies that are poised to join the billion dollar revenue club. Remitly, for instance, posted 46 percent revenue growth, ending Q3 with LTM revenue at $871M. Payoneer grew 36 percent to reach $790M LTM revenue by Q3, and Xero grew 27 percent to $982M. These companies could post even slower growth in 2024 and still reach $1B in revenue.

It is worth noting how quickly these companies reached this milestone. Block (fka Square) went from zero to more than $1B in revenue in a matter of five years. It took Nubank, Stripe, and Adyen seven, eight and 11 years, respectively. As early stage investors, we often ask ourselves whether a company can bring in more than $1B in revenue someday, and it is re-affirming for the sector to see private startups scaling so rapidly. The speed and scale of their growth validates our conviction about the size of the markets they’re chasing. Many of these startups are still operating in their local markets or in just a handful of countries. Like many older multinationals, they will be able to continue scaling as publicly listed companies selling internationally and would benefit from the prestige and resources that come with public listing.

Overall, the number and size of companies poised to go public or cross the billion-dollar revenue threshold heralds further growth for the fintech industry. Over the next five years, we believe the F-Prime Fintech Index’s market capitalization will grow significantly from new public listings.

We encourage you to tinker with the F-Prime Fintech Index, which now includes head-to-head comparisons; dynamic charts comparing company performance (by market cap, revenue, growth, margins, multiples, and more); and multiples benchmarks to help explore the connections between valuation multiples and performance metrics like margins and growth rates.

Originally published in Financial Revolutionist.