How much labor spend will AI capture? A lot, but not as much as the headlines suggest.

How much labor spend will AI capture? A lot, but not as much as the headlines suggest.

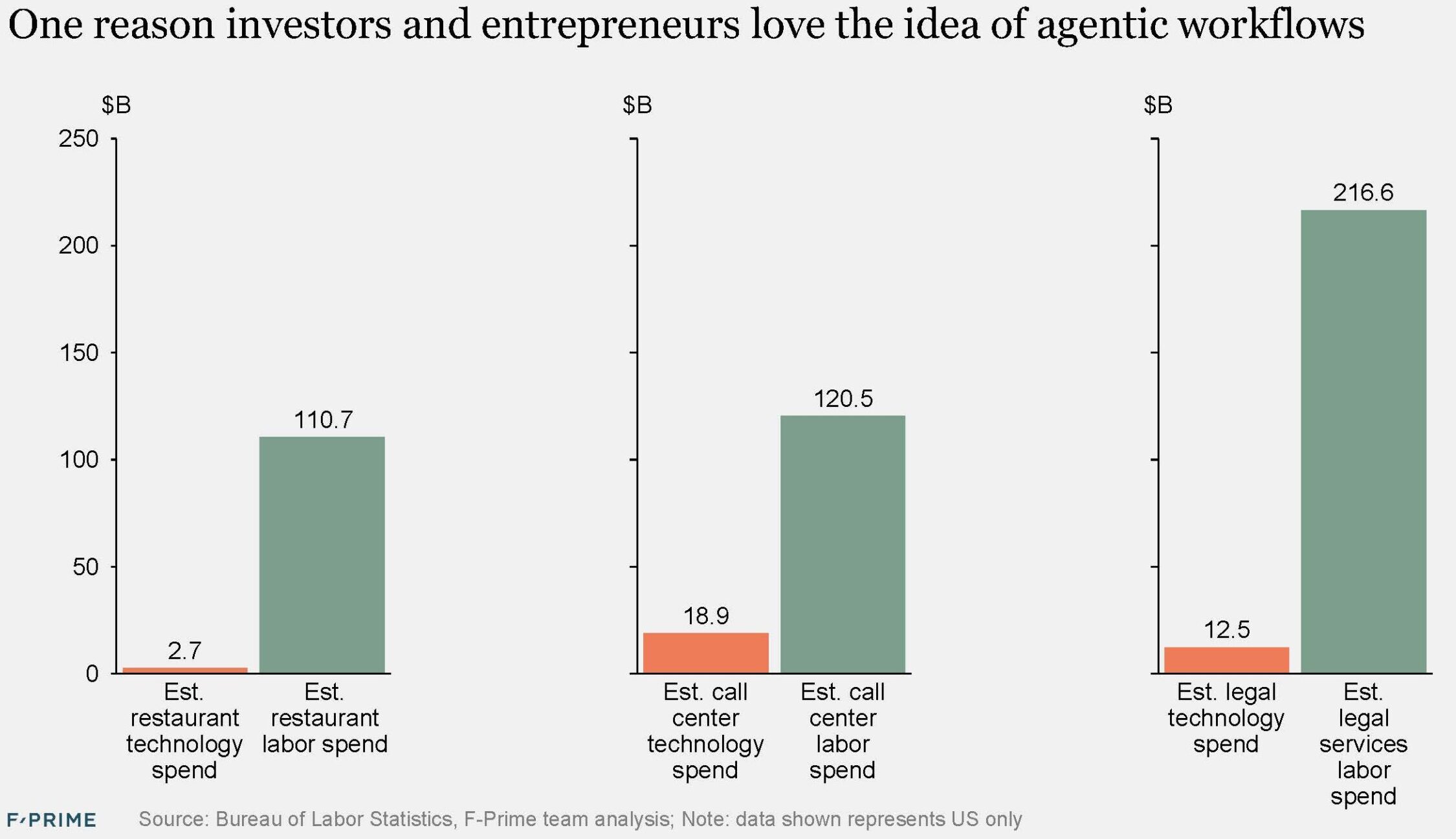

A core tenet has emerged that the AI opportunity is much larger than SaaS because it is going after labor spend which is 10-30x larger. At the headline level, this is undeniably true in almost every industry.

However, over the last three years we have started to see how much labor spend AI can actually capture. TLDR: It’s a lot less than the headlines, but still a large expansion from SaaS. I anticipate software spend will increase 2-3x with the addition of agentic workflows.

