While ConnexPay began in travel, its growth during this challenging period for the industry only strengthened our belief in the value of their solution. We’re equally excited the team is demonstrating success beyond the travel sector and into insurance agencies, freight brokers, and e-commerce marketplaces. We’re especially thrilled to be partnering with ConnexPay Founder and CEO, and payments industry veteran, Bob Kauffman, whose leadership roles at US Bank and Elavon propelled the vision for ConnexPay. Bob has attracted a talented team of payments experts, including Jacob, Beth, Julie, Kunal, Judson and many more. Thanks for welcoming F-Prime Capital as part of your story!

Announcing our Investment in ConnexPay

Announcing our Investment in ConnexPay

Managing payments on behalf of their customers is essential to powering the best customer experience possible.

If you’ve ever purchased a trip with Booking.com, a gift from Etsy, or insurance from an agent, you’ve experienced the critical role that brokers, agents, marketplaces, and other intermediaries play in our society. Far from being simply middlemen, these intermediaries own the customer relationship and more importantly customer experience, providing essential value to customers such as a brand they trust, price comparison, product recommendation, or simply coordination across multiple parties to simplify the purchase experience.

These groups are massive contributors to the economy — travel agents, freight brokers, and insurance agents alone control over $1.5T of spend in the U.S. — and yet their customer experience often falls short when it comes to managing payments. Right at the point of purchasing, many intermediaries are forced to turn over the customer to the party providing the product or service (e.g. a travel agent passing your credit card details to the hotel or airline for processing), sacrificing control of the customer payment experience at the most critical time and losing the ability to manage refunds, chargebacks or ongoing purchase updates thereafter.

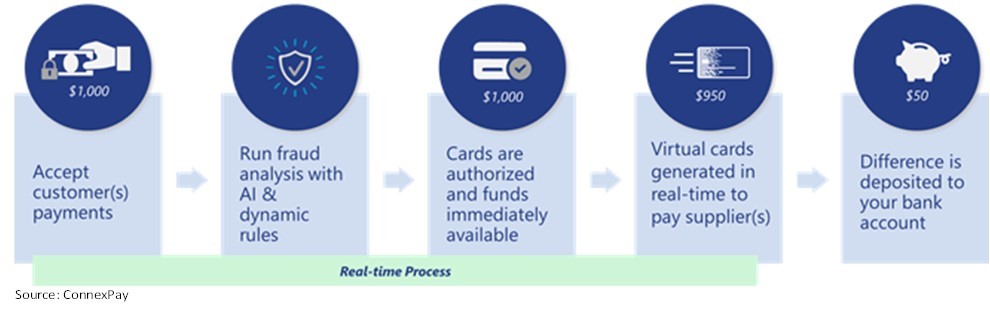

We believe intermediaries are a critical backbone of commerce. Managing payments on behalf of their customers is essential to powering the best customer experience possible. We’re excited to announce our investment in ConnexPay, a company that puts transparency and control of payments back in the hands of these important businesses that own the customer relationship. ConnexPay has built a powerful platform that tackles the infinitely complex problems intermediaries face when it comes to payments — accepting consumer cards, paying suppliers, routing payments intelligently, managing fraud, chargebacks and refunds— and exposes it all with a simple set of APIs. This elegant and truly end-to-end solution empowers intermediaries to facilitate the payment for their customers by becoming the merchant of record with the flip of a switch, thereby improving profitability, reducing fraud, speeding reconciliation, and removing the need for pre-funded accounts and credit lines.

This problem is particularly apparent in the travel industry, where ConnexPay got started. Online and offline travel agents remain an enormous force in travel, processing ~$740B in total global spend each year. Travel is paid for immediately on booking, yet travel agents and OTAs (Online Travel Agents) typically have a one to two day lag awaiting funds settlement from travelers. Further, agents want control over the customer experience, latitude to negotiate supply in advance from suppliers, and the ability to take commission directly out of the payment flow versus reconciling on the back-end with suppliers. ConnexPay solves all of these problems by helping agents become the merchant of record, supported by its unique solution granting instant funds availability.

Illustrative payment flow for an intermediary with ConnexPay:

It’s an elegant solution, and one which we are especially excited about having long searched for disruptive businesses in travel payments. In the same way our planes aren’t flying any faster than when we were kids, payment tech in travel has hardly evolved to the digital world. From our own portfolio, we’ve seen first hand the incredible value of integrated vertical payments solutions (e.g. Toast, Flywire) and the opportunity for technology disruptors in travel and hospitality (e.g. OTA Insight, Avantstay). Our ongoing search for solutions improving the bewildering, complex world of travel payments led us to ConnexPay.

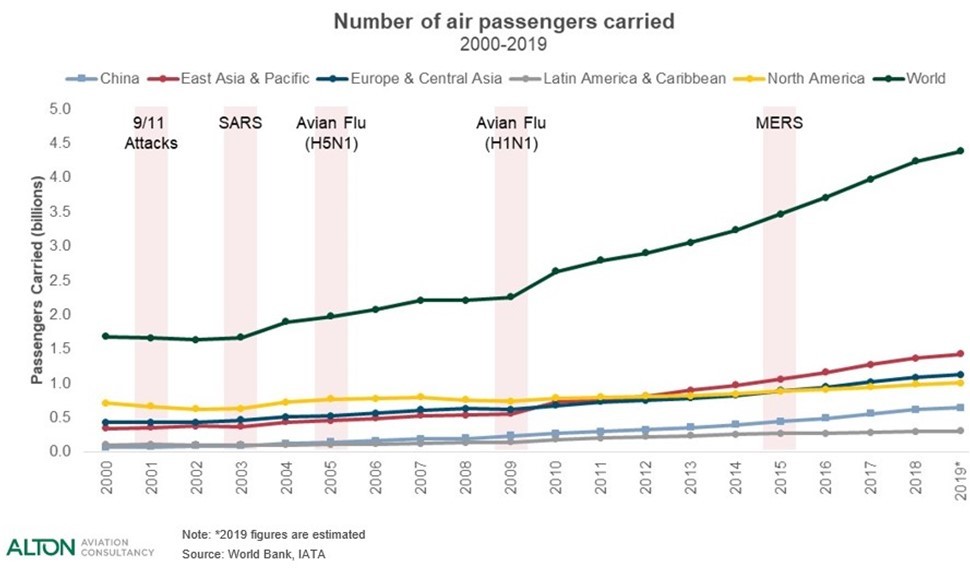

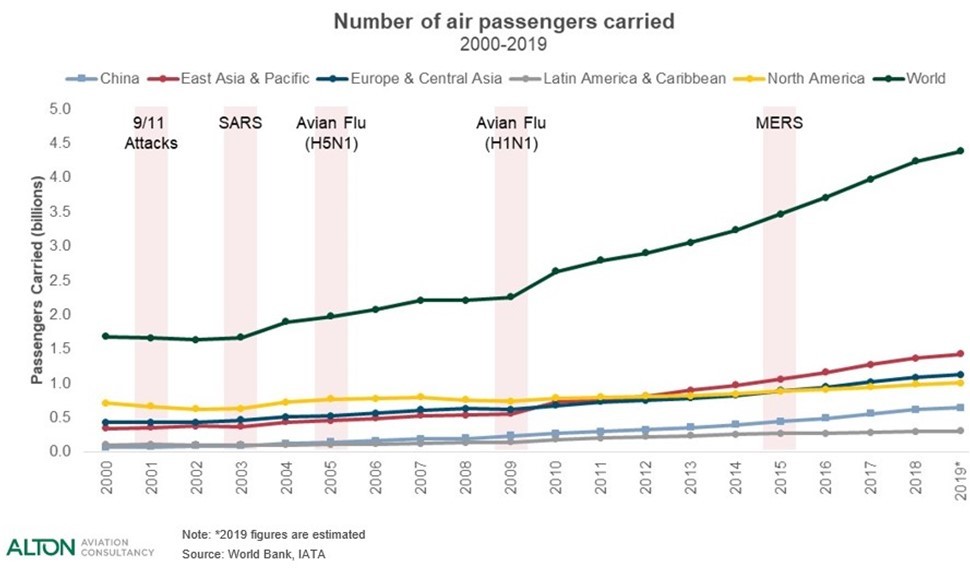

At the outset of the COVID pandemic, we started talking about investments in terms of scratches and scars. Urban exodus: scratch or scar? Work from home: scratch or scar? Time and again, the travel industry has shown resilience coming out of every existential crisis it has faced, man-made or otherwise. Some might believe global travel will never fully recover; we believe our increasingly globalized world is nowhere near the ceiling on tourism and business travel. With the hopeful news of a COVID-19 vaccine, we like many others are dreaming about life when we can travel once again.