Plaid Acquires Quovo — Another Brick in the New Financial Services Tech Stack

Plaid Acquires Quovo — Another Brick in the New Financial Services Tech Stack

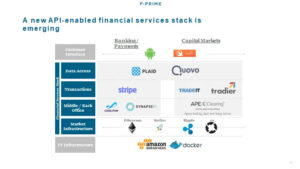

Last year I gave a talk at a FinTech Sandbox event about the new financial services tech stack, showing Quovo and Plaid emerging as the new data access layer. Last week, less than one year later, news broke that Plaid acquired Quovo for over $200M. This new infrastructure layer feels solidified.

F-Prime Capital co-led Quovo’s Series B round and I have had the joy of working with co-founders Lowell Putnam and Niko Karvounis as they willed their way through the challenging early years when no one but financial advisors cared about account aggregation, and later as they surfed the tsunami of new applications incorporating account authentication and aggregation. They did it with grit, humility and class.

In the future, I think we will look back on the Quovo-Plaid merger as a significant milestone in the FinTech wave of disruption. For one, I believe the combined Quovo-Plaid will become the data access layer in the new financial services tech stack. In addition, this merger is happening at the same time as authentication and aggregation move from a ‘nice to have’ to a ‘must have,’ and as we transition from building out the infrastructure to delivering analytics and insights. We are moving from Chapter 1 to Chapter 2, but it won’t stop there.

A quick view on the past, present and future.

Chapter 1: new consumer financial data infrastructure. Together Quovo and Plaid have helped millions of consumers connect their financial accounts to services like Venmo, Coinbase, Betterment and to a long tail of other financial service providers. They connect to over 14,000 financial institutions and provide clean consumer transaction data via APIs, making it easy for consumers to add a bank account for payments (e.g., Venmo), transfer funds into their brokerage account (e.g., Stash), see their categorized spend in budgeting tools (e.g., Personal Capital) and power frictionless rewards programs (e.g., Drop). They are literally everywhere consumers touch a financial service. They do not move money; but they provide the metadata, and in the process have enabled hundreds of new FinTech applications and services.

As a combined entity they will continue to build out the infrastructure in the US and soon the world, but we are already well on our way to Plaid and Quovo owning the data access layer of the new financial services stack.[i]

Chapter 2: analytics and insights. What do you do once you have poured the foundation? You build on top. Plaid and Quovo are now helping businesses analyze consumer data to make better decisions in an automated, real-time way. Lenders like SoFi use Quovo to estimate W-2 income when a consumer applies for a loan, rather than asking for tax returns. Stash uses Quovo to predict the best day to move funds from a consumer’s bank account to help them avoid overdraft fees. Insurance companies can quickly authenticate a policy holder’s bank account to direct deposit insurance proceeds, rather than sending a check. The surface area is wide and Plaid and Quovo should someday generate 3–4x more revenue from derived insights embedded into business workflow.

Chapter 3: what’s next? One inevitable path is for Plaid and Quovo to give consumers more tools to control access to their financial data. In all of my examples, consumers proactively permission use of their data, but what do they do afterwards? Consumers will need easy dashboards to track and revoke access when for instance they no longer use a service. Plaid and Quovo will be well-positioned to do this on behalf of consumers and may become consumer brands themselves in the process. The combined entity can turn over many other cards and it’s exciting to consider other ways they could leverage their data access and analytics, such as, to support identity or credit verification.

Closing thoughts

There are many issues to navigate, from Open Banking in Europe to privacy and regulatory concerns in the US, but I’m optimistic that the triad of regulators, financial institutions and data access providers will act sensibly and with consumers’ interests in mind. If so, the combined Plaid and Quovo has a tremendous future ahead.

And if all goes well, in several years closing documents for company mergers will not require investors to submit their bank account numbers in writing…the final irony in the merger of the two leaders in digital account authentication.

[i] To be fair, time did not start with Quovo and Plaid, and for more than a decade Yodlee (now part of Envestnet) was the data access layer and one of the great early FinTech success stories.