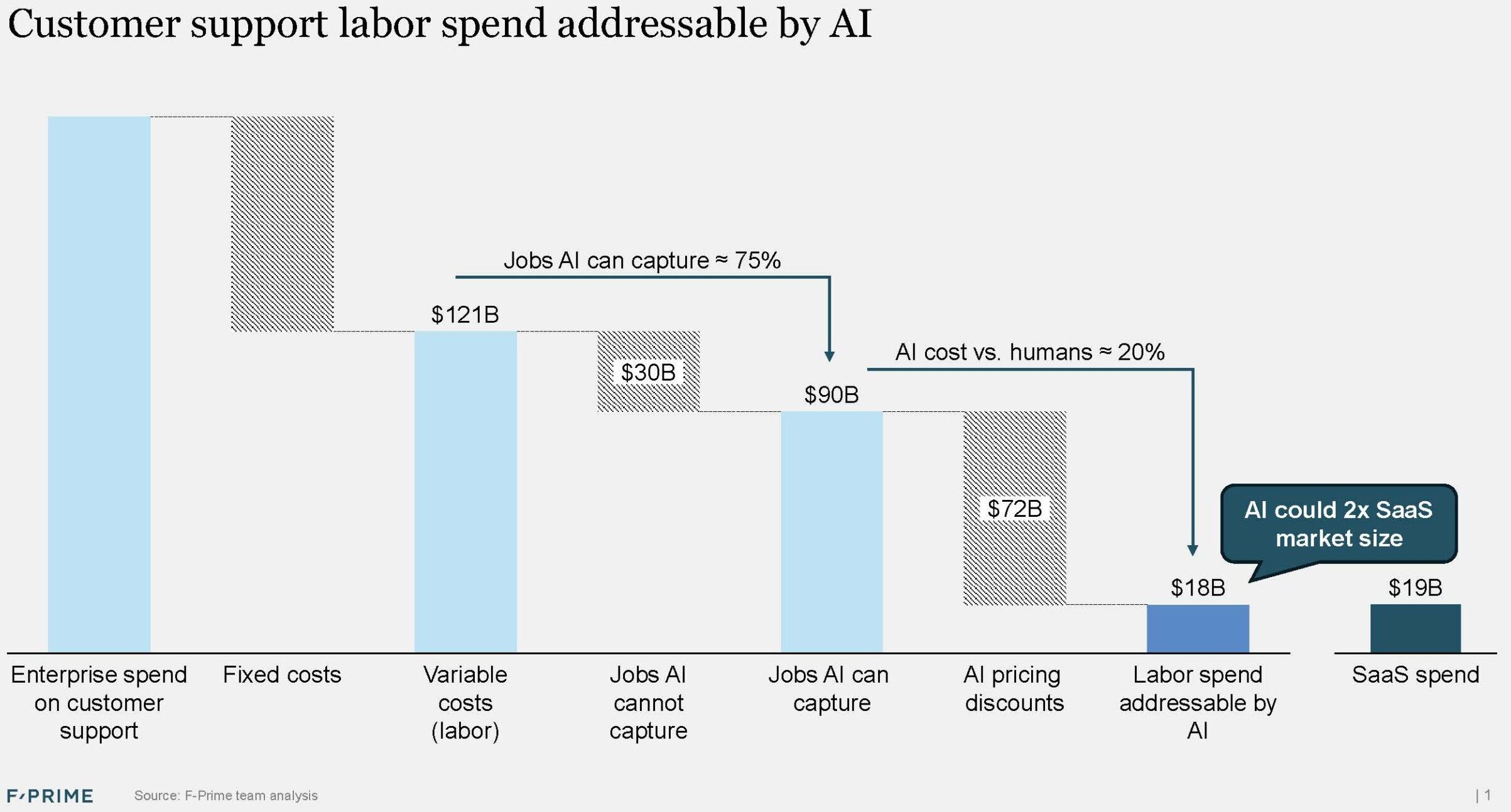

The answer will vary a lot by industry, but I am using this framework for sizing the AI market opportunity. I will illustrate it with customer support data, one of the earliest adopters of AI in the enterprise.

There are three main drivers.

#1 Fixed vs. variable costs. Call centers will continue to have management teams that hire and manage employees, procure technology, analyze data, and make decisions. Of a total customer support budget, it is typical to see 40% fixed costs, leaving 60% variable human costs doing the actual work of customer support.

% of jobs that AI can handle. This number will steadily rise as AI gets better and enterprises customize agentic workflows to their specific needs; however, it’s not going to be 100% of all customer support interactions for many reasons – one-off or highly complex support needs, enterprise unwillingness to integrate AI agents with high-risk systems like payments or prescription ordering, etc. However, out of the gate, we have seen AI handle 50% of chats and emails (less of voice calls), encouraging enterprises to target 75% deflection of support from live humans. It’s impossible to know where this settles, but 75% is possible, if optimistic. Over a long enough horizon, I will bet on AI’s inexorable improvement.

AI cost vs. humans. It is fascinating to see AI vendors pricing AI agents at 10-20% of their comparable unit of labor replacement. For example, it costs many companies $5-10 per customer support interaction (variable only), but AI vendors like Sierra, Decagon, and Maven often charge ~$1. That is 80-90% variable spend reduction for enterprises…and reduced market size for AI vendors. To be sure, as companies grow, their customer support interactions gr ow, and so will the AI market opportunity, but all things equal, aggressive AI pricing deflates the market size.

In summary, there might be 10-30x more labor spend than SaaS today, but it is probable that only 10-20% of that is accessible to AI. That is better news for people worried about losing jobs to AI, but worse news for investors hoping for a larger market opportunity. In the end, there are many ways AI could capture more labor spend, and even take spend from SaaS, so this framework will evolve. We will all learn together.