PropTech Investment Themes and Our Investment in Snapdocs

PropTech Investment Themes and Our Investment in Snapdocs

Real estate is the world’s oldest, largest and arguably most resistant asset class to disruption. Yet the forces at work today are striking, fueled by talented entrepreneurs changing long-held notions among real estate participants.

With our investment in Snapdocs, I wanted to share our broader investment thesis for real estate and specifically our views on the digitization of real estate transactions. If you too love the real estate sector, then I hope you’ll read on.

Our investment thesis

For several years at F-Prime Capital we have been investing against the changing landscape in real estate. We have drawn from our experience in equities and FX, where we recognize how transparency, data and standardization drive greater liquidity, fractionalization and the disruption of intermediaries and see the same trends emerging in real estate.

We are finally seeing these in force in real estate. Data has never been more accessible — more vendors, data variables and APIs — leading to transparency in acquisition and portfolio management. iBuyers like OpenDoor and REITs like Invitation Homes have leveraged this to prove there is more standardization in real estate than previously thought, placing offers on homes in minutes and in bulk, based on data-driven underwriting models. All this comes at a time when consumers are changing their attitudes on home ownership, partly out of necessity and partly out of generational shifts.

F-Prime PropTech Investment Themes

F-Prime’s investment themes in real estate

I wrote about the changing nature of home ownership and how we see the home becoming more semi-liquid and fractionalized (Theme #4). In this post, I wanted to share how we see the real estate purchase process digitizing (Theme #3) and why we led the Series B in Snapdocs, the emerging leader in digital mortgages.

Digitization of the mortgage: the problem

It’s a big market.

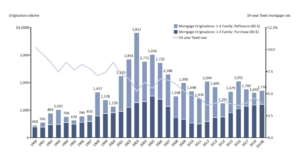

First, for context, the mortgage industry is big…really big…with annual transaction volumes of 4.7M first-lien mortgage originations (purchase) and 2.2M second-lien mortgages (refinancing), for a total origination value around $2T annually. While residential real estate transactions are subject to broader macroeconomic factors, especially interest rates, the base spending on transactions including all parties has exceeded $42B annually for the last 20 years.

U.S. Mortgage Originations

Source: MBA; Freddie Mac

It’s painful.

Anyone who has bought a home knows the pain of finding a mortgage, sharing personal financial documentation and reviewing up to 100 pages of documents. For me, the Closing process is the most frustrating part, often involving seven people, dozens of signatures and several hours of time in a lender or closing agent’s office. For first-time home buyers this can be especially emotional, stressful and bewildering.

I love the “Closing Day Tips” from The Balance financial blog….sure, take the entire day off!

The main problem is the large number of participants involved in the process, including real estate agents, loan officers, title companies, notaries, correspondent banks, securitization agents and government backed-agencies like Freddie Mac and Fannie Mae (GSEs). It was never easy, but it was simpler when a borrower’s local bank made the loan and held the loan to maturity. That changed with the introduction of the 30-year mortgage in the 1950s, GSEs and securitizations. Today we still have a single unit — the mortgage — yet dozens of participants are involved. One of Snapdocs’ early insights was that point solutions could not address these problems and that the industry needed better workflow and collaboration tools.

It’s a huge time commitment, but it’s also costly. The typical purchase mortgage has a 2–4% fee drag or $6,000 — $12,000 in fees paid to intermediaries, adding up to the $42B in industry fees across and purchase and refi. This is not counting the ~5% in real estate commissions paid by the seller.

Progress to an all-digital experience

Fortunately, new technology vendors have improved the upfront stages of the mortgage process. Finding a home itself became a more digital process a long time ago with players like Redfin and Zillow. New takes from Compass and Homey have pushed the digital search process, engagement and offer even further into digital realms. We won’t eliminate a buyer’s desire to see a home in person, but we’re already moving it to self-service with digital lockboxes and cameras.

Though not perfect, finding a mortgage has dramatically improved from ten years ago. Today most mortgage searches start online and online mortgage companies like Better, Quicken and Homelight offer faster, digital experiences with mortgage quotes tailored to the individual borrower. Even Financial, one of F-Prime’s portfolio companies, soon will extend its API-first approach from personal loans to mortgages and leapfrog LendingTree and Bankrate with mortgage offers based on deep integrations with lender underwriting models pushed out to borrowers wherever they start their online journeys.

Applying for and originating a loan have also taken big steps forward thanks to players like Roostify and Blend who have built new, all-digital borrower onboarding platforms and loan origination systems. Anyone who has provided a year of bank and brokerage statements to a lender appreciates replacing that with a Plaid-supported automated data pull. These platforms, and other home-grown systems like Quicken’s, need wider deployment, but many lenders have invested in these systems and feel ready to tackle the next challenge — closing.

We believe mortgage closings are next. Closings matter in small and big ways. For one, it’s the culmination of a highly regulated process where mistakes in documents or process cost time and risk regulatory violations. Closings are also the culminating moment in the borrower experience, both legally and emotionally. Lenders work hard to win and retain borrowers, yet for this critical borrower experience, lenders are mostly cut off from the process with little visibility. Instead, nearly all other industry participants come together in a short-fused, pressurized setting, including many new participants inserted at the last moment, such as, title agents and notaries.

As an inherently networked workflow, the industry needs a collaboration platform on which all closing participants can engage as first-class citizens, but with permissions tailored to their roles. Borrowers should be able to review, notarize and sign documents digitally, with the benefit of machine learning models that automate document production, error detection and signature annotation. The industry is just beginning to embrace all-digital closings, with digital mortgages (eNotes) produced at the end. Players like Snapdocs have the opportunity to build foundational industry infrastructure.

While invisible to most of us, the post-closing life of a mortgage — the secondary market — is where things get really interesting. Wholesale lenders and the securitization market have always been the tail that wags the mortgage market, and they have built around the idea of holding the paper mortgage as proof of ownership. So, what happens when there is no paper? Fannie Mae has documented the requirements for its digital mortgages (eNotes), and digital mortgage registrations increased 5x in 2019. Granted that’s only 95,458 actual mortgages, most of which are from Quicken, but having the largest mortgage lender in the country pushing digital mortgages is exactly the way industries change. In addition, one of the world’s largest exchange operators, ICE/NYSE, acquired eMERS in 2018, the industry’s de facto eNote registry, revealing a sophisticated player’s intention to lean into digital mortgages and the downstream securitization market. Adoption is still early, but we see an exciting and open field for new players to make smart strategic decisions that position themselves for an enduring role in the secondary market, including as electronic registries, custodians and sources of data analytics.

TL;DR

The real estate sector is receiving a huge dose of technology. One of our favorite investment themes is the digitization of mortgage. The front-end processes are well underway — borrower application and underwriting — and the closing and secondary markets are on the verge as well. We are excited to be working with Aaron King and the team at Snapdocs where they can build foundational industry infrastructure and improve the closing experience for all of us.

Photo by Scott Webb on Unsplash