The Effects of RIA Stack Fragmentation

The Effects of RIA Stack Fragmentation

Sneak Preview: A Wealth Tech Deep Dive.

The last decade of wealthtech investment has been marked by the success of high-profile names like Robinhood and Coinbase (two companies we track in the F-Prime Fintech Index), but despite the success of many direct-to-consumer businesses, there are equally exciting opportunities emerging in the world of traditional advisor technology. Several market shifts — an expected $84T wealth transfer, the rise of alternative assets, breakaway RIAs, and advances in AI — all represent an opportunity to rebuild the industry’s technology infrastructure.

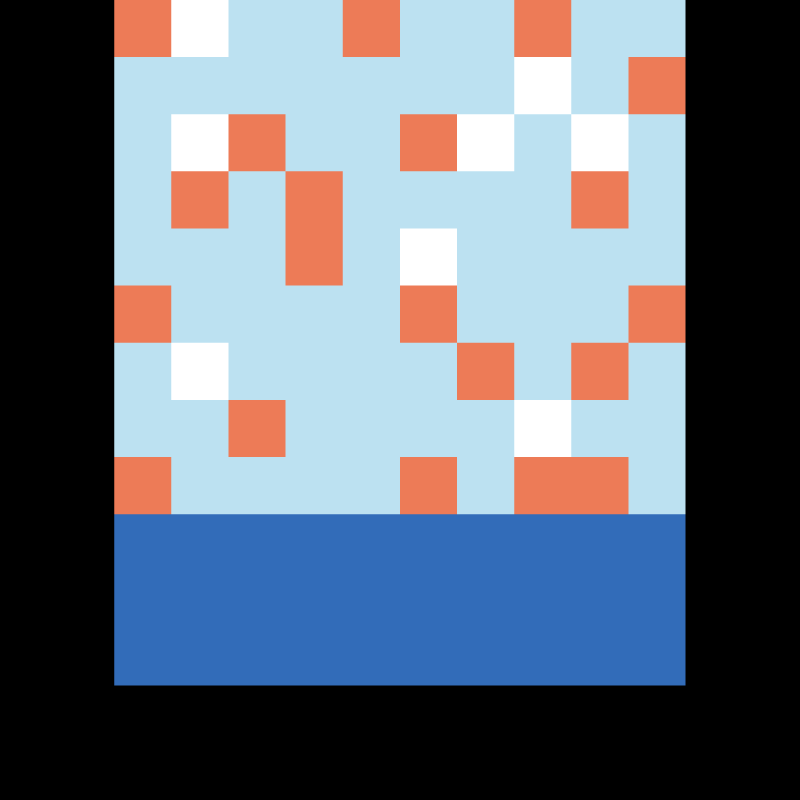

Startups are already wise to this opportunity. Witness below the jump in market penetration for estate planning software — from four percent to 39 percent between 2021 and 2024. High-profile funding rounds from players like Vanilla and Wealth.com this year also help demonstrate how hot this sector is as of late.

In the above chart — which comes from our upcoming State of Wealth deep dive, due out next month — you can also see the growing sprawl of the advisor’s tech stack. RIAs must now contend with a wide array of tools with little-to-no integration across platforms, and startups have emerged to create tighter integrations.

There are three main approaches to this problem:

- Some players are creating pre-integrated tech stacks via acquisition. For example, Orion Advisor Solutions started life as a portfolio management tool that acquired financial advisor CRM Redtail and investment and trading platform TownSquare Capital in 2022. The goal here is to acquire different pieces of the RIA tech stack from top-to-bottom and the challenge, of course, is to integrate those pieces.

- Others are opting to create new age all-in-one platforms from the ground up. In effect, the end-to-end platforms built by companies like Advyzon and Advisor360 end up looking similar to the pre-integrated tech stacks discussed above, but instead of building via acquisition they are founded with the intention to become an all-encompassing platform.

- The third solution is tech stack synchronization. Under this paradigm, advisors are free to use their favorite point solutions for each level of the RIA tech stack, and use an orchestration platform to ensure that data is flowing seamlessly between them. Companies like Dispatch enable advisors to collect, structure, and sync client data across various advisor platforms, ensuring that any data changes made in the CRM are reflected in financial planning and portfolio management tools, and vice versa.

As David wrote when announcing our investment in Dispatch earlier this year, “This is one of those deep infrastructure solutions that solves an enormous pain point, offers an immediate ROI, and can run in the background as the integration layer for customer data. The more integrations they support, the more valuable they become to the industry.”

Originally published on Fintech Prime Time